Situation in the euro area and the EU

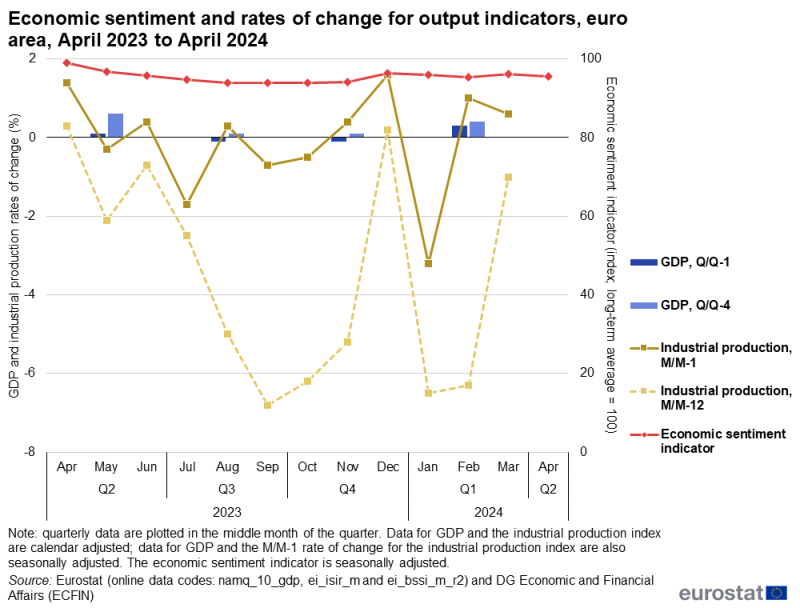

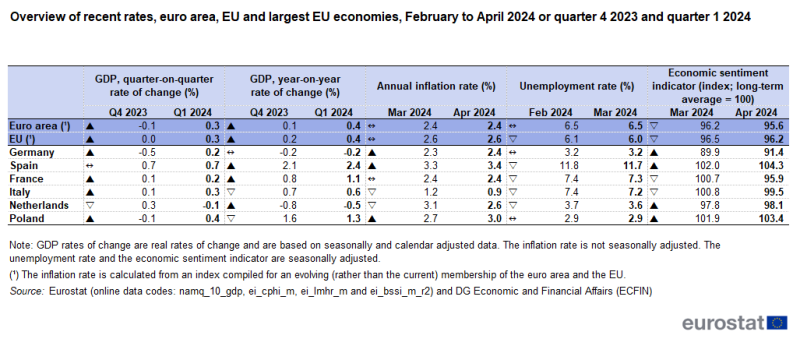

In the 1st quarter of 2024, seasonally adjusted GDP increased by 0.3% quarter-on-quarter in both the euro area and the EU. For comparison, in the 4th quarter of 2023, GDP had decreased marginally (by 0.1%) in the euro area and had been stable in the EU. Compared with the 1st quarter of the previous year, GDP was 0.4% higher in the 1st quarter of 2024 in both the euro area and the EU.

In March 2024, seasonally adjusted industrial production increased month-on-month by 0.6% in the euro area and by 0.2% in the EU. In the previous month, it had increased by 1.0% in the euro area and by 0.9% in the EU. Compared with March 2023, industrial output was 1.0% lower in March 2024 in both the euro area and the EU.

In April 2024, the economic sentiment indicator decreased by 0.6 points to 95.6 in the euro area and by 0.3 points to 96.2 in the EU. The decrease in the euro area resulted from notably lower confidence among industrial and retail managers and somewhat lower confidence among construction and services managers outweighing a small increase in consumer confidence.

Source: Eurostat (namq_10_gdp), (ei_isir_m) and (ei_bssi_m_r2) and DG Economic and Financial Affairs (ECFIN)

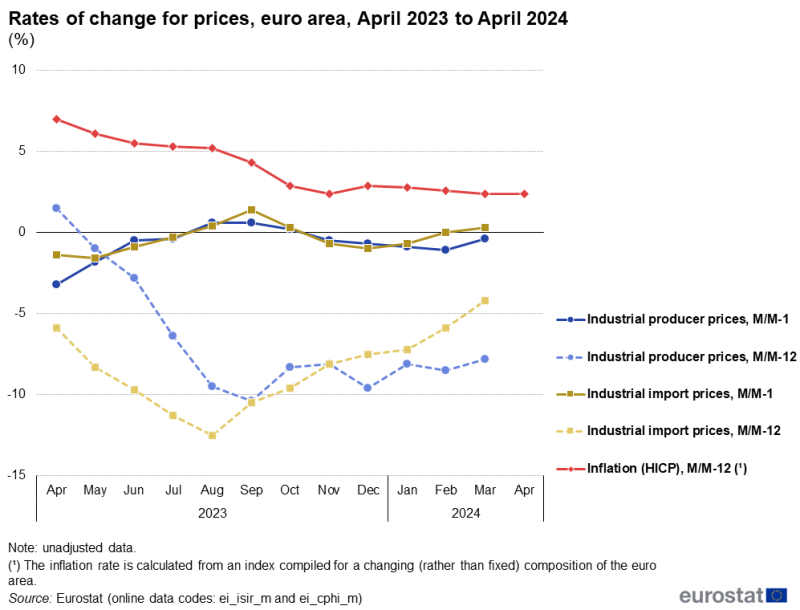

Over the past year, the rate of inflation (based on the HICP) slowed considerably. In the euro area, the inflation rate fell from 7.0% in April 2023 to 2.4% in April 2024; in the EU, it fell from 8.1% in April 2023 to 2.6% in April 2024. In both cases, there was a modest upturn in the inflation rate in December 2023 before the downward trajectory continued. Year-on-year rates of change for industrial producer prices also decelerated and turned negative over the last year. Year-on-year rates of change for import prices were already negative in April 2023 and have remained negative since then.

According to the latest data from Eurostat, the annual inflation rate (based on the HICP) in the euro area was 2.4% in April 2024, unchanged from the rate in the previous month. The category of services recorded the highest annual rate in April 2024 (prices were up 3.7%, which was lower than the 4.0% rate recorded in the previous 5 months), followed at some distance by food, alcohol and tobacco (up 2.8% in April 2024 after an increase of 2.6% in March 2024) and non-energy industrial goods (up 0.9%, compared with 1.1% in March 2024). By contrast, the annual rate for energy remained negative in April 2024 (down 0.6%), extending a series of successively smaller falls; for example, the index for energy was down 11.5% in November 2023. In the EU, annual inflation was 2.6% in April 2024, also unchanged from the rate in the previous month.

Compared with a year earlier, industrial producer prices in March 2024 were 7.8% lower in the euro area and 7.6% lower in the EU; in February 2024, they had been, respectively, 8.5% and 8.2% lower than a year earlier. Turning to month-on-month changes, industrial producer prices decreased in March 2024 by 0.4% in the euro area and by 0.5% in the EU; these were smaller than the decreases observed in the previous month (down 1.1% in the euro area and 1.0% in the EU).

Compared with a year earlier, industrial import prices in March 2024 were 4.2% lower in the euro area. On the basis of a month-on-month comparison, industrial import prices increased in March 2024 by 0.3% in the euro area. Compared with a year earlier, these prices in February 2024 were 5.5% lower in the EU and were marginally (0.1%) higher on the basis of a month-on-month comparison.

(%)

Source: Eurostat (ei_isir_m) and (ei_cphi_m)

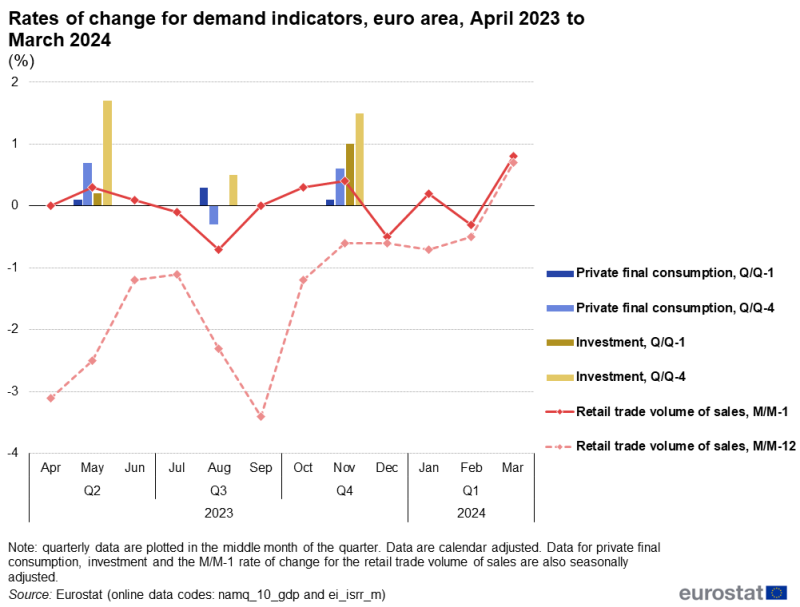

In the 4th quarter of 2023

- private final consumption expenditure increased quarter-on-quarter by 0.1% in the euro area and by 0.2% in the EU (after increases of 0.3% in both the euro area and the EU in the previous quarter)

- government final consumption expenditure increased by 0.5% in the euro area and by 0.4% in the EU (after increases of 0.7% in the euro area and 0.6% in the EU in the previous quarter)

- gross fixed capital formation (investment) increased by 1.0% in the euro area and by 0.9% in the EU (after no change in the euro area and a marginal increase (up 0.1%) in the EU in the previous quarter).

In March 2024, the seasonally adjusted volume of sales in retail trade increased month-on-month by 0.8% in the euro area, following on from a decrease of 0.3% in the previous month. In the EU, retail sales increased by 1.2% in March 2024, having decreased marginally (down 0.1%) in the previous month.

(%)

Source: Eurostat (namq_10_gdp) and (ei_isrr_m)

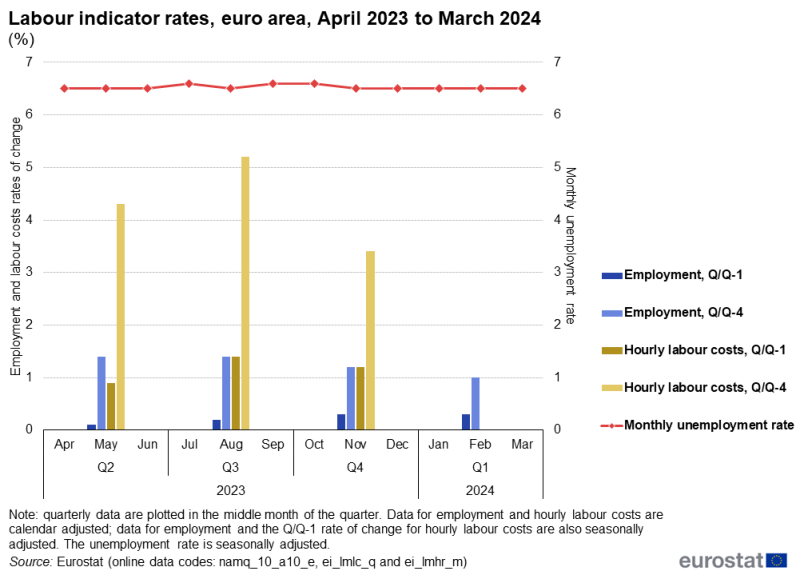

In March 2024, the seasonally adjusted unemployment rate was 6.5% in the euro area, the same as it had been in each of the previous 4 months. In the EU, the rate fell to 6.0%, having been 6.1% for the previous 6 months. Compared with March 2023, unemployment in March 2024 was lower by 51 000 people in the euro area, whereas it was higher by 175 000 people in the EU. In March 2024, the youth unemployment rate (for people aged 15–24 years) was 14.1% in the euro area, down from 14.4% in the previous 2 months. In the EU, the rate was 14.6%, down from 14.7% in the previous month. The rate for people aged 25 years or older was 5.7% in the euro area and 5.2% in the EU, unchanged compared with the previous month in both the euro area and the EU.

In the 1st quarter of 2024, the number of people in employment increased by 0.3% in the euro area and by 0.2% in the EU compared with the previous quarter, following similar increases in the 4th quarter of 2023. Compared with the 1st quarter of 2023, employment in the 1st quarter of 2024 was 1.0% higher in the euro area and 0.8% higher in the EU.

Compared with the previous quarter, hourly labour costs increased by 1.2% in both the euro area and the EU in the 4th quarter of 2023; in the 3rd quarter of 2023, there had been increases of 1.4% in the euro area and 1.5% in the EU. Compared with the 4th quarter of 2022, hourly labour costs in the 4th quarter of 2023 were 3.4% higher in the euro area and 4.0% higher in the EU.

The employment expectations indicator, as measured by business and consumer surveys, decreased in the euro area in April 2024, down 0.7 points. This was due to more pessimistic employment plans among retail trade and industrial managers as well as less optimistic plans among services managers outweighing more optimistic plans among construction managers. In the EU, the situation was similar: more pessimistic employment plans among industrial managers and less optimistic plans among retail trade and services managers outweighed more optimistic plans in construction such that the overall index decreased by 0.5 points. In April 2024, the index level (with a long-term average = 100) of the indicator was 101.8 in the euro area and 101.7 in the EU.

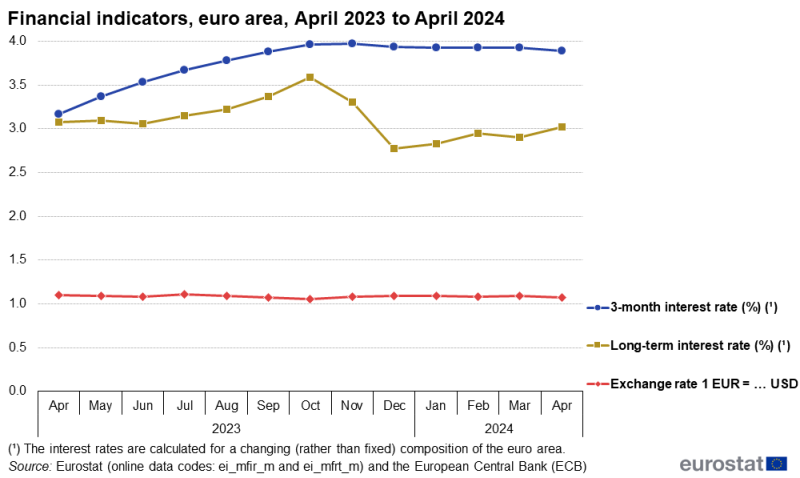

Interest rates

On 11 April 2024, the Governing Council of the European Central Bank (ECB) decided to keep the 3 key ECB interest rates unchanged. Accordingly, the interest rates on the main refinancing operations, the marginal lending facility and the deposit facility remained at 4.50%, 4.75% and 4.00%, respectively.

The euro area’s 3-month interest rate, the Euro Interbank Offered Rate (Euribor), decreased to 3.89% in April 2024, down from 3.92% in the previous month. Long-term interest rates (monthly average weighted 10-year government bond yields) of the euro area increased to 3.02% in April 2024 from 2.90% in the previous month. The EU’s long-term interest rates on government bonds increased to 3.37% in April 2024 from 3.23% in the previous month.

Exchange rates

In April 2024 (compared with the previous month), the monthly averages of day-to-day exchange rates were as follows

- euro-US dollar: USD 1.0728 (down from USD 1.0872)

- euro-Japanese yen: JPY 165.03 (up from JPY 162.77)

- euro-Swiss franc: CHF 0.9761 (up from CHF 0.9656).

Source: Eurostat (ei_mfir_m) and (ei_mfrt_m) and the European Central Bank (ECB)

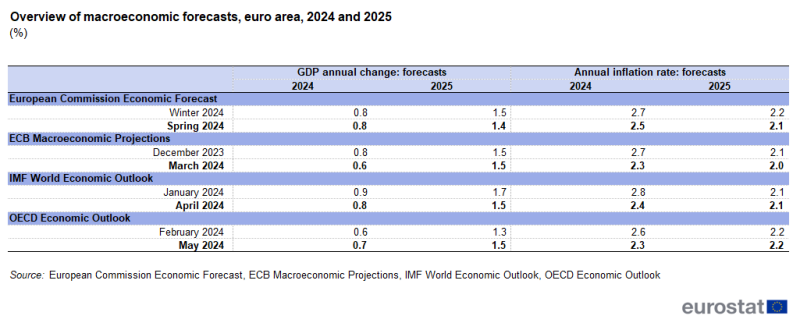

Latest macroeconomic forecasts

The latest available forecasts by 4 international organisations – the European Commission (EC) [1], the ECB [2], the Organisation for Economic Co-operation and Development (OECD) [3] and the International Monetary Fund (IMF) confirmed for the euro area moderate economic growth in 2024, with growth forecasted to approximately double in 2025. Growth forecasts for 2024 were revised downwards by 2 of these 4 organisations – the ECB and the IMF – in their latest forecasts compared with their previous ones, while the European Commission left its forecast unchanged and the OECD revised its forecast upwards from 0.6% to 0.7%. The growth forecast for 2025 was revised downwards by the European Commission and the IMF, there was no change in the forecast from the ECB, while the OECD revised its forecast upwards. Annual inflation in the euro area is projected to be lower in 2025 than in 2024, although all 4 of these organisations revised their inflation forecasts for 2024 downwards in their latest forecasts. Overall, the European Commission forecasts a gradual expansion amid high geopolitical risks.

According to the latest information, euro area economic growth (based on real changes in GDP) is forecasted to be 0.6% (the ECB), 0.7% (the OECD) or 0.8% (the European Commission and the IMF) for 2024. For 2025, economic growth is forecasted to be 1.5% (the ECB, the IMF and the OECD) or 1.4% (the European Commission).

Compared with its previous forecast in winter 2024, the European Commission revised down its forecast for annual inflation rates in the euro area for 2024 (to 2.5% from 2.7%) and 2025 (to 2.1% from 2.2%) in its spring 2024 forecast. In March 2024, the ECB forecasted euro area annual inflation of 2.3% for 2024 (revised down from 2.7% in the previous forecast) while it also revised down its forecast for 2025 from 2.1% to 2.0%. In April 2024, the IMF forecasted an annual inflation rate for the euro area of 2.4% for 2024 (down from 2.8% in the previous forecast), followed by a lower rate of 2.1% for 2025 (unchanged from its previous forecast). In its report in May 2024, the OECD updated its inflation forecast for 2024 to 2.3% (revised down from 2.6% in its previous forecast) and maintained its forecast for 2025 at 2.2%.

Following a prolonged period of stagnation and a mild recession in the second half of 2023, growth returned to the euro area’s economy at the start of 2024. A gradual acceleration in growth is expected over the course of 2024 and 2025 as private consumption is supported by declining inflation, recovering purchasing power and continued employment growth. The improved outlook for global trade in goods should support external trade, helping to lift the prospects of the weakened manufacturing sector. Nevertheless, global trade and energy markets appear particularly vulnerable in the context of external risks.

Read more under Latest forecasts indicate a gradual expansion amid high geopolitical risks in the data visualisation.

Situation in the EU countries

In the 1st quarter of 2024, changes in GDP showed a generally upward development among the EU countries [4]. Based on the latest quarter-on-quarter rates of change, GDP increased in the 1st quarter of 2024 in 17 countries, decreased in 3 and remained stable in 1 (1st quarter data are not available for 6 countries at the time of writing). Cyprus (up 1.2%) and Ireland (up 1.1%) recorded the largest increases of GDP. The largest decrease was observed in Estonia (down 0.4%).

The highest estimated annual inflation rates (based on the HICP) [5] in April 2024 were recorded in Romania (up 6.2%), Belgium (up 4.9%) and Croatia (up 4.7%). The lowest inflation rates were recorded in Lithuania (up 0.4%), Denmark (up 0.5%) and Finland (up 0.6%).

In March 2024, the lowest unemployment rates were recorded in Czechia, Poland (both 2.9%), Slovenia (3.1%), Malta and Germany (both 3.2%). The highest rates were in Spain (11.7%) and Greece (10.2%). Eurostat estimates that 13.3 million people in the EU were unemployed in March 2024; 11.1 million of these people were in the euro area.

In April 2024, the economic sentiment indicator showed a varied development among the EU countries, increasing in 15 and decreasing in 11 (Ireland, no data available). The strongest increase was in Austria (up 3.7 points), while the strongest decreases were in France (down 4.8 points) and Croatia (down 4.9 points). The index level of the economic sentiment indicator (with a long-term average = 100) varied from 81.6 in Estonia to 108.5 in Greece.

Country in focus – Lithuania

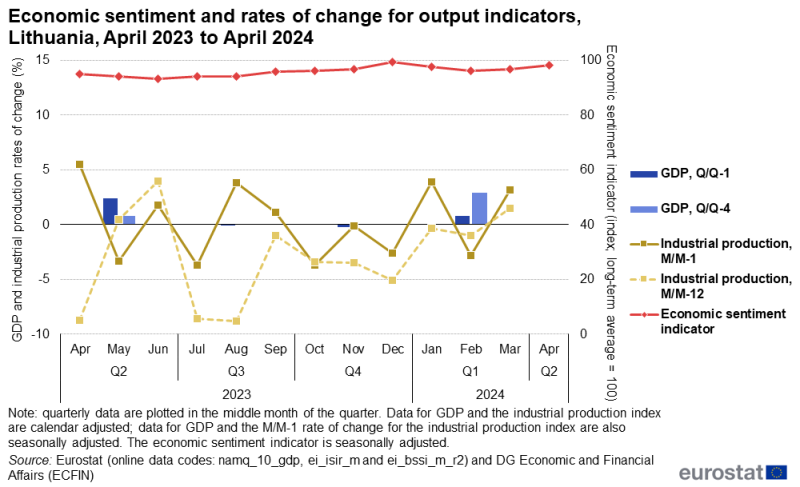

The economy in Lithuania expanded in the 1st quarter of 2024. Quarter-on-quarter, GDP increased by 0.8%, one of the largest increases among the EU countries; this followed a decrease of 0.2% in the previous quarter. GDP was 2.9% higher in the 1st quarter of 2024 than a year earlier.

Industrial production increased month-on-month by 3.2% in March 2024, after a decrease of 2.8% in the previous month.

In April 2024, the economic sentiment indicator increased by 1.4 points to 98.1, after an increase of 0.6 points in the previous month.

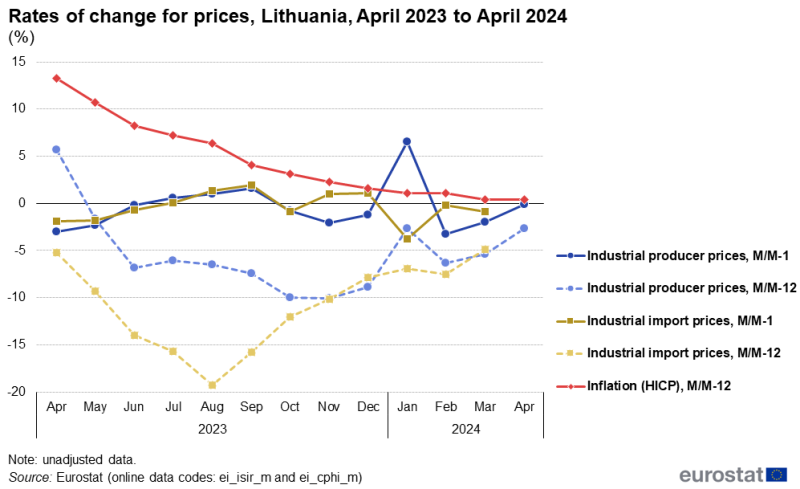

Annual inflation remained at 0.4% in April 2024 as it had been in the previous month. It was down from 13.3% a year earlier (April 2023). In April 2024, Lithuania had the lowest inflation rate among all EU countries.

Industrial producer prices were 2.7% lower in April 2024 than a year earlier and marginally (0.1%) lower than the previous month.

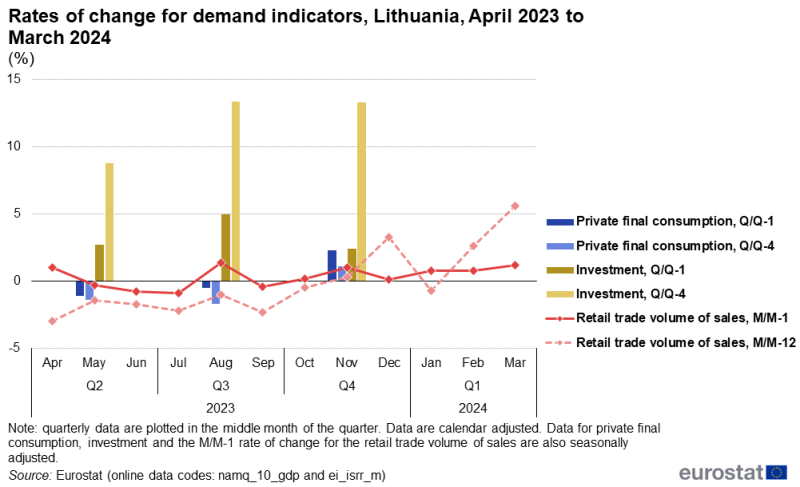

The volume of retail sales increased month-on-month by 1.2% in March 2024, which was the 6th consecutive monthly increase.

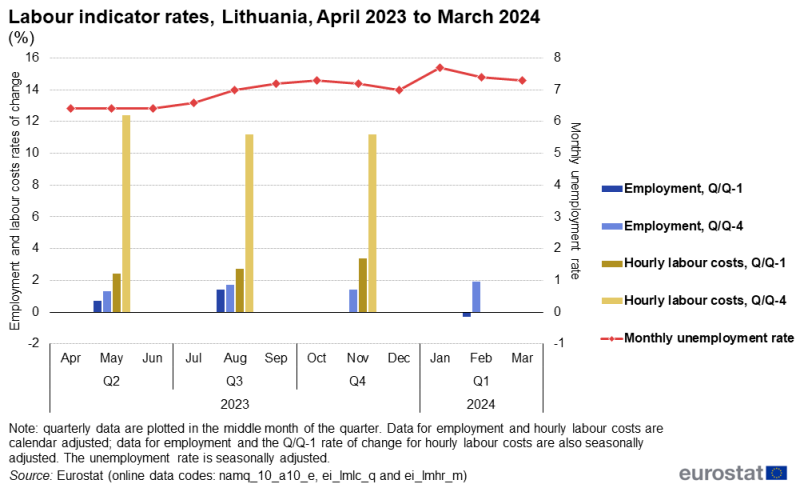

The unemployment rate in March 2024 was 7.3%, down from 7.4% in the previous month. With the exception of January 2024 (when the rate was 7.7%), the monthly unemployment rate had remained between 7.0% and 7.4% from August 2023 to March 2024. Approximately 112 000 people were unemployed in March 2024, of which 17 000 were young people (aged under 25 years).

Source: Eurostat (namq_10_gdp), (ei_isir_m) and (ei_bssi_m_r2) and DG Economic and Financial Affairs (ECFIN)

(%)

Source: Eurostat (ei_isir_m) and (ei_cphi_m)

(%)

Source: Eurostat (namq_10_gdp) and (ei_isrr_m)

Situation in the largest EU economies

All except 1 of the 6 largest EU economies recorded quarter-on-quarter growth in GDP in the 1st quarter of 2024, with the highest growth rate at 0.7% in Spain and the lowest at 0.2% in both Germany and France. The exception was the Netherlands where a small decrease (down 0.1%) was recorded in the 1st quarter of 2024. In April 2024, the annual inflation rate was higher than in the previous month in 3 of these countries, unchanged in 1 and lower in 2. The highest annual inflation rate among these economies was recorded in Spain (3.4%) and the lowest in Italy (0.9%). The latest unemployment rates are for March 2024: these were lower than in the previous month in 4 of the largest economies and unchanged in the other 2. Spain recorded the highest unemployment rate (11.7%) and Poland the lowest (2.9%). Economic sentiment showed a mixed development in April 2024, decreasing in 2 of these economies and increasing in the remaining 4.

Source: Eurostat (namq_10_gdp), (ei_cphi_m), (ei_lmhr_m) and (ei_bssi_m_r2) and DG Economic and Financial Affairs (ECFIN)

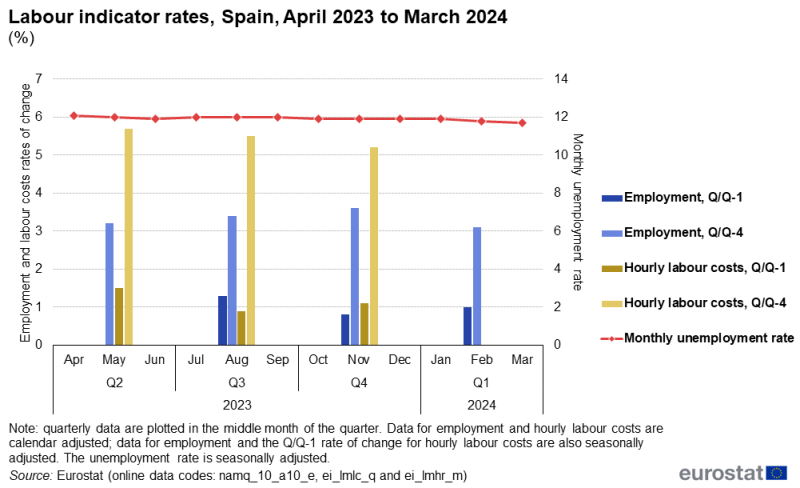

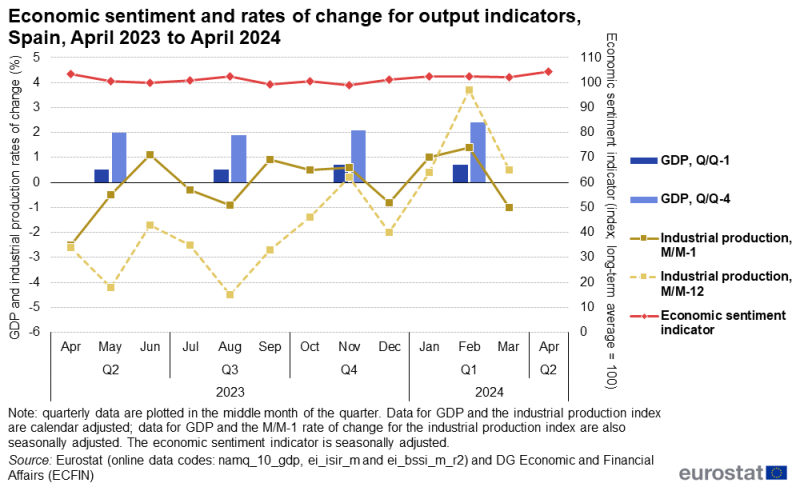

Country in focus – Spain

Compared with the previous quarter, GDP in Spain expanded by 0.7% in the 1st quarter of 2024; this followed on from a similar-sized increase in the previous quarter. GDP was 2.4% higher in the 1st quarter of 2024 than a year earlier.

Industrial production contracted month-on-month in March 2024, down 1.0% after an increase of 1.4% in the previous month. Overall, industrial production was 0.5% higher in March 2024 than a year earlier.

In March 2024, the economic sentiment indicator increased by 2.3 points to 104.3, after a decrease of 0.3 points in the previous month.

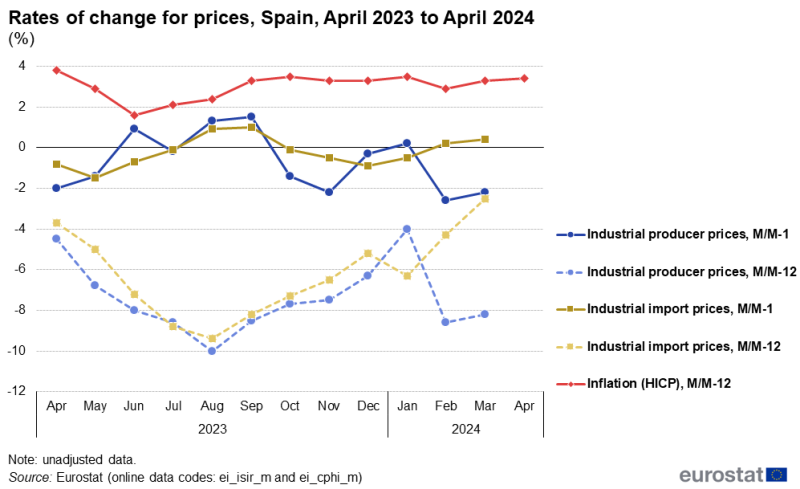

The annual inflation rate was 3.4% in April 2024, up from 3.3% in the previous month. Since March 2023, the Spanish inflation rate has remained below 4.0%.

The month-on-month decrease of 2.2% in March 2024 contributed to industrial producer prices being 8.2% lower in March 2024 than a year earlier.

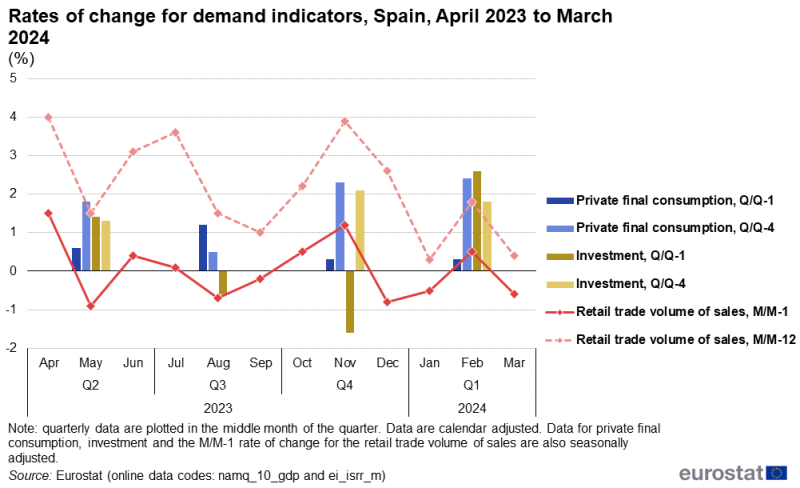

The volume of retail sales decreased in March 2024, down 0.6%. This extended the series of relatively small changes – both negative and positive – recorded for more than a year: the last month-on-month change in excess of 1.5% was recorded in January 2023.

An unemployment rate of 11.7% was recorded in March 2024, down from 11.8% in the previous month. This was the highest unemployment rate in March 2024 among all EU countries. In March 2024, approximately 2.9 million people were unemployed in Spain, of which 480 000 were young people (aged under 25 years).

Source: Eurostat (namq_10_gdp), (ei_isir_m) and (ei_bssi_m_r2) and DG Economic and Financial Affairs (ECFIN)

(%)

Source: Eurostat (ei_isir_m) and (ei_cphi_m)

(%)

Source: Eurostat (namq_10_gdp) and (ei_isrr_m)

International context

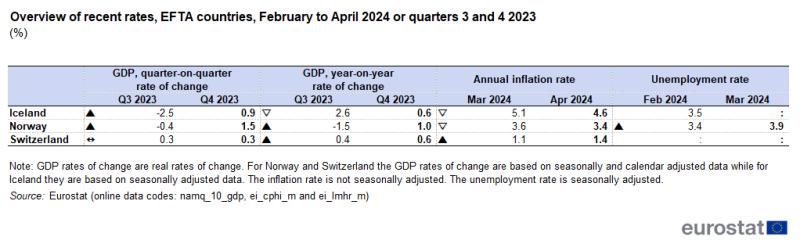

Situation in the EFTA countries

- Compared with the previous quarter, GDP expanded in the 4th quarter of 2023 in Norway (up 1.5%), Iceland (up 0.9%) and Switzerland (up 0.3%).

- In April 2024, Iceland recorded the highest annual inflation rate (up 4.6%), followed by Norway (up 3.4%) and Switzerland (up 1.4%). The rates for Iceland and Norway were lower than those of the previous month, while in Switzerland the rate had increased.

- In March 2024, the unemployment rate increased in Norway (to 3.9% from 3.4%). In February 2024, the unemployment rate was 3.5% in Iceland while in December 2023 it was 4.1% in Switzerland.

Situation in other non-EU countries

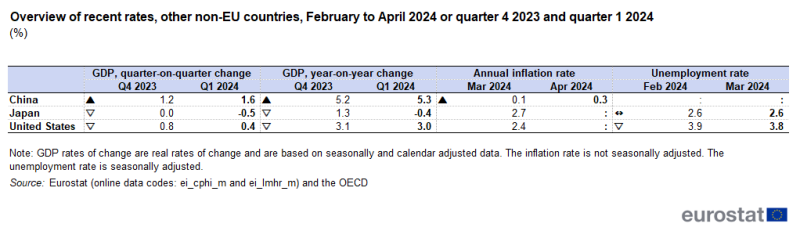

- Compared with the previous quarter, GDP expanded in the 1st quarter of 2024 in China by 1.6% and in the United States by 0.4%, while it contracted in Japan by 0.5%. Compared with the 1st quarter of 2023, GDP in the 1st quarter of 2024 was 5.3% higher in China and 3.0% higher in the United States, while it was 0.4% lower in Japan.

- In April 2024, the annual inflation rate increased to 0.3% (from 0.1%) in China. In March 2024, the annual inflation rate in Japan was 2.7% and in the United States it was 2.4%.

- In March 2024, the unemployment rate was stable in Japan at 2.6% while it decreased in the United States to 3.8% (from 3.9%).

(%)

Source: Eurostat (ei_cphi_m) and (ei_lmhr_m) and the OECD

Source data for tables and figures

Data sources

Data for non-EU countries come either from Eurostat’s datasets or from an external source, such as the OECD Data Explorer.

Data for the euro area, EU and EU countries

- GDP, quarter-on-quarter and year-on-year percentage change, seasonally and calendar adjusted (namq_10_gdp)

- Industrial production, month-on-month percentage change, seasonally and calendar adjusted, and year-on-year percentage change, calendar adjusted (ei_isir_m)

- Economic sentiment indicator, seasonally adjusted (Directorate-General for Economic and Financial Affairs (ECFIN) ei_bssi_m_r2)

- Inflation (based on the HICP), year-on-year percentage change (not adjusted) (ei_chpi_m)

- Industrial producer prices, month-on-month and year-on-year percentage change (not adjusted) (ei_isir_m)

- Import prices, month-on-month and year-on-year percentage change (not adjusted) (ei_isir_m)

- Retail trade volume of sales, month-on-month percentage change, seasonally and calendar adjusted, and year-on-year percentage change, calendar adjusted (ei_isrr_m)

- Household final consumption expenditure, quarter-on-quarter and year-on-year percentage change, seasonally and calendar adjusted (namq_10_gdp)

- Government final consumption expenditure, quarter-on-quarter and year-on-year percentage change, seasonally and calendar adjusted (namq_10_gdp)

- Gross fixed capital formation, quarter-on-quarter and year-on-year percentage change, seasonally and calendar adjusted (namq_10_gdp)

- Unemployment rate, seasonally adjusted (ei_lmhr_m) and unemployment in thousand people, seasonally adjusted (ei_lmhu_m)

- Hourly labour costs (based on the labour cost index), month-on-month, quarter-on-quarter and year-on-year percentage change, seasonally and calendar adjusted (ei_lmlc_q)

- Employment, quarter-on-quarter percentage change, seasonally adjusted, and year-on-year percentage change (not adjusted) (namq_10_a10_e)

- Employment expectations indicator, seasonally adjusted (Directorate-General for Economic and Financial Affairs (ECFIN) ei_bsee_m_r2)

- Exchange rates (not adjusted) (ei_mfrt_m)

- Interest rates (not adjusted) (ei_mfir_m)

Data for Iceland, Norway and Switzerland

- GDP, quarter-on-quarter and year-on-year percentage change, seasonally and calendar adjusted (namq_10_gdp)

- Inflation (based on the HICP), year-on-year percentage change, all items (not adjusted) (ei_cphi_m)

- Unemployment rate, seasonally adjusted (ei_lmhr_m)

Data for China, Japan and the United States

Data for China and Japan

Data for the United States

- Unemployment rate, seasonally adjusted (ei_lmhr_m)

- Inflation (based on the HICP), year-on-year percentage change (not adjusted) (ei_cphi_m)

Macroeconomic forecasts

- European Commission Economic Forecast, see

- ECB Macroeconomic Projections, see

- IMF World Economic Outlook, see

- OECD Economic Outlook, see

Rates of change

For monthly data, 2 rates of change are presented

- M/M-1: change compared with the previous month

- M/M-12: change compared with the same month of the previous year.

For quarterly data, 2 rates of change are presented

- Q/Q-1: change compared with the previous quarter

- Q/Q-4: change compared with the same quarter of the previous year.

Context

The principal European economic indicators (PEEIs) represent a comprehensive set of infra-annual macroeconomic statistics aiming to describe the economic and labour market situation as well as price developments in the euro area, the EU and the EU countries; these statistics are of particularly high importance for economic and monetary policy.

The Communication of the European Commission to the European Parliament and the Council on euro area statistics Towards improved methodologies for euro area statistics and indicators of November 2002 defined the list of PEEIs and their timeliness targets, amended in the 2008 Economic and Financial Committee (EFC) report.

In 2002, Eurostat produced an initial list of 19 PEEIs, which subsequently expanded to 22. Data for these indicators are published regularly and posted in the dedicated Euro indicators section on the Eurostat website. Since 2002, PEEIs have been regularly monitored and improved in terms of coverage and timeliness. The list of indicators includes, for example, GDP, private final consumption, the external trade balance and the 3-month interest rate.

The progress that has been achieved with the timeliness and availability of PEEIs and remaining challenges are constantly monitored. Each year Eurostat, in cooperation with the ECB, drafts a Status Report on Information Requirements in the Economic and Monetary Union (EMU) which is submitted to the EFC and then to the Economic and Financial Affairs Council (ECOFIN). All reports can be found in the dedicated Euro indicators section under publications.