Enterprise demography

Enterprise demography statistics describe the population of enterprises: they cover, among other things, the birth of new enterprises, the growth and survival of existing enterprises (with particular interest centred on their employment impact), and enterprise deaths. These indicators provide an important insight into business dynamics, as new enterprises / fast-growing enterprises tend to be innovators that may improve the overall level of efficiency and productivity in an economy.

Note that throughout this section on enterprise demography the ‘business economy’ is generally defined as NACE Sections B to S, excluding the activities of holding companies (NACE Group 64.2). Note that for the analyses of enterprise birth and death rates, a narrower range of activities – excluding Sections O to S – has been used for the EU total/average and Belgium, as well as for Iceland and Serbia.

Births and deaths

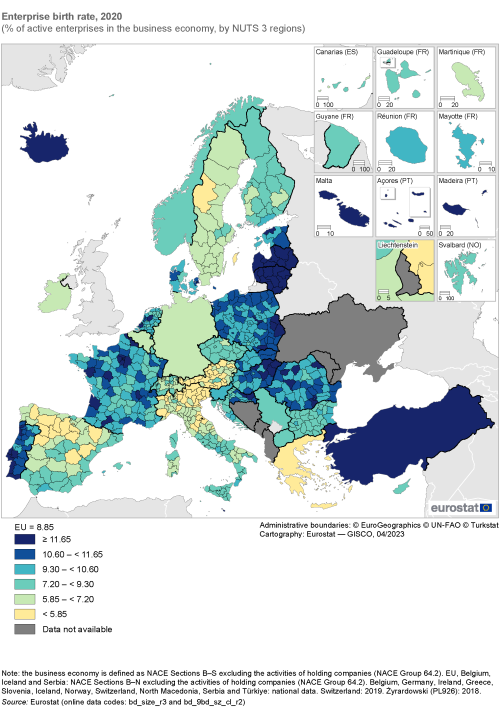

The EU’s enterprise birth rate was 8.85 %

The enterprise birth rate measures the number of new enterprises born during the course of a year in relation to the total population of active enterprises in the same year. In 2020, the enterprise birth rate in the EU’s business economy was 8.85 %. This latest figure was 1.16 percentage points lower than in 2019, highlighting the impact of the COVID-19 crisis, which likely made some entrepreneurs reluctant to start new businesses during 2020.

In 2020, close to one in five (19.57 %) enterprises active in the business economy of Utenos apskritis in Lithuania were newly born; this was the highest enterprise birth rate among NUTS level 3 regions. The next highest rates were also recorded in Lithuania: Alytaus apskritis (18.81 %) and Klaipėdos apskritis (18.37 %). All three of these regions had very high levels of ‘business churn’ – a measure of how frequently new enterprises are created and existing enterprises closed down – indicating a high degree of business dynamism (which is often linked to productivity growth).

There were 65 NUTS level 3 regions (out of 654 for which data are available; note that several EU Member States are unable to provide a regional breakdown for these statistics, see Map 1 for more details) where the enterprise birth rate for the business economy in 2020 was at least 11.65 %, as shown by the darkest shade of blue. This group included:

- all six regions of Latvia;

- all 10 regions of Lithuania;

- both regions in Malta;

- the capital regions of Denmark, Estonia and Portugal;

- a number of regions within close proximity of capitals – as was the case for the seven regions that encircle the French capital of Paris, or the single regions that encircle the Danish and Romanian capitals;

- high enterprise birth rates were also recorded in eight additional regions of Portugal, seven additional regions of France, five additional regions of Romania, as well as in five regions each from Hungary and Poland (Żyrardowski; 2018 data), three regions from the Netherlands, and two regions from Croatia.

Summarising the above, there were two main patterns observed. Enterprise birth rates tended to be relatively homogeneous across different regions of individual EU Member State, highlighting that societal values, the underlying national business environment, administrative, macro- and socioeconomic conditions likely play an important role. By contrast, in some Member States there was evidence to suggest that enterprise birth rates were higher in predominantly urban regions, particularly in and around the capital city.

At the other end of the range, there were 65 NUTS level 3 regions where the enterprise birth rate in 2020 was below 5.85 %. Most of these were concentrated in the southern EU Member States of Italy (29 regions), Spain (12 regions) and Greece (national data). Otherwise, a majority of regions in Austria (21 regions) had relatively low enterprise birth rates, as was the case for two regions of Sweden. The lowest rates were recorded in three popular Alpine destinations, Tiroler Oberland (3.90 %) and Bludenz-Bregenzer Wald (4.32 %) in western Austria, and Sondrio (4.56 %) in northern Italy. Note these relatively low figures are likely to reflect the particular circumstances in 2020 of the COVID-19 pandemic and related restrictions.

(% of active enterprises in the business economy, by NUTS 2 regions)

Source: Eurostat (bd_size_r3) and (bd_9bd_sz_cl_r2)

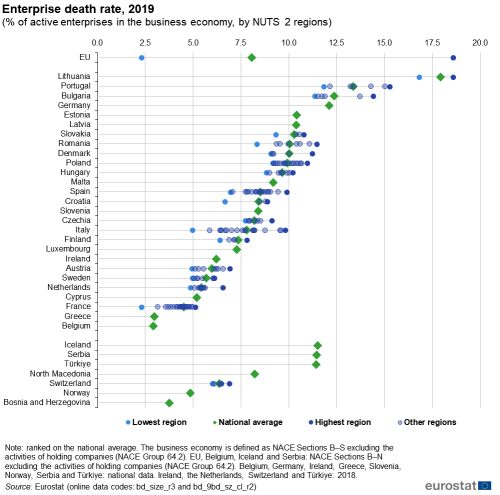

The EU’s enterprise death rate was 8.06 %

Note the reference year for enterprise death rates generally lags that for enterprise births as, when compiling statistics on deaths, it is necessary to ensure that enterprises have remained inactive during a period of two years (without being reactivated). The latest data for the enterprise death rate are therefore for 2019 and do not yet reflect the impact of the COVID-19 crisis. In 2019, the enterprise death rate across the EU’s business economy was 8.06 %. It was relatively common for regions with high enterprise birth rates to also record high enterprise death rates. This is perhaps not surprising, as dynamic and innovative enterprises entering a market may be in a position to drive less productive incumbents out of the market (‘creative destruction’). Figure 1 shows there was a relatively narrow range of regional enterprise death rates across most of the EU Member States. Indeed, there tended to be (even) less variation in enterprise death rates between regions of the same Member State than was the case for enterprise birth rates.

Across the business economies of NUTS level 2 regions in 2019, the highest enterprise death rates were recorded in the two Lithuanian regions – Vidurio ir vakarų Lietuvos regionas (18.59 %) and Sostinės regionas (16.82 %). High rates were also recorded for all seven regions of Portugal, the two highest Portuguese rates being 15.28 % in the capital region of Área Metropolitana de Lisboa and 15.02 % in Algarve. There were also high enterprise death rates in two regions of Bulgaria – Yugoiztochen (14.40 %) and Severoiztochen (13.71 %).

By contrast, very low enterprise death rates were observed across the business economies of Greece (2.97 %) and Belgium (2.93 %); note that only national data are available for both of these EU Member States and that the Belgian business economy is defined as NACE Sections B to N excluding Group 64.2. Leaving these national values aside, the 24 lowest regional rates were all concentrated in France (which is composed of 27 NUTS level 2 regions; the only exceptions with somewhat higher death rates were Nord-Pas de Calais, Centre – Val de Loire and La Réunion). It is also interesting to note that while all French regions had enterprise death rates that were lower than the EU average, their enterprise birth rates were generally much higher (suggesting that the total number of enterprises was growing at a relatively rapid pace). Outside of France, the lowest enterprise death rate was observed in the Dutch region of Friesland (4.84 %; 2018 data).

(% of active enterprises in the business economy, by NUTS 2 regions)

Source: Eurostat (bd_size_r3) and (bd_9bd_sz_cl_r2)

High-growth enterprises

High-growth enterprises are of particular interest to policymakers insofar as they can improve the economic performance of a region, create employment opportunities and, if sustained, change its economic structure. For the purpose of this analysis, high-growth enterprises are defined as those:

- born before 2017 which had survived up to 2020;

- with at least 10 employees in 2017; and

- with average employee growth of more than 10.0 % per year between 2017 and 2020.

The threshold of at least 10 employees is designed to exclude very small enterprises where employment increases could be very high in relative terms, but with little economic impact in absolute terms. This indicator should be analysed with caution as it fails to capture potential downsides, insofar as high-growth enterprises may displace incumbents and/or disrupt markets, possibly lowering overall economic performance. Note that in this section, the business economy for the EU, Belgium, Germany, Ireland, Greece, Cyprus, Luxembourg and Slovenia (as well as Iceland, Norway, North Macedonia and Türkiye) is defined as NACE Sections B to N excluding Group 64.2.

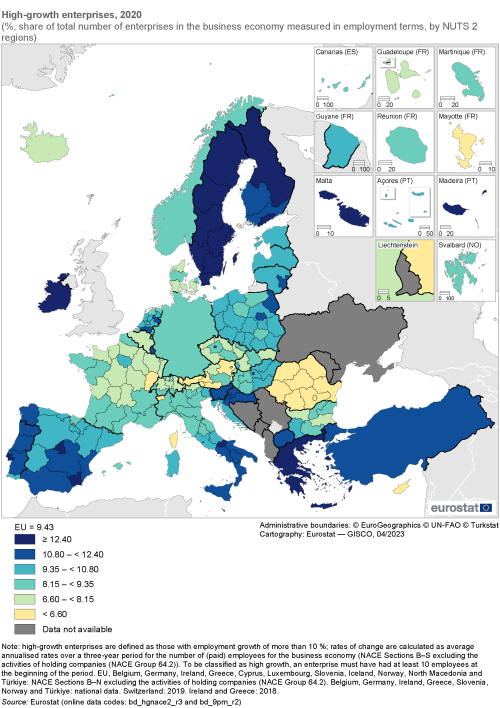

High-growth enterprises accounted for approximately 1 out of every 10 enterprises active in the EU’s business economy, some 9.43 % in 2020. There was a relatively even distribution of high-growth enterprises across the 180 NUTS level 2 regions for which data are available: 48.3 % (or 87 out of 180 regions) recorded shares that were equal to or above the EU average; 51.7 % (or 93 regions) had shares below the EU average.

The darkest shade of blue in Map 2 shows those NUTS level 2 regions where high-growth enterprises accounted for 12.40 % or more of all active enterprises in 2020; there were 19 regions at or above this threshold. The existence of high-growth enterprises reflects, at least in part, the business enterprise structure of each region: it is generally easier for a relatively small enterprise (compared with a relatively large enterprise) to grow at a rapid pace; this pattern is often referred to as the ‘catch-up’ process. The 19 regions with a relatively high proportion of high-growth enterprises were largely concentrated in the Nordic and southern EU Member States:

- all eight regions of Sweden and two regions from Finland;

- three regions in Spain, two regions in Portugal, one region in southern Italy, Greece (national data for 2018) and Malta;

- the only other region with a share above 12.40 % was Ireland (national data for 2018).

The capital regions of Bulgaria, Czechia, Denmark, Lithuania, Hungary, Austria, Poland, Romania, Slovakia and Finland recorded the highest proportions of high-growth enterprises on their national territories. This bias towards capital regions might reflect, among other factors, the availability of: capital for business start-ups; highly-qualified people to staff rapidly growing enterprises; a critical mass of potential business and/or consumer clients for new businesses.

(%, share of total number of enterprises in the business economy measured in employment terms, by NUTS 2 regions)

Source: Eurostat (bd_hgnace2_r3) and (bd_9pm_r2)

Regional patterns of employment specialisation and concentration in manufacturing

Structural business statistics (SBS) can be analysed at a very detailed sectoral level (several hundred economic activities), by enterprise size class (for micro, small, medium and large-sized enterprises) or, as here, by region. They provide data covering issues such as labour input, wealth creation, productivity, investment and profitability. This information can be used to analyse (among other issues) structural shifts in an economy, national or regional specialisations, and sectoral patterns.

In 2020, there were 23.4 million enterprises active in the EU’s non-financial business economy; together, their gross value added was €6 496 billion and they employed 127.6 million persons. The COVID-19 crisis disrupted many enterprises across the EU’s non-financial business economy. During 2020, most governments introduced temporary support schemes to offset the impact of the pandemic (often with a focus on protecting jobs). This may explain, at least in part, the resilience of the total number of enterprises in the EU, up 0.9 % between 2019 and 2020. By contrast, the corresponding rate of change for the number of persons employed was a fall of 3.0 %, while the decrease for value added (in current price terms) was even greater, at 5.2 %.

The EU’s manufacturing base has migrated eastwards

Manufacturing (NACE Section C) produces goods and provides industrial services. These may be for domestic use (investment, further processing or consumption) and for export. It has traditionally been considered a cornerstone of economic prosperity within the EU. However, over several decades this sector has experienced wide-ranging transformations, through outsourcing, globalisation, changes to business paradigms (such as just-in-time manufacturing), the growing importance of digital technologies, or concerns linked to sustainable production and the environment.

There has been an eastward shift in the EU’s manufacturing base during the last two to three decades, reflecting, among other factors, differences in: labour costs; taxes and subsidies; flows of foreign direct investment (FDI) and the presence of multinational enterprises; natural resource endowments; environmental standards. Eastern EU Member States have been increasingly used as manufacturing bases by enterprises from other Member States, in particular neighbouring countries such as Germany, and enterprises from non-EU countries that would like to establish a manufacturing base within the EU’s single market. These enterprises often form an integral part of international supply chains, with a relatively highly-skilled workforce.

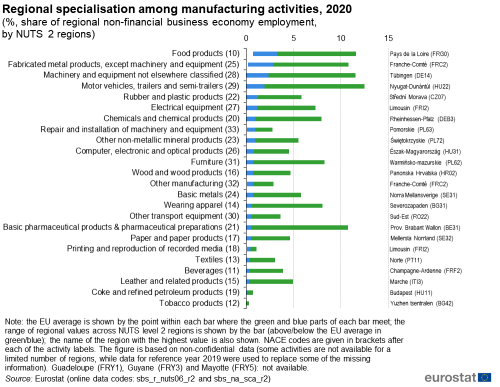

In 2020, manufacturing employed close to one quarter (23.0 %) of the EU’s non-financial business economy workforce, while its share of value added was 6.0 percentage points higher, at 29.0 %. The three largest manufacturing subsectors in the EU – in employment terms and as defined by NACE divisions – were the manufacture of food products (3.2 % of the non-financial business economy total), the manufacture of fabricated metal products, except machinery and equipment (2.8 %), and the manufacture of machinery and equipment not elsewhere classified (2.4 %). There were only three other manufacturing subsectors which accounted for at least 1.0 % of the EU’s non-financial business economy workforce: the manufacture of motor vehicles, trailers and semi-trailers (1.9 %), the manufacture of rubber and plastic products (1.3 %) and the manufacture of electrical equipment (1.2 %).

Figure 2 shows information for 24 different manufacturing activities (as defined by NACE divisions). The bars show the number of persons employed in a specific manufacturing activity as a share of the non-financial business economy workforce, with the right- and left-hand ends of each bar providing information on the regions with the highest/lowest regional shares; the point where the blue and green parts of each bar meet indicates the EU average. For example, in the French region of Pays de la Loire, the manufacture of food products employed 11.6 % of the non-financial business economy workforce in 2020; this was 3.6 times as high as the EU average (3.2 %).

Primary processing activities are often located close to the source of raw materials

Figure 2 also shows that the distribution of employment across the various manufacturing divisions was often highly skewed. In some activities, particularly high levels of employment were concentrated in a handful of regions. Activities that involve the primary processing stages of agricultural, fishing or forestry products were often located close to the source of their raw materials. This was the case for the manufacture of food products in Pays de la Loire (as mentioned above). There were four agricultural regions where the manufacture of food products accounted for 9.0–10.6 % of employment within the non-financial business economy in 2020, namely Ipeiros and Thessalia (both in Greece), Bretagne in France, and Mazowiecki regionalny in Poland. Champagne-Ardenne (France; 3.9 %) had the highest employment share for the manufacturing of beverages (NACE Division 11). Regions specialised in the manufacture of textiles (NACE Division 13) were often located close to an abundant supply of water; Norte (Portugal; 3.0 %) had the highest regional share in the EU. Norra Mellansverige (Sweden) had the highest employment share for the manufacture of basic metals (NACE Division 24; 5.8 %), while the neighbouring region of Mellersta Norrland had the highest share for the manufacture of paper and paper products (NACE Division 17; 4.6 %). The Croatian region of Panonska Hrvatska had the highest employment share for the manufacture of wood and wood products, except furniture (NACE Division 16; 4.7 %).

German regions often specialise in export-orientated subsectors

Exports make it possible for enterprises to maintain or increase production when faced with stagnating domestic demand. Germany exports a high proportion of its manufacturing output; this is particularly the case for its motor vehicles, electrical, engineering and chemical subsectors. In 2020 and among NUTS level 2 regions of the EU, Tübingen in south-west Germany had the highest employment share for the manufacture of machinery and equipment not elsewhere classified (NACE Division 28; 11.6 %), while Rheinhessen-Pfalz in western Germany had the highest employment share for the manufacture of chemicals and chemical products (NACE Division 20; 7.9 %).

The manufacture of transport equipment is characterised by clusters of economic activity

Over time, some production has moved abroad, to exploit efficiency gains in global value chains. For example, this has included an expansion in production in some eastern EU Member States. The manufacture of transport equipment is characterised by clusters of economic activity and highly-integrated production chains. In 2020, the westernmost Hungarian region of Nyugat-Dunántúl had the highest degree of employment specialisation for the manufacture of motor vehicles, trailers and semi-trailers (NACE Division 29; 12.5 %). Vest (Romania; 11.8 %) and Střední Čechy (Czechia; 11.6 %) also reported double-digit employment shares for this activity. Another Romanian region, Sud-Est, was the most specialised for the manufacture of other transport equipment (NACE Division 30; 3.6 %).

(%, share of regional non-financial business economy employment, by NUTS 2 regions)

Source: Eurostat (sbs_r_nuts06_r2) and (sbs_na_sca_r2)

Regional patterns of employment specialisation and concentration in services (other than finance)

Non-financial services (NACE Sections G to J and L to N and Division 95) provided work to 82.1 million persons across the EU in 2020. This equated to slightly less than two thirds (64.3 %) of the total number of persons employed in the non-financial business economy. Among NUTS level 2 regions, the contribution of non-financial services to the non-financial business economy workforce was less than 45.0 % in eight regions that were predominantly located in eastern EU Member States: four of these were in Czechia (where the capital region of Praha was alone in having more than half of its non-financial business economy workforce employed in non-financial services), while the others included Vzhodna Slovenija (Slovenia), Közép-Dunántúl (Hungary) and Sjeverna Hrvatska (Croatia). There were also one region in eastern Germany – Chemnitz – with a relatively low proportion of its non-financial business economy workforce employed in non-financial services.

At the other end of the range, there were 14 NUTS level 2 regions in the EU where the contribution of non-financial services to the non-financial business economy workforce was higher than four fifths in 2020. This group included:

- the capital regions of Noord-Holland (the Netherlands), Région de Bruxelles-Capitale/Brussels Hoofdstedelijk Gewest (Belgium), Área Metropolitana de Lisboa (Portugal), Comunidad de Madrid (Spain) and Wien (Austria);

- the popular holiday destinations of Notio Aigaio, Kriti (both Greece), Canarias (Spain) and Algarve (Portugal);

- as well as Ciudad de Melilla (Spain), Utrecht and Flevoland (both in the Netherlands), Hamburg (Germany) and Prov. Vlaams-Brabant (Belgium).

Some service activities are commonly spread across the EU territory, whereas others are concentrated within close proximity of a mass of potential clients

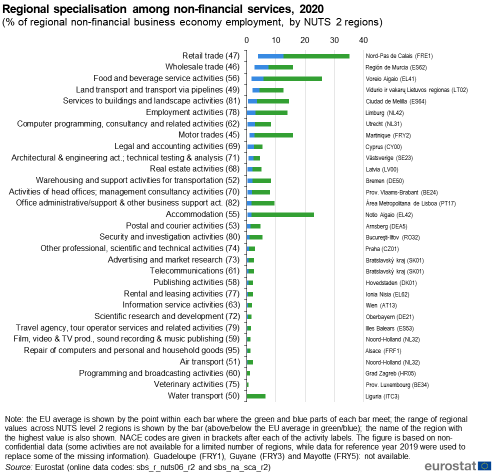

Figure 3 provides information for 31 different non-financial service activities, presenting those NUTS level 2 regions with the highest degree of employment specialisation (based on regional shares for each activity in the non-financial business economy workforce). Some of the variations in employment specialisation may reflect, among other issues: access to skilled employees; the adequate provision of infrastructure; climatic and geographic conditions; proximity to a critical mass of customers; access to markets; or legislative constraints.

A number of different service activities are ubiquitous, frequently appearing across every region of the EU, for example, retail trade, wholesale trade, or food and beverage services. These three activities were among the largest employers in the EU: retail trade (NACE Division 47) accounted for 12.7 % of the EU’s non-financial business economy workforce in 2020, followed by wholesale trade (NACE Division 46; 7.4 %) and food and beverage service activities (NACE Division 56; 5.7 %). The French region of Nord-Pas de Calais had the highest employment share (35.1 %) for retail trade among NUTS level 2 regions, which may reflect, at least to some degree, its location – providing ease of access to cross-border shoppers from Belgium or the United Kingdom. The highest employment share for wholesale trade was observed in Región de Murcia (Spain; 15.9 %) – with a high level of fruit and vegetables transported out of this region. In regions traditionally associated with tourism, it was commonplace to find that a relatively high share of the non-financial business economy workforce was employed within food and beverage service activities. The 12 highest regional shares were all observed in Greece, peaking in the island regions of Voreio Aigaio and Notio Aigaio (both 25.7 %). The only Greek region not to feature in the top 12 was the capital region of Attiki, although its share of employment within food and beverage service activities was the 14th highest, surpassed by that of Algarve (Portugal).

Capital regions were among some of the most specialised regions for a range of activities that rely on the close proximity of a large number of potential clients (be these other businesses, households or governments). For example, in 2020 the Área Metropolitana de Lisboa (Portugal) had the highest employment share for office administrative/support and other business support activities (9.6 %), Bucureşti-Ilfov (Romania) for security and investigation activities (5.4 %), Praha (Czechia) for other professional, scientific and technical activities (2.8 %) and Bratislavský kraj (Slovakia) for advertising and market research (2.5 %).

(%, share of regional non-financial business economy employment, by NUTS 2 regions)

Source: Eurostat (sbs_r_nuts06_r2) and (sbs_na_sca_r2)

The final part of this chapter provides a special focus for three activities that were particularly impacted by the COVID-19 crisis and its associated restrictions. The information presented below for retail trade, transportation and storage, and accommodation services refers to the early stages of the pandemic in 2020 (the latest reference period for which structural business statistics are available).

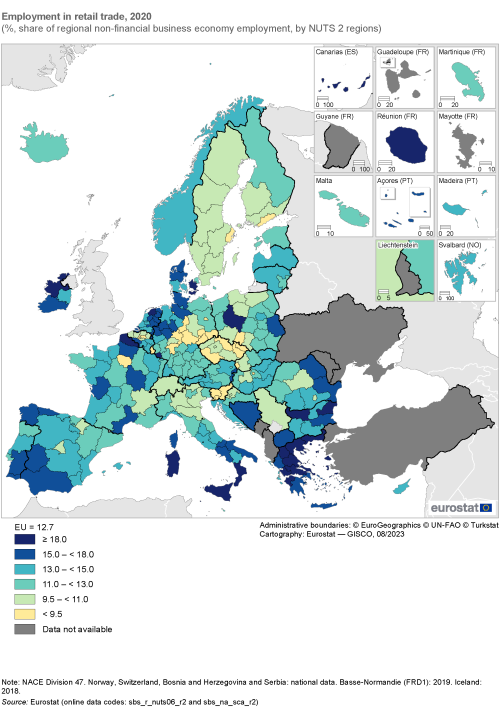

Focus on retail trade

Retail trade (NACE Division 47) uses a range of formats to supply consumers, mainly through specialised or unspecialised stores (the latter often distinguished between those with food dominating and others); retail trade also includes retailing outside of stores, through traditional forms – such as outdoor markets or via mail order – and increasingly via online sales, which became more popular during the pandemic.

With the onset of the COVID-19 crisis, most governments in the EU took the decision to close large parts of their retail trade activities in March 2020; the principal exceptions were food retailers and pharmacies. By May 2020, some governments started to remove or dilute the measures/restrictions that had been put in place; retail outlets re-opened, often with a limit on the number of persons allowed to enter a shop. Despite further relaxation during the summer months, a second wave of the virus led to some governments re-introducing restrictions towards the end of the year.

The EU’s retail trade sector employed 16.2 million persons in 2020; this represented 12.7 % of the non-financial business economy workforce. In absolute terms, the highest numbers of persons employed in retail trade were recorded in:

- the French capital region of Ile-de-France, at over half a million (542 000);

- Düsseldorf (Germany; 338 500); and

- Lombardia (Italy; 309 700).

In 2020, the regional distribution of retail trade employment was relatively uniform insofar as there were 126 out of 239 NUTS level 2 regions for which data are available (or 52.7 % of all regions) where this share was equal to or above the EU average. Retail trade provided work to 18.0 % or more of the non-financial business economy workforce in 22 EU regions (as shown by the darkest shade of blue in Map 3). These relatively high employment shares were concentrated in:

- three southern EU Member States – Greece, Spain and Italy;

- several regions that were sparsely-populated and/or relatively isolated;

- several regions characterised by industrial decline, including the French region of Nord-Pas de Calais, where more than one third (35.1 %) of the non-financial business economy workforce was employed within retail trade – this was, by far, the highest regional share in the EU.

In 2020, the retail trade sector employed less than 9.5 % of the non-financial business economy workforce across 23 different NUTS level 2 regions (as shown by the lightest shade). They were concentrated in Czechia, Germany and Slovenia, and included the capital regions of Germany, France, Hungary, Slovenia, Slovakia, Finland and Sweden, as well as Luxembourg. Many of these regions were characterised as densely-populated, urban regions, including Berlin and Bremen (both in Germany), which had the lowest shares (7.5 % and 7.1 %, respectively).

(%, share of regional non-financial business economy employment, by NUTS 2 regions)

Source: Eurostat (sbs_r_nuts06_r2) and (sbs_na_sca_r2)

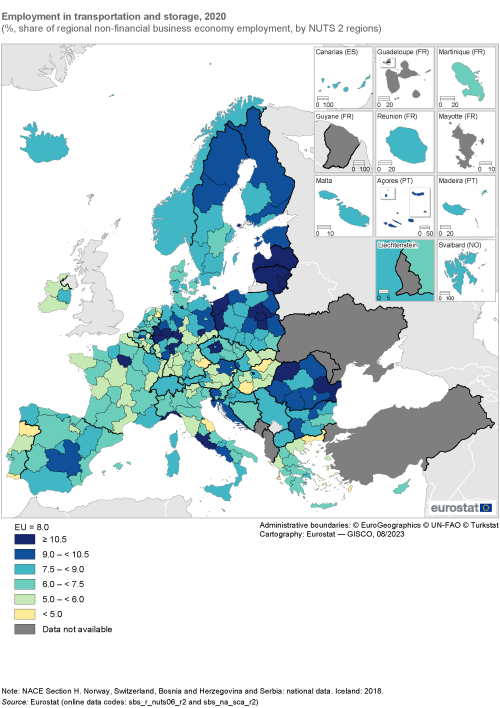

Focus on transportation and storage

Transportation and storage (NACE Section H) includes:

- the provision of passenger or freight transport by road, rail, pipeline, air (including space) and water;

- the operation of transport facilities (bus and train stations, harbours, airports, parking facilities) and transport infrastructure (roads, bridges, tunnels, rail networks, air traffic control);

- cargo handling and warehouse storage;

- the renting of transport equipment with a driver/operator; and

- postal and courier activities.

There were 10.2 million persons employed in the EU’s transportation and storage sector in 2020, equivalent to 8.0 % of the non-financial business economy total. In absolute terms, there were four NUTS level 2 regions where the transportation and storage sector employed more than 200 000 persons: Ile-de-France (the French capital region; 821 800), Lombardia (Italy; 225 500), Düsseldorf (Germany; 221 600) and Darmstadt (also Germany; 215 200).

The transportation and storage sector was among a number of activities particularly impacted by the COVID-19 crisis. Passenger transport services were temporarily shutdown or reduced to a minimum (for example, for air or rail travel), while the flow of goods was disrupted, impacting supply chains and deliveries to consumers. Although some restrictions were lifted during the course of 2020, further waves of the virus led governments to re-introduce controls, for example, with constraints on travel to specific destinations and/or requiring arrivals to spend time in quarantine. Overall, there was a dramatic reduction in the number of passengers transported during 2020, as services were cut and demand fell, with some people working from home and others having fears of contracting/spreading the virus when using public modes of transport.

Nevertheless, in employment terms the transportation and storage sector was relatively resilient during 2020, as the total number of persons employed across the EU fell at an annual rate of 2.0 %; this was a smaller contraction than that experienced for the whole of the non-financial business economy (down 3.0 %). During 2020, many governments introduced temporary support schemes to offset the impact of the pandemic: the impact of these job-retention schemes was apparent, insofar as value added in the EU’s transportation and storage sector fell at a much faster pace, down 15.0 % (in current price terms). It is also interesting to note that the main economic indicators for postal and courier activities followed an upward trajectory in 2020, suggesting that this may have been one of the few activities to benefit from the pandemic. Growth may be linked to increased demand for parcel services (as consumers made greater use of e-commerce and/or mail-order shopping during the period that traditional retail formats were closed) and new services arising out of the pandemic (for example, self-testing COVID-19 kits that had to be sent to laboratories).

The regional distribution of employment in the transportation and storage sector was skewed, insofar as there were 93 NUTS level 2 regions where this share was equal to or above the EU average (8.0 %) in 2020, compared with 146 regions that recorded lower than average shares. Transportation and storage provided work to at least 10.5 % of the non-financial business economy workforce in 25 regions across the EU (as shown by the darkest shade of blue in Map 4). These relatively high employment shares were unsurprisingly concentrated in urban regions where demand for transportation and postal/courier activities was concentrated; they included the capital regions of Belgium, France, Italy, Lithuania, Hungary and Poland. Together, these 25 regions accounted for more than one quarter (28.7 %) of the total number of persons employed in the EU’s transportation and storage services sector.

In 2020, the highest employment shares within the transportation and storage sector were recorded in the Finish archipelago of Åland and the northern German region of Bremen. More than one third (35.1 %) of the total number of persons employed in the non-financial business economy of Åland worked in the transportation and storage sector, with a particular specialisation in water transport services. Transportation and storage accounted for approximately one fifth (20.2 %) of those employed in non-financial business economy of Bremen, a port city with a highly-developed logistics sector.

(%, share of regional non-financial business economy employment, by NUTS 2 regions)

Source: Eurostat (sbs_r_nuts06_r2) and (sbs_na_sca_r2)

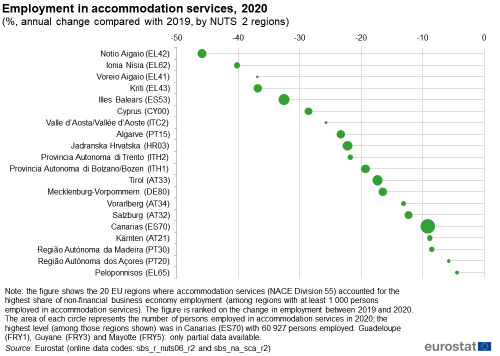

Focus on accommodation services

Accommodation service activities (NACE Division 55) include: hotels and similar accommodation such as apartment hotels or motels; holiday and other short-stay accommodation, such as self-contained apartments, chalets, villas and cabins rented on a daily or weekly basis; camping and caravanning sites; other accommodation, such as residences for students and workers or railway sleeping cars.

The COVID-19 crisis had an unprecedented impact on accommodation service activities, with most EU governments closing or strictly limiting access to hotels and other forms of accommodation in March 2020. Despite the gradual re-opening of accommodation services and the roll-out of vaccination programmes, many hoteliers faced weak demand. Tourists were often reluctant to book foreign travel and business travel also remained below pre-pandemic levels with trade fairs / conferences slow to restart (after restrictions were lifted) and some business people choosing to favour online meetings. Note that more detailed information on tourism statistics at a regional level is presented in Chapter 10.

In 2020, accommodation service activities across the EU employed 2.0 million persons; this represented 1.6 % of the non-financial business economy workforce. The regional distribution was relatively skewed insofar as accommodation service activities accounted for at least 1.6 % of the non-financial business economy workforce in less than two fifths (93 out of 239) of EU regions. There were nine NUTS level 2 regions across the EU where the employment share of accommodation service activities in the non-financial business economy was at least 10.0 %. These regions with high employment shares were concentrated in regions notable for tourism, particularly southern coastal or Alpine regions of the EU. The highest shares were recorded in three Greek island regions – Notio Aigaio (23.0 %), Ionia Nisia (17.3 %) and Kriti (13.8 %).

Figure 4 shows the 20 NUTS level 2 regions in the EU where accommodation services accounted for their highest share of non-financial business economy employment in 2020; note that only regions with at least 1 000 persons employed in accommodation services were taken into consideration. The information is ranked on the decline in employment between 2019 and 2020, highlighting the considerable impact of the COVID-19 crisis. Indeed, unlike some other sectors of the economy where job-retention schemes resulted in relatively minor job losses, there were often quite large annual contractions for the number of persons employed in accommodation services. This may reflect, among other factors, the dramatic fall in demand for accommodation services and the relatively insecure nature of work (for example, among young people and/or those with temporary employment contracts).

Based on information for the 20 regions presented in Figure 4, the number of persons employed in accommodation services fell by more than one third across four different regions of Greece in 2020 – Notio Aigaio, Ionia Nisia, Voreio Aigaio and Kriti. The biggest decrease was observed in Notio Aigaio, down 45.9 %. The number of persons employed in accommodation services also fell by more than one quarter in Illes Balears (Spain), Cyprus and Valle d’Aosta/Vallée d’Aoste (Italy). Figure 4 also provides information on the relative size of the accommodation services workforce. In 2020, the highest numbers of persons employed in accommodation services were recorded in two Spanish island regions – Canarias and Illes Balears (60 900 and 35 900, respectively) – they were followed by the Alpine region of Tirol (Austria; 30 300 persons).

(%, annual change compared with 2019, by NUTS 2 regions)

Source: Eurostat (sbs_r_nuts06_r2) and (sbs_na_sca_r2)

Source data for figures and maps

Data sources

Enterprise demography

A pilot data collection for regional business demography statistics was launched in 2012 with the support of the European Commission’s Directorate-General for Regional and Urban Policy. This voluntary exercise provided a number of grants to national statistical authorities. Further surveys were launched from 2015 and regional business demography statistics (as shown here) were delivered on a voluntary basis. Note that starting from reference year 2021, regional statistics for enterprise births, survival (for three years after their birth), enterprise deaths and high-growth enterprises will have a new legal basis – the EBS Regulation (Regulation (EU) 2019/2152 of the European Parliament and of the Council of 27 November 2019 on European business statistics). As of reference year 2021, these regional statistics will be compiled at NUTS level 3 for all EU Member States and will be based on the enterprise as the statistical unit.

Structural business statistics

The recast SBS Regulation (EC) No 295/2008 and its implementing regulations provide the legal basis for the annual collection of structural business statistics (SBS) presented in this chapter. Note that a new legal basis has been adopted and will be used for SBS starting with the 2021 reference year (in other words, for the next edition of Eurostat’s regional yearbook).

Regional SBS are compiled for the number of persons employed (as used in this chapter), as well as the number of local units and for wages and salaries. The data presented in this chapter cover the non-financial business economy (NACE Sections B to J and Sections L to N, as well as Division 95) and therefore exclude agricultural, forestry and fishing activities and public administration and other services (such as defence, education and health), which are not covered by SBS; the non-financial business economy aggregate and the non-financial services aggregate also exclude financial services (NACE Section K) for which only partial information exists within the SBS data collection.

The statistical unit used for regional SBS is generally the local unit, which is an enterprise or part of an enterprise (for example, a workshop, factory, warehouse, office, or depot) that is situated in a geographically identified place. The nature of regional SBS – combining a quite detailed level of the activity classification with the regional classification – is such that some data cells are not disclosed for reasons of statistical confidentiality.

Indicator definitions

Enterprise demography

Within the context of enterprise demography statistics, an enterprise birth concerns the creation of a combination of production factors with the restriction that no other enterprises are involved in the event; as such, births do not include entries into the enterprise population due to mergers, break-ups, split-offs or restructurings of existing enterprises, nor do they include entries into a subpopulation resulting only from a change of activity. Rather, an enterprise birth occurs when an enterprise starts a new activity with new production factors and new jobs created. If a dormant unit is reactivated within two years, this event is not considered as an enterprise birth.

An enterprise death is the dissolution of a combination of production factors, again with the restriction that no other enterprises are involved in the event. As such, deaths do not include exits from the enterprise population due to mergers, take-overs, break-ups or restructurings of existing enterprises, or exits from a subpopulation resulting only from a change of activity. An enterprise is included in the count of deaths only if it is not reactivated within two years.

Following Commission Implementing Regulation (EU) 439/2014 of the European Parliament and of the Council concerning structural business statistics, as regards the definitions of characteristics and the technical format for the transmission of data, high-growth enterprises are defined as those with employment growth of more than 10 %. Rates of change are based on average annualised growth for the number of (paid) employees over a three-year period (t-3 to t). To be classified as ‘high growth’, an enterprise must have had at least 10 employees at the beginning of the period under consideration.

Employment

SBS data presented in this chapter are based on a measure of labour input, namely a count of the number of persons employed. This indicator is defined as the total number of persons who work in the observation unit, as well as persons who work outside the unit who belong to it and are paid by it (for example, sales representatives, delivery personnel, repair and maintenance personnel). As well as (paid) employees, the number of persons employed includes working proprietors, partners working regularly in the unit and unpaid family workers.

Context

Single market strategy

The EU’s single market allows people, goods, services and money to move around the EU almost as freely as within a single country. EU citizens can study, live, shop, work and retire in any EU Member State, while enjoying products from all over the EU. The single market gives business a large domestic market, stimulating trade and competition, and improving efficiency. Hundreds of technical, legal and bureaucratic barriers to free trade and free movement between EU Member States have been removed. As a result, businesses have expanded their operations and competition has brought prices down and given consumers more choice. At the same time, the EU works to ensure that these greater freedoms do not undermine fairness, consumer protection or environmental sustainability.

The European Commission presented a single market strategy in October 2015 with the aim of delivering a deeper and fairer single market – one designed, among other things, to: improve mobility for service providers; make it easier for retailers to do business across borders; enhance access to goods and services throughout the EU. In January 2017, the European Commission made proposals for a new package of measures concerning the single market for services, designed to help service providers navigate administrative formalities and remedy overly burdensome or outdated requirements, so that EU businesses and professionals may find it easier to provide services to customers across national borders within the single market.

As part of its six priorities for 2019–2024, under the heading of ‘An economy that works for people – ensuring social fairness and prosperity’, the European Commission aims to develop a deeper and fairer internal market. In March 2020, the European Commission presented a Long term action plan for better implementation and enforcement of single market rules (COM(2020) 94 final).

Some barriers to a fully functioning single market remain. With this in mind, the EU is working to:

- address current regulatory or administrative obstacles that prevent people from easily buying or selling goods and services from or in another EU Member State;

- make it easier for business – small and medium-sized enterprises (SMEs) as well as larger enterprises – to raise money, for example, through the capital markets union;

- encourage workers to take up jobs in other EU Member States order to fill vacancies and meet the need for special skills;

- prevent social dumping, the practice of using cheaper labour and moving production to a low-wage country or area;

- boost cooperation between national tax authorities; and

- establish a common consolidated corporate tax base in the EU and a financial transaction tax.

Industrial policy

The European Commission is committed to supporting the digital and green transformation of industry within the EU. In September 2017, the Commission outlined a comprehensive renewal of its industrial policy strategy bringing together existing and new cross-cutting and sector-specific initiatives, with the goal of making European industry a world leader in innovation, digitisation and decarbonisation. Investing in a smart, innovative and sustainable industry – A renewed EU Industrial Policy Strategy (COM(2017) 479 final) includes, among other elements: a package to reinforce industrial cyber-security; a proposal for new rules on the free flow of non-personal business data, helping to create a common European data space; initiatives to modernise the EU’s policy framework for intellectual property rights; an initiative to improve the functioning of public procurement in the EU; a strategy to help direct private capital flows towards more sustainable investments; and a new framework for the screening of foreign direct investment (Regulation (EU) 2019/452 of the European Parliament and of the Council was adopted on 19 March 2019).

In November 2018, the European Commission presented a fresh assessment of the situation – The Single Market: Europe’s best asset in a changing world – which provided details in relation to alternatives for developing the single market, while exploiting its full potential in a digital era and ensuring sustainability. In March 2020, these ideas were further developed within A new industrial strategy for Europe (COM(2020) 102 final), designed to help deliver three key priorities:

- maintaining global competitiveness;

- making Europe climate-neutral by 2050; and

- shaping Europe’s digital future.

Green Deal Industrial Plan

Most commentators agree that the 2020s will be key for limiting the rise in global temperatures, as well as taking the initial steps that are necessary with respect to the EU’s net-zero ambitions. However, these challenges also bring opportunities, as they may act as catalyst for investment in clean energies and industries. The EU has a detailed framework in place for the transformation of EU industry, including:

In February 2023, the European Commission presented a range of new ideas in A Green Deal Industrial Plan for the Net-Zero Age (COM(2023) 62 final). Among other aspects, it highlighted: that phasing-out Russian fossil fuels was accelerating a new industrial revolution; the possibilities for developing a wide range of net-zero technologies in transport, buildings, manufacturing, energy, as well as new markets; the need to ensure job transitions and quality job creation through training and education.

The new Green Deal Industrial Plan is designed to encourage the EU to become a global leader in the net-zero industrial age. It highlights the need to increase dramatically technological developments as well as the manufacture and installation of net-zero products. It is based on four pillars:

- a predictable and simplified regulatory environment;

- faster access to sufficient funding;

- skills; and

- open trade for resilient supply chains.

Small and medium-sized businesses

Small and medium-sized enterprises (SMEs) are considered vital to the success of the EU’s economy, accounting for a very large share of the number of businesses and around two thirds of all jobs in the EU’s non-financial business economy. To provide support and information to SMEs seeking to boost their business, the European Commission sponsors several support networks, including:

Adopted in June 2008, the Small Business Act for Europe (COM(2008) 394 final) reflects the European Commission’s recognition of the central role that SMEs play in the EU economy. It provides a policy framework for SMEs, aiming to promote entrepreneurship, help SMEs tackle problems which hamper their development and implant a ‘think small first’ principle in policymaking.

In March 2020, the European Commission highlighted the key role played by SMEs. It presented An SME Strategy for a sustainable and digital Europe (COM(2020) 103 final) designed to unleash the economic power of Europe’s SMEs in this twin transition. To do so, the European Commission highlighted the need to: secure access to skills; upgrade the European Enterprise Network with dedicated sustainability advisors; expand European Digital Innovation Hubs (EDIHs).

Upskilling and reskilling the workforce

The COVID-19 crisis had a profound impact on labour markets: some people lose their jobs, while others experienced a significant loss of income. By contrast, green and digital transitions are opening up new opportunities for people and businesses. Rapid changes towards a climate-neutral Europe and digital transformations are changing the way that people work, learn, take part in society and lead their everyday lives. In the face of these challenges, it is likely that large parts of the EU’s labour force will need to acquire additional or new skills in order to keep their current jobs or find new work in expanding or new sectors of the economy. The European Year of Skills is designed to give fresh impetus to lifelong learning, empowering people and businesses to contribute to the green and digital transitions, supporting innovation and competitiveness.

SURE

In the early stages of the COVID-19 crisis, the European Commission developed the European instrument for temporary support to mitigate unemployment risks in an emergency (SURE). It was designed for those EU Member States that needed to mobilise significant financial means to fight the negative economic and social consequences of the pandemic, providing financial assistance up to €100 billion in the form of loans to address sudden increases in public expenditure for the preservation of employment (short-time work schemes and similar measures to help protect against the risk of unemployment and a loss of income). The availability of the SURE instrument ended on 31 December 2022. With the final disbursements made in December 2022, the EU had provided €98.4 billion in loans to 19 of the EU Member States.