Number of nights spent in tourist accommodation

Tourism statistics are traditionally collected from suppliers of tourism services through surveys of tourist accommodation establishments or from administrative data. These establishments include all types of accommodation which provide, as a paid service, accommodation for tourists. They are defined according to the activity classification NACE and include:

The number of nights spent in EU tourist accommodation remained 36.3 % below pre-pandemic levels

In 2021, there were 1.83 billion nights spent in all forms of tourist accommodation across the EU. This figure reflects both the length of stay and the number of tourists and is considered a key indicator for analysing tourism, even if it does not cover stays at non-rented accommodation nor same-day visits. Although there was a partial recovery in the total number of nights spent in EU tourist accommodation during 2021 (up 28.8 % compared with 2020), this figure should be put into context. Prior to COVID-19, the total number of nights spent had reached 2.87 billion in 2019; as such, the latest annual figure for 2021 remained more than one third (36.3 %) below its pre-pandemic peak.

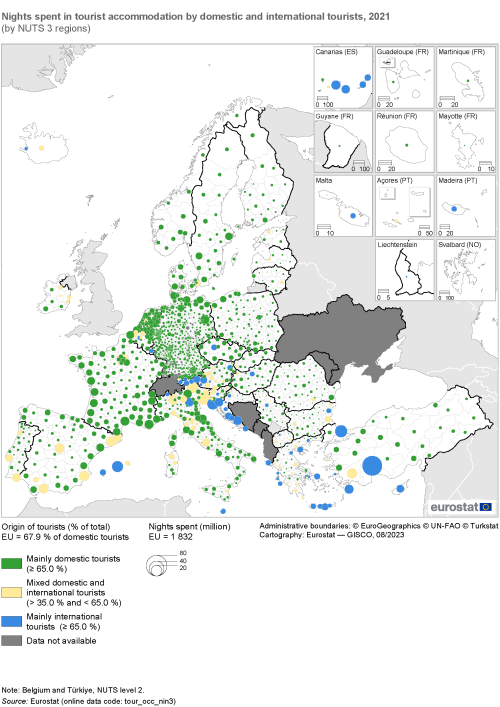

Map 1 shows information on the total number of nights spent in tourist accommodation for NUTS level 3 regions; note that the data for Belgium and Türkiye are presented at level 2. Aside from presenting information on the total number of nights spent by tourists (the size of each circle), the map also provides details as to their origin – whether they were domestic or international tourists. In 2021, this distribution was heavily skewed, as many tourists remained in their country of residence due to uncertainties associated with the COVID-19 crisis. There were 87 regions across the EU (out of 1 102 for which data are available) where the number of nights spent by international tourists was higher than the number spent by domestic tourists. Put a different way, less than 1 in 10 (or 7.9 % of EU regions) had a higher number of nights spent by international (rather than domestic) tourists.

International tourists tend to cluster in a very small number of regions that are among the most frequented destinations, which may lead to additional tourism pressures and have implications for sustainable development. In 2021, there were 52 NUTS level 3 regions where international tourists accounted for at least 65.0 % of the total nights spent (they are shown in a blue shade within Map 1). The vast majority (45 out of these 52 regions) recorded at least 1.0 million nights spent in tourist accommodation. These heavily frequented international tourist destinations could be split into three principal groups:

- capital regions (as was the case in Belgium, Czechia, Greece, Croatia, Luxembourg, Hungary and Austria);

- coastal regions that are traditionally popular beach holiday destinations (for example, Varna in Bulgaria; Kalymnos, Karpathos, Kasos, Kos, Rodos in Greece; Mallorca, Tenerife and Gran Canaria in Spain; Istarska županija, Splitsko-dalmatinska županija and Primorsko-goranska županija in Croatia; Cyprus; Malta; or Região Autónoma da Madeira in Portugal); and

- mountain regions that are popular winter (and sometimes summer) holiday destinations (for example, Tiroler Unterland and Pinzgau-Pongau in western Austria).

Overall, international tourists accounted for less than one third (32.1 %) of the total nights spent in EU tourist accommodation during 2021. However, as noted above, some of the EU’s most frequented tourist regions are characterised by a high proportion of international tourists. The two most frequented NUTS level 3 regions (in terms of nights spent) – Venezia and Bolzano-Bozen in northern Italy – both reported a majority of nights spent by international tourists (60.8 % and 62.1 % respectively). The relative importance of international tourists was even greater elsewhere: for example, international tourists accounted for 88.5 % and 95.3 % respectively of the total nights spent in the EU’s fourth and fifth most frequented regions, namely, Mallorca (Spain) and Istarska županija (an Adriatic region in Croatia). Looking in more detail, the concentration of international tourists was also very high in several other NUTS level 3 regions: alongside Istarska županija (Croatia), international tourists accounted for at least 19 out of every 20 nights spent in 2021 in: Irakleio and Rethymni (both on the island of Crete in Greece) and Außerfern (an Alpine region that forms part of Tirol in Austria).

Domestic tourists accounted for more than two thirds (67.9 %) of the total nights spent in EU tourist accommodation during 2021. This figure was considerably higher than before the COVID-19 crisis, underlining a shift from foreign destinations to ‘staycations’ during the pandemic. In 1 015 out of 1 102 NUTS level 3 regions for which data are available (92.1 % of EU regions), domestic tourists accounted for a majority of the nights spent in tourist accommodation.

Based on 2021 data for NUTS level 3 regions, the French capital of Paris recorded the highest number (14.3 million) of nights spent in tourist accommodation by domestic tourists. As such, almost two thirds (62.3 %) of the total number of nights spent in the French capital – the third most frequented tourist region in the EU (see the infographic above for more details) – were accounted for by domestic tourists. Along with Paris, there were three more of the 10 most frequented regions in the EU that reported a higher proportion of domestic (rather than international) tourists, all in Spain – Madrid (where the share of domestic tourists was 64.3 %), Alicante/Alacant (58.0 %) and Málaga (50.4 %).

Domestic tourists accounted for at least 95.0 % (19 out of 20) nights in 121 different regions across the EU; note, however, that these very high shares were often recorded in regions characterised by relatively low tourist numbers. Looking in more detail, a subset of 38 regions had an overall total of at least 1.0 million nights spent in tourist accommodation and at least 95.0 % of all nights accounted for by domestic tourists (they form part of the group identified by the biggest green circles in Map 1). These regions tended to be in relatively large EU Member States (where domestic demand was likely to be higher) and included: 22 regions from Germany; nine regions from Poland; three regions from the Netherlands and from Romania; and a single region from Sweden. Within this group of 38 regions, the share of nights spent by domestic tourists peaked at 99.5 % in Wittmund (a coastal region in northern Germany) and Włocławski (in central Poland).

(by NUTS 3 regions)

Source: Eurostat (tour_occ_nin3)

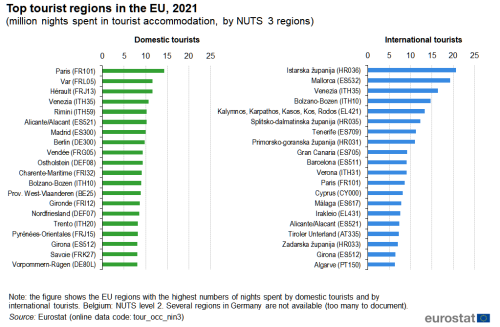

Paris had the highest count of nights spent in tourist accommodation by domestic tourists, while the Adriatic region of Istarska županija (Croatia) had the highest number of nights spent by international tourists

Figure 1 presents the EU’s most frequented tourist destinations in 2021: it is based on NUTS level 3 regions with the highest number of nights spent in tourist accommodation by domestic tourists (left-hand side of the figure) and by international tourists (right-hand side of the figure).

The French capital region of Paris (14.3 million) had the highest count of nights spent in tourist accommodation by domestic tourists in 2021. It was followed by two more French regions, as domestic tourists spent 11.6 million nights in each of the Mediterranean regions of Var and Hérault. There were four other regions in the EU where domestic tourists spent at least 10.0 million nights in tourist accommodation: the Adriatic regions of Venezia and Rimini (both Italy), the Mediterranean region of Alicante/Alacant (Spain) and the Spanish capital region of Madrid.

In 2021, the Adriatic region of Istarska županija in Croatia (which includes, among others, the popular holiday destinations of Poreč, Pula and Rovinj) had the highest count of nights spent in tourist accommodation by international tourists, at 20.7 million. It was followed by the Spanish island region of Mallorca (19.3 million nights), while the third most frequented region in the EU for international tourists was Venezia (Italy; 16.5 million nights). There were five additional regions across the EU which recorded more than 10.0 million nights spent by international tourists: the mountainous region of Bolzano-Bozen in northern Italy; the Greek island region of Kalymnos, Karpathos, Kasos, Kos, Rodos; Splitsko-dalmatinska županija and Primorsko-goranska županija (two more Adriatic regions in Croatia); and another Spanish island region, Tenerife.

(million nights spent in tourist accommodation, by NUTS 3 regions)

Source: Eurostat (tour_occ_nin3)

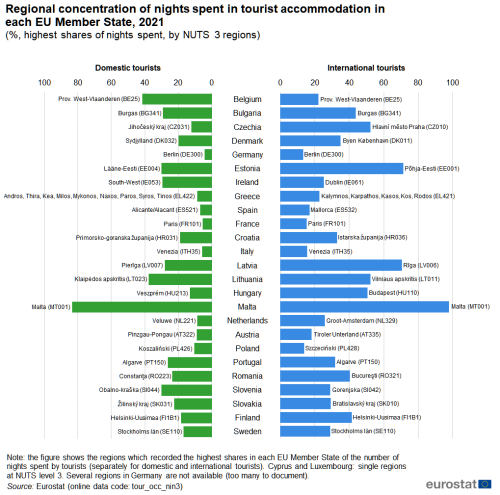

Figure 2 extends the analysis by showing, within each EU Member State, the most frequented region for domestic and for international tourists (based on the share of the total number of nights spent in tourist accommodation in each Member State). Note that these relative shares reflect, to some degree, the number of regions in each Member State and that Cyprus and Luxembourg are single regions at NUTS level 3 (and hence are not shown), while data for Belgium is at NUTS level 2.

There were nine EU Member States (out of 25 for which data are presented) where the same region was the most frequented among both domestic and international tourists:

- in Germany, France, Malta, Finland and Sweden this was the capital region – Berlin, Paris, the island of Malta, Helsinki-Uusimaa and Stockholms län;

- in Belgium, Bulgaria, Italy and Portugal this was a region other than the capital – Prov. West-Vlaanderen, Burgas, Venezia and Algarve.

In 10 of the 16 remaining EU Member States, the capital region was the most frequented among international tourists; this was the case in Czechia, Denmark, Estonia, Ireland, Latvia, Lithuania, Hungary, the Netherlands, Romania and Slovakia. In the other six Member States, the most frequented regions for international tourists were:

- the coastal regions of Kalymnos, Karpathos, Kasos, Kos, Rodos in Greece, Mallorca in Spain and Istarska županija in Croatia;

- the mountainous regions of Tiroler Unterland in Austria and Gorenjska in Slovenia (which includes the popular tourist attraction of Lake Bled); and

- Szczeciński in north-west Poland (which is located close to the German border and on the Baltic coast).

Among the same 16 EU Member States, the most frequented regions for domestic tourists were often less well-known internationally. Leaving aside the four landlocked Member States for which data are available – Czechia, Hungary, Austria and Slovakia – the most frequented regions for domestic tourists shared a common characteristic insofar as all but one was a coastal region: Sydjylland (Denmark); Lääne-Eesti (Estonia); South-West (Ireland); Andros, Thira, Kea, Milos, Mykonos, Naxos, Paros, Syros, Tinos (Greece); Alicante/Alacant (Spain); Primorsko-goranska županija (Croatia); Pierīga (Latvia); Klaipėdos apskritis (Lithuania); Koszaliński (Poland); Obalno-kraška (Slovenia); and Constanţa (Romania). The only exception was Veluwe in the centre of the Netherlands (that contains a national park).

(%, highest shares of nights spent, by NUTS 3 regions)

Source: Eurostat (tour_occ_nin3)

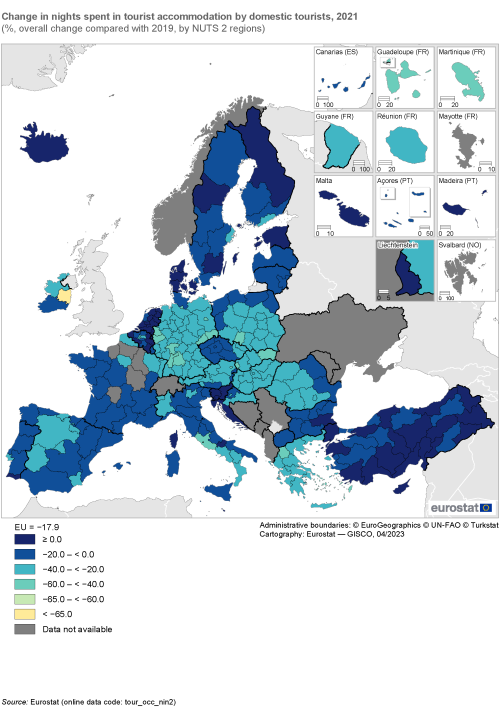

Impact of COVID-19: the number of nights spent in EU tourist accommodation by domestic tourists was 17.9 % lower in 2021 than it had been in 2019

Note that the detail of the analyses in the final two maps of this section has been reduced, as regional statistics at NUTS level 2 (rather than NUTS level 3) are available for a longer time series.

Prior to the onset of the COVID-19 crisis in 2019, the highest number of nights spent in tourist accommodation by domestic tourists across NUTS level 2 regions was recorded in the French capital region of Ile-de-France (40.7 million). Rhône-Alpes and Provence-Alpes-Côte d’Azur (also in France), Andalucía (Spain) and Schleswig-Holstein (Germany) were the only other regions in the EU where domestic tourists spent more than 30.0 million nights. In 2021, the same five regions continued atop the ranking for the number of nights spent by domestic tourists. Provence-Alpes-Côte d’Azur (34.3 million) was the most frequented region, passing Ile-de-France that fell to second place (32.1 million), while domestic tourists spent at least 28.5 million nights in Rhône-Alpes, Andalucía and Schleswig-Holstein.

The total number of nights spent in EU tourist accommodation by domestic tourists was 17.9 % lower in 2021 than it had been in 2019. The regional distribution of this change was somewhat skewed insofar as there were 134 regions (equivalent to 56.8 % of all NUTS level 2 regions for which data are available) where the decline in the number of nights spent by domestic tourists between 2019 and 2021 was more substantial than the EU average. Some of the biggest reductions in nights spent by domestic tourists were observed in capital regions and urban regions, with tourists likely favouring more rural locations during the pandemic and lower levels of professional travel. The largest reduction was recorded in the Irish capital region of Eastern and Midland, with a fall of 72.0 %; it is shaded in yellow in Map 2. The number of nights spent by domestic tourists fell by close to half between 2019 and 2021 in the following:

- the capital regions of Région de Bruxelles-Capitale / Brussels Hoofdstedelijk Gewest (Belgium), Berlin (Germany), Wien (Austria) and Bratislavský kraj (Slovakia);

- the German regions of Darmstadt, Düsseldorf and Stuttgart; and

- Notio Aigaio in Greece.

At the other end of the range, there were 34 NUTS level 2 regions across the EU where the number of nights spent by domestic tourists was higher in 2021 than it had been in 2019; Algarve (Portugal) was the only region in the EU to record almost the same number in both years (0.0 % rate of change). Together, these 35 regions are shown in the darkest shade of blue in Map 2. Looking in more detail, the biggest increases in nights spent by domestic tourists were observed in:

- the Slovenian capital region of Zahodna Slovenija (up 65.8 %);

- Zeeland in the Netherlands (up 56.9 %); and

- Cyprus (up 52.9 %).

(%, overall change compared with 2019, by NUTS 2 regions)

Source: Eurostat (tour_occ_nin2)

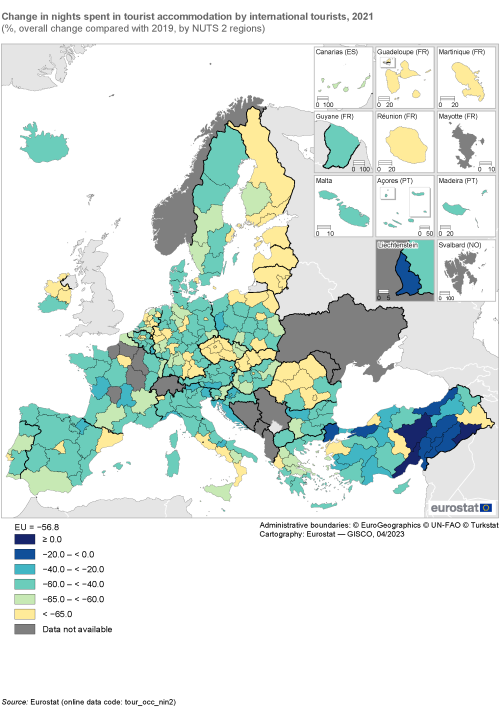

Impact of COVID-19: the number of nights spent in EU tourist accommodation by international tourists was 56.8 % lower in 2021 than it had been in 2019

The total number of nights spent in EU tourist accommodation by international tourists was 56.8 % lower in 2021 than it had been in 2019 (compared with a fall of 17.9 % for the number of nights spent by domestic tourists). The downturn in international tourist activity could be linked to national governments introducing travel bans and/or quarantine restrictions that stopped or dissuaded many people from travelling to an international destination (particularly when using air transport that could be cancelled at short notice due to a change in rules/regulations). Furthermore, at least during the initial stages of the pandemic, national, regional or local governments often imposed restrictions on a range of activities to prevent the spread of the virus (for example, closing hotels completely, reducing access to bars and restaurants, or banning large groups of people).

Prior to the onset of the pandemic, the highest number of nights spent in tourist accommodation by international tourists across NUTS level 2 regions was recorded in the Spanish island region of Canarias (83.9 million in 2019), while large numbers of international tourist nights – within the range of 48.2–80.6 million – were recorded in Jadranska Hrvatska (Croatia), Illes Balears, Cataluña (both Spain) and Veneto (Italy). In 2021, these five regions were also at the top of the ranking, although the impact of the pandemic on international tourist nights was much greater in the Spanish regions. Jadranska Hrvatska (61.0 million nights spent by international tourists) was the most frequented region, followed at some distance, by Canarias (32.1 million). In Jadranska Hrvatska, the number of nights spent by international tourists between 2019 and 2021 was 24.3 % lower than it had been in 2019. This was the smallest fall recorded for any NUTS level 2 region of the EU and could be contrasted with decreases of 61.7 % and 66.9 % in Canarias and Cataluña, respectively.

The asymmetric impact of the COVID-19 crisis is apparent when studying Maps 2 and 3; note that these two maps use a common scale to aid comparison. EU regions that traditionally attracted high numbers of international tourists were generally far more affected by the pandemic than regions principally frequented by domestic tourists:

- the overall number of nights spent in tourist accommodation by international tourists was lower in 2021 than in 2019 in all 236 NUTS level 2 regions for which data are available;

- there were 66 regions where the number of nights spent by international tourists was more than 65.0 % lower in 2021 than in 2021 (in contrast to a single region for domestic tourists);

- only two regions reported a smaller decrease in the number of nights spent by international (rather than domestic) tourists between 2019 and 2021 – Notio Aigaio (Greece) and Chemnitz (Germany).

Map 3 shows that the regional distribution of the overall change in nights spent by international tourists between 2019 and 2021 was somewhat skewed insofar as there were 138 regions (equivalent to 58.5 % of all regions) where the decrease in total nights spent was more substantial than the EU average. Among these, the biggest falls – where the number of nights spent fell by more than 65.0 % (as shown by the lightest shade of yellow in Map 3) – were primarily concentrated in:

- capital regions – those of Belgium, Czechia, Denmark, Germany, Ireland, Spain, France, Italy, Lithuania, Hungary, the Netherlands, Austria, Poland, Portugal, Romania, Slovakia, Finland and Sweden;

- other urban regions (which may have been impacted, among others, by a downturn in business travellers);

- island regions (that are typically reached by air transport, which was significantly curtailed during the pandemic).

Looking in more detail, three of the five NUTS level 2 regions with the biggest decreases in their number of nights spent in tourist accommodation by international tourists between 2019 and 2021 were capital regions: Lazio (Italy; down 82.0 %), Praha (Czechia; down 79.1 %) and Bratislavský kraj (Slovakia; down 78.1 %). There were also very large contractions observed in Ciudad de Ceuta (Spain; down 87.1 %) and Etelä-Suomi (Finland; down 79.7 %) although both these regions received relatively few international tourists (even prior to the pandemic).

(%, overall change compared with 2019, by NUTS 2 regions)

Source: Eurostat (tour_occ_nin2)

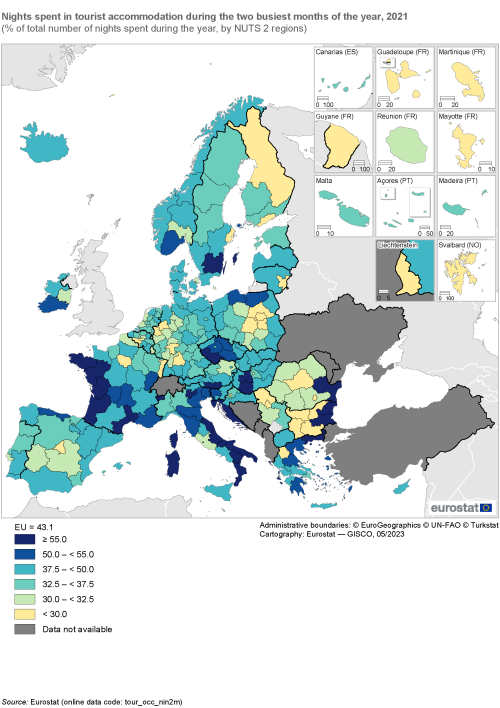

Seasonality

Seasonality can have a considerable impact on tourism: it is linked to a range of environmental factors such as climate or geographical location, as well as socioeconomic factors like public and school holidays or factories closing down for annual leave. During the COVID-19 pandemic, traditional patterns of seasonality were overlaid with the impact of peaks/troughs in infection rates and changes to travel and/or quarantine restrictions. As a result, many people had to reassess their holiday plans, choosing different types of accommodation, changing their preferred mode of transport, travelling at different periods of the year, and/or considering alternative destinations; some chose not to travel at all.

With COVID-19 infection rates generally lower in the summer (than the winter) months, the traditional dominance of July and August was amplified in 2020. There was a partial return to ‘normality’ in 2021, as seasonality patterns returned somewhat closer to those displayed pre-pandemic, albeit at a lower overall level.

There were 358 million and 431 million nights spent in EU tourist accommodation during the months of July and August 2021. As such, they were the two busiest months for tourism in the EU, together accounting for more than two fifths (43.1 %) of all nights spent in tourist accommodation during the course of 2021. Note that tourist arrivals are generally more evenly spread than the number of nights spent across the calendar year, due to a higher concentration of longer stays in the summer months. Domestic tourists were the main contributors to this summer peak, as they accounted for approximately two thirds of all nights spent in July and August 2021 (67.7 % and 66.6 % respectively); these shares were considerably higher than before the pandemic, when international tourists had accounted for approximately half of the total nights spent in the EU during the summer months.

Map 4 shows for each NUTS level 2 region the share of the two busiest months in the total number of nights spent in tourist accommodation during 2021. In approximately three quarters of EU regions (185 out of the 242 for which data are available), July and August had the highest numbers of nights spent. In those regions where July and August were not the two busiest months, it was generally the case that one or both were replaced by autumn or winter months (towards the end of the year). Note there were a considerable number of lockdowns in place at the start of 2021 and hence most traditional winter resorts did not receive very high numbers of tourists during the first few months of 2021. The exceptions – where July and August were not the two busiest months – were observed among capital regions or urban regions, which may receive a relatively high number of tourists for professional reasons and are popular destinations for short/weekend breaks. For example, October and November were the two busiest months in 2021 in the Belgian, French, Spanish and Hungarian capital city regions. It is also interesting to note that some popular coastal destinations also had peaks in seasonality towards the end of the year that could be linked, at least in part, to their favourable climates. This was the case, for example, in Canarias (Spain) where October and November were the two busiest months, or the French outermost regions of Guadeloupe, Martinique and La Réunion where December was one of the two busiest months.

There were 49 NUTS level 2 regions across the EU where the two busiest months of the year accounted for at least half of all nights spent in tourist accommodation during 2021. These regions with a high degree of seasonality are shown by the darkest two shades of blue in Map 4. Looking in more detail, there were five regions where the two busiest months of the year accounted for at least two thirds of the total nights spent. In all five cases, this high degree of seasonality could be linked to a dramatic increase in tourist activity during the summer months of July and August 2021, as seen in:

- the two main tourist regions of Bulgaria – Yugoiztochen and Severoiztochen – where July and August accounted for 70.9 % and 67.8 %, respectively, of the total nights spent in tourist accommodation during 2021;

- the most frequented tourist region in the EU (at NUTS level 2) – Jadranska Hrvatska (Croatia; 68.7 %);

- Sud-Est in Romania (68.5 %); and

- Calabria in southern Italy (66.6 %).

The lowest levels of concentration in the two busiest months were generally observed either in capital/urban regions or in more rural, sparsely populated regions that had relatively low levels of tourism; in both cases, demand was more evenly spread over the year. In 2021, there were 31 NUTS level 2 regions where the two busiest months accounted for less than 30.0 % of the total nights spent in tourist accommodation (as shown by the lightest shade of yellow in Map 4). This group included:

- the capital regions of Bulgaria, Spain, France, Croatia, Lithuania, Poland, Romania, Finland and Sweden;

- several German regions with relatively large cities – Darmstadt, Stuttgart, Münster, Düsseldorf and Bremen;

- four out of the five outermost regions of France (while the fifth region, La Réunion, had a share of 30.0 %).

The lowest levels of seasonality during 2021 were observed in:

- the Spanish autonomous region of Ciudad de Melilla (which had a very low overall number of tourists), where August and September accounted for 22.6 % of the total number of nights spent in 2021;

- the French capital region of Ile-de-France, where October and November accounted for 24.4 % of all nights spent; and

- the Bulgarian capital region of Yugozapaden, where July and August accounted for 25.5 % of all nights spent.

(% of total nights spent during the year, by NUTS 2 regions)

Source: Eurostat (tour_occ_nin2m)

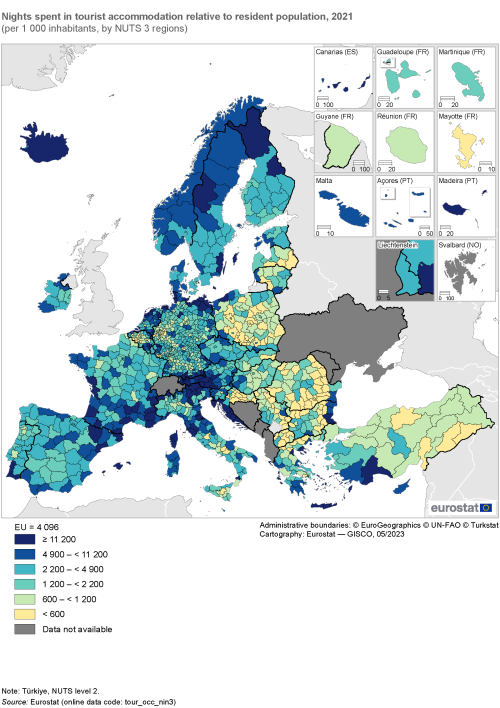

Tourism pressures

Sustainable tourism involves the preservation and enhancement of cultural and natural heritage, including the arts, gastronomy or biodiversity. The success of tourism is, in the long-term, closely linked to its sustainability, with the quality of destinations often influenced by their natural and cultural environment and/or integration into the local community. Since the advent of mass tourism in the 1950s and 1960s, EU regions have been affected by tourism in different ways: while some regions continue to receive very few visitors, others have seen their numbers of tourists grow considerably. Although some regions in the EU receive a steady flow of tourists year-round, most receive the vast majority of their visitors during a single season.

Tourism intensity, defined here as the number of nights spent in tourist accommodation per 1 000 inhabitants, is shown in Map 5. Note that the statistics presented are likely to underestimate the true extent of tourism pressures, given the numerator for the ratio does not include same-day visitors or tourists staying in non-rented accommodation (such as second homes, or stays with friends/relatives). Across the whole of the EU, there were 4 096 nights spent in tourist accommodation per 1 000 inhabitants in 2021. The regional distribution of tourism pressures was heavily skewed, highlighting that mass tourism tends to be concentrated in relatively few regions and those outside of capital cities and other major urban areas, often have a relatively small resident population. Indeed, the ratio of tourist nights spent per 1 000 inhabitants was higher than the EU average in less than 3 out of every 10 NUTS level 3 regions (339 out of 1 116 for which data are available). Map 5 shows where tourism pressures were concentrated in 2021: there were 117 regions where at least 11 200 nights were spent in tourist accommodation per 1 000 inhabitants (as shown by the darkest shade of blue). These regions could be divided into two groups:

- regions characterised by mass tourism, that are relatively well equipped to receive large numbers of tourists in heavily frequented resorts at the same time of year;

- other destinations that were relatively sparsely populated, where even quite small numbers of tourists might place a considerable strain on the local infrastructure.

Looking in more detail, there were eight NUTS level 3 regions where the number of nights spent in tourist accommodation per 1 000 inhabitants was greater than 50 000 in 2021:

- the Adriatic regions of Istarska županija and Ličko-senjska županija (in Croatia) – the former had the highest ratio of tourism intensity across the EU, at 103 137 nights spent per 1 000 inhabitants;

- the Greek island regions of Zakynthos and Kalymnos, Karpathos, Kasos, Kos, Rodos.

- the Spanish island region of Fuerteventura (that is part of Canarias);

- the western Austrian region of Außerfern;

- the Belgian coastal region of Arr. Veurne; and

- the northernmost German region of Nordfriesland (also a coastal region).

(per 1 000 inhabitants, by NUTS 2 regions)

Source: Eurostat (tour_occ_nin3)

Guest nights spent at short-stay accommodation offered via online collaborative economy platforms

Developments in information and communication technologies have had a major impact on the tourist accommodation market. The emergence of online platforms has made it easier for small-scale service providers to advertise/offer their rooms, apartments and holiday homes to potential guests, with a rapid expansion of this market.

Experimental statistics on short-stay accommodation offered via online platforms

The information presented so far in this chapter has been based on official tourism statistics, compiled according to Regulation (EU) No 692/2011. Those statistics provide only limited coverage of holiday and short-stay accommodation, as data for holiday homes, apartments and rooms in otherwise private buildings are often outside the scope of tourism registers and surveys. Official statistics on holiday and short-stay accommodation are generally underestimated, given that several EU Member States limit the scope of observations to establishments with, for example, at least 10 bed places. In recent years, this coverage issue has been further compounded by the emergence of online platforms that provide relatively simple methods for private individuals and small enterprises to offer short-stay accommodation; this has led to a surge in the provision of this type of accommodation.

For this reason, Eurostat embarked on an experimental data collection exercise aimed at improving the completeness of tourism statistics. It is based on a previously unexplored channel, namely data on listings/bookings obtained directly from four major online platforms (Airbnb, Booking.com, Tripadvisor and Expedia Group). The exercise was restricted to the collection of information on holiday and short-stay accommodation (NACE Group 55.2), reflecting the principal type of accommodation for service providers within the collaborative economy.

As with other areas of the tourism sector, the COVID-19 crisis had a considerable impact on the number of guest nights spent at short-stay accommodation reserved through online booking platforms. Prior to the pandemic in 2019, some 511.9 million guest nights were spent at short-stay accommodation across the EU. This number fell dramatically to 271.2 million in 2020 (down 46.9 %), before recovering somewhat during 2021, when 363.9 million guest nights were spent at short-stay accommodation reserved through online booking platforms. As such, the number of guest nights spent at short-stay accommodation in the EU remained 28.9 % lower in 2021 than it had been pre-pandemic. However, a more detailed analysis reveals an interesting contrast insofar as the number of nights spent by domestics guests rose 19.9 % between 2019 and 2021, whereas the number of nights spent by international guests fell 53.1 %. Across the 1 166 NUTS level 3 regions for which data are available, there were 821 regions that recorded an increase in the number of nights spent by domestic guests between 2019 and 2021. By contrast, there were only 95 regions where the number of nights spent by international guests rose during the period under consideration. Those regions that did report an increase in their number of nights spent by international guests were usually rural regions; they were generally characterised by a relatively low initial number of international guests (in 2019).

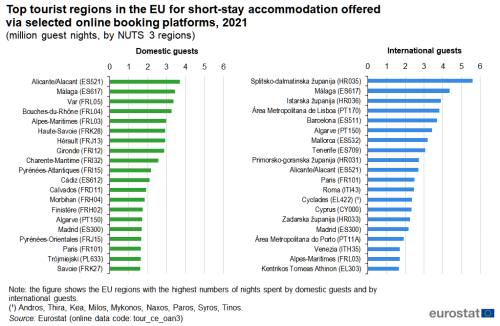

The Mediterranean coastal region of Alicante/Alacant (Spain) was the most frequented region in terms of nights spent by domestic guests in short-stay accommodation offered via selected online booking platforms

At the time of writing (April 2023), the latest annual data for short-stay accommodation reserved through online booking platforms concern 2021. Across NUTS level 3 regions, the most frequented tourist regions for domestic guests – in absolute terms – were coastal regions in two of the largest EU Member States:

- the Spanish regions of Alicante/Alacant (that had the highest count, at 3.7 million guest nights) and Málaga; and

- the southern French regions of Var, Bouches-du-Rhône and Alpes-Maritimes.

The most frequented tourist region for domestic guests that was not coastal was the French region of Haute-Savoie in the Alps.

The Adriatic region of Splitsko-dalmatinska županija (Croatia) was the most frequented region in terms of nights spent by international guests in short-stay accommodation offered via selected online booking platforms

Figure 3 also shows those NUTS level 3 regions that recorded the highest number of nights spent by international guests at short-stay accommodation offered via online booking platforms. In 2021, the highest count was recorded in the southern Croatian coastal region of Splitsko-dalmatinska županija (5.6 million nights). There were seven other regions across the EU where upwards of 3.0 million nights were spent by international guests:

- four of these were located in Spain – Málaga, Barcelona, Mallorca and Tenerife;

- two in Portugal – Área Metropolitana de Lisboa and Algarve;

- with one (additional) region in Croatia – Istarska županija.

Comparing the two lists – the 20 most frequented regions for domestic and for international guests – there were six regions that featured in both rankings:

- the Spanish regions of Málaga, Alicante/Alacant and Madrid;

- the Portuguese region of Algarve;

- the French regions of Alpes-Maritimes and Paris.

(million guest nights, by NUTS 3 regions)

Source: Eurostat (tour_ce_oan3)

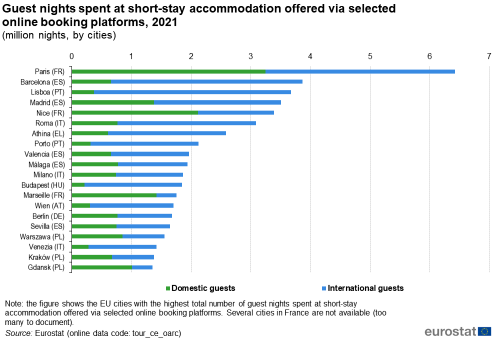

The analysis presented in Figure 4 focuses on cities. It shows those EU cities with the highest number of guest nights spent at short-stay accommodation offered via selected online booking platforms in 2021 (with a split between domestic and international guests).

Figure 4 shows the 20 most frequented cities in the EU as measured by the number of guest nights spent at short-stay accommodation offered via selected online booking platforms in 2021. The impact of the COVID-19 crisis was particularly hard on city destinations, likely reflecting a downturn in business as well as personal travel. Among these 20 most frequented cities, a majority reported that their overall number of guest nights was at least 50 % lower in 2021 than it had been in 2019. The largest decreases were recorded in Budapest (Hungary; down 72.9 %), Roma (Italy; down 69.5 %), Wien (Austria; down 66.3 %), Barcelona (Spain; down 65.0 %) and Lisboa (Portugal; down 64.1 %). Marseille (France) was the only city – among the top 20 in 2021 – to report a higher number of guest nights spent at short-stay accommodation offered via selected online booking platforms in 2021 than in 2019 (up 0.9 %).

In 2021, Paris was the most frequented city in the EU in terms of guest nights spent at short-stay accommodation offered via selected online booking platforms (a total of 6.4 million nights). This was considerably higher than in Barcelona (3.9 million), while Lisboa, Madrid, Nice and Roma also reported more than 3.0 million guest nights. Figure 4 also provides information as to the origin of guests staying at short-stay accommodation offered via selected online booking platforms. The relative importance of domestic and international guests to each city varied considerably. For example, while more than four out of every five nights spent in Marseille could be attributed to domestic guests, almost 9 out of every 10 nights spent in Lisboa could be attributed to international guests. In 2021, domestic guests accounted for more than half of all nights spent at short-stay accommodation offered via selected online booking platforms in Marseille, Gdansk, Nice, Warszawa and Paris. International guests accounted for more than three quarters of all nights spent in Lisboa, Budapest, Porto, Barcelona, Wien, Venezia, Athina and Roma.

(million nights, by cities)

Source: Eurostat (tour_ce_oarc)

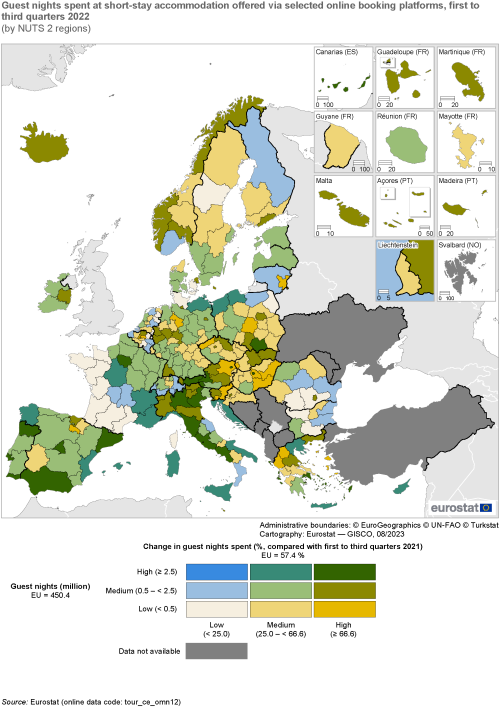

The final analysis in this section based on data from online booking platforms concerns a timelier dataset. At the time of writing (April 2023), information for the first three quarters (January to September) of 2022 is available at NUTS level 2, which allows for a more profound analysis of the recovery from the COVID-19 crisis.

During the first three quarters of 2022 (which include the peak months of July and August), the number of guest nights spent at EU short-stay accommodation offered via selected online booking platforms was 450.4 million. This was 6.3 % higher than the value recorded during the first three quarters of 2019 (423.7 million), suggesting that the online bookings market had recovered from the impact of the pandemic.

The Adriatic coastal region of Jadranska Hrvatska (Croatia) recorded, by far, the highest number (25.7 million) of guest nights spent at short-stay accommodation offered via selected online booking platforms during the first three quarters of 2022. Note that most regions have their guest nights concentrated in the summer months (and hence their peak season is included in the data presented here). However, tourist demand in some regions may be spread more evenly across the year and so the final quarter (for which data are not yet available) may account for a greater share of the annual total. The Spanish region of Andalucía had the second highest number of guest nights (20.4 million), followed by Provence-Alpes-Côte d’Azur (France; 18.9 million), and two more Spanish regions – Cataluña (14.8 million) and Comunitat Valenciana (13.2 million). Together these five regions accounted for more than one fifth of the total number of guest nights spent at EU short-stay accommodation during the first three quarters of 2022.

The number of guest nights spent at short-stay accommodation offered via selected online booking platforms during the first three quarters of 2022 increased in the vast majority of NUTS level 2 regions when compared with the equivalent period in 2021. The number of guest nights increased in 239 out of 242 regions for which data are available. Two of the three exceptions were located in the Netherlands, with no change in the number of guest nights recorded in Friesland and a modest fall in Drenthe. The only other region in the EU to record a fall (also modest) in its number of guest nights was Sud-Est (Romania). At the other end of the range, there were 26 regions where the number of guest nights spent at short-stay accommodation offered via selected online booking platforms at least doubled between the first three quarters of 2021 and 2022. This group included the capital regions of Belgium, Czechia, Ireland, Spain, France, Italy, Hungary, Austria, Poland, Portugal, Slovenia and Slovakia. Among these, there were two regions – Budapest (Hungary) and Praha (Czechia) – where the number of guest nights more than trebled during the period under consideration.

Map 6 can be used to identify those regions with: i) at least 2.5 million guest nights spent at short-stay accommodation offered via selected online booking platforms during the first three quarters of 2022; and ii) at least 66.6 % growth in the number of guest nights between the first three quarters of 2021 and 2022. There were 21 NUTS level 2 regions that met both of these criteria, and they are shown using the darkest shade of green. This group of 21 regions was composed principally of regions located in traditional holiday destinations across southern EU Member States – in Greece, Spain, Italy and Portugal. However, it also included:

- three regions in Austria – Wien, Salzburg and Tirol;

- the French and Hungarian capital regions of Ile-de-France and Budapest;

- Małopolskie in Poland (whose provincial capital is Kraków).

(by NUTS 2 regions)

Source: Eurostat (tour_ce_omn12)

Source data for figures and maps

Data sources

Tourism statistics presented within this chapter may be split into two main types:

Official statistics relating to the occupancy of collective tourist accommodation

Regional tourism statistics are available from suppliers of tourism services and are collected through surveys of tourist accommodation establishments (establishments are also referred to as local kind-of-activity units). These surveys provide information that covers tourism capacity (counts of establishments, rooms and bed places) and occupancy (the number of arrivals and nights spent). The data may be analysed by region, by degree of urbanisation, and for coastal/non-coastal areas.

Since 2012, the legal basis for the collection of tourism statistics has been Regulation (EU) No 692/2011 of the European Parliament and of the Council of 6 July 2011 concerning European statistics on tourism and Commission Implementing Regulation (EU) No 1051/2011 of 20 October 2011. Among other changes, Commission delegated Regulation (EU) 2019/1681 of 1 August 2019 introduced a requirement to provide additional data on nights spent at tourist accommodation establishments:

- monthly data for NUTS level 2 regions;

- annual data for NUTS level 3 regions;

- annual data for selected cities (capital cities, cities with at least 200 000 inhabitants, and other selected cities with relevance for tourism).

Tourism statistics are analysed according to the tourist’s country of residence (not the tourist’s citizenship). Domestic tourism covers the activities of residents who stay in their own country (but outside their usual environment) and this may be contrasted with the activities of international tourists (often referred to as inbound or non-resident tourists).

Experimental statistics on short-stay accommodation reserved through online booking platforms

Statistics on short-stay holiday rentals have traditionally been under-covered, given the relatively high number of small market participants – many of whom are private individuals – that are often excluded from business or tourism registers. Indeed, Regulation (EU) No 692/2011 allows tourism statistics to be collected using a threshold whereby EU Member States can opt to limit the scope of their observations to establishments having at least 10 bed places (or 20 bed places for smaller tourism countries). In practice, this means that a significant part of the short-stay holiday rentals market is not represented in official statistics.

Following an agreement with Airbnb, Booking.com, Tripadvisor and Expedia Group, since 2021 Eurostat has published a set of experimental statistics for short-stay accommodation booked through these four online platforms. This new data source allows an information gap to be closed, since many holiday homes, apartments and rooms in otherwise private buildings were previously not covered by tourism statistics. However, at this stage it is not yet possible to integrate this new source into existing tourist accommodation statistics, due to the potential double-counting of online listings that are also covered by traditional statistics; methodological work in this area is ongoing.

The four online platforms agreed to share their data on the number of nights booked and the number of guests, allowing access to reliable information on holiday and other short-stay accommodation reserved through their platforms. These experimental statistics are published from reference year 2018 onwards and may be analysed at a regional and at a city level. It is important to stress that, while these statistics from online platforms cover a significant part of the market, they do not cover the entire market and new online platforms may emerge. In the future, Eurostat will investigate the possibility of extending the scope of this experimental data collection exercise to other types of accommodation (for example, hotels).

Indicator definitions

Tourist accommodation establishments include all types of tourist accommodation providing, as a paid service, accommodation for tourists, regardless of whether or not the provision of tourist accommodation is the main or a secondary activity. These establishments are defined according to the activity classification NACE as units providing short-term or short-stay accommodation services:

- hotels and similar accommodation (NACE Group 55.1) – includes accommodation provided by hotels, resort hotels, suite/apartment hotels, motels;

- holiday and other short-stay accommodation (NACE Group 55.2) – includes holiday homes, visitor flats and bungalows, cottages and cabins without housekeeping services, youth hostels and mountain refuges;

- camping grounds, recreational vehicle parks and trailer parks (NACE Group 55.3) – includes the provision of accommodation in campgrounds, trailer parks, recreational camps, and fishing and hunting camps for short-stay visitors.

The number of nights spent (overnight stays) is based on a count of nights that guests/tourists actually spend (sleep or stay) in specific types of accommodation.

Within the context of experimental statistics on short-stay accommodation reserved through four selected online booking platforms, the number of nights spent at short-stay accommodation is compiled using the number of overnights stays (in other words, the number of nights that short-stay accommodation has been rented out) multiplied by the number of guests staying at the accommodation. Note the scope of these experimental statistics is narrower than that used for traditional tourism statistics, with information only collected for NACE Group 55.2.

Context

The EU is a key cultural tourism destination thanks to its heritage that includes museums, theatres, archaeological sites, historical cities, industrial sites as well as music and gastronomy. The EU aims to promote a balanced approach between the needs to boost growth on one hand, and the preservation of artefacts, historical sites, local traditions and the environment on the other. Tourism makes a significant contribution to the economy across the EU and can help to achieve the objectives of various EU, national, regional and local policies thanks to its cross-cutting economic and social dimensions. The EU’s competence in the area of tourism is one of support and coordination in relation to the actions of individual EU Member States. Policymakers seek to maintain the EU’s position as a tourist destination while supporting the contribution made by tourism-related activities to overall growth and employment.

A European Commission communication Europe, the world’s No. 1 tourist destination – a new political framework for tourism in Europe (COM(2010) 352 final) was adopted in June 2010 and remains in force. It provides a framework for the development of tourism within the EU, with four priority areas for action: stimulate competitiveness; promote sustainable and responsible tourism; consolidate Europe’s image as a collection of sustainable, high-quality destinations; maximise the potential of policies / financial instruments for developing tourism in the EU.

The European Commission has encouraged the diversification of the EU’s tourism offer through initiatives relating to maritime/coastal tourism, sustainable tourism, cultural tourism, tourism for all, accessible tourism, low-season tourism or collaborative tourism. To enhance the visibility of the EU as a tourist destination and increase international tourist arrivals, the European Commission undertakes a wide range of communication and promotion activities. Furthermore, it provides ad hoc grants to the European Travel Commission (ETC), a non-profit organisation responsible for promoting Europe as an international tourist destination through reports, handbooks and websites (such as visiteurope.com).

In its communication on maritime and coastal tourism A European Strategy for more Growth and Jobs in Coastal and Maritime Tourism (COM(2014) 86 final), the European Commission reflected on the diversity of the EU’s coastal regions and their capacity to generate wealth and jobs by fostering ‘a smart, sustainable and inclusive Europe’ in line with the Blue Growth opportunities for marine and maritime sustainable growth (COM(2012) 494 final). With this in mind, policymakers are seeking to redefine ‘mass-tourism’ and to develop new forms of ‘niche’ tourism which focus on solutions that are sustainable from an economic, social and environmental point of view.

The COVID-19 pandemic put considerable pressure on the EU’s tourism and travel-related activities. On 13 May 2020, the European Commission adopted a comprehensive package of initiatives to establish a coordinated framework to resume activities after the first wave of the pandemic within Europe. At the centre of the package was a communication that provided a strategy to stimulate recovery, Tourism and transport in 2020 and beyond (COM(2020) 550 final). The package also included:

- a common approach to restoring free movement and lifting restrictions at EU internal borders in a gradual and coordinated way;

- a framework to support the gradual re-establishment of transport whilst ensuring the safety of passengers and personnel;

- a recommendation to make travel vouchers an attractive alternative to cash reimbursement for consumers;

- criteria for restoring tourism activities safely and gradually and for developing health protocols for hospitality establishments such as hotels.

On 17 March 2021, the European Commission made a Proposal for a Regulation of the European Parliament and of the Council on a framework for the issuance, verification and acceptance of interoperable certificates on vaccination, testing and recovery to facilitate free movement during the COVID-19 pandemic (COM(2021) 130 final). Regulation (EU) 2021/953 (the EU Digital COVID Certificate Regulation) entered into force on 1 July 2021, facilitating the free movement of people within the EU during the pandemic. It allowed residents of the EU to have their COVID certificates issued and verified and was extended to cover non-EU countries if various conditions (including reciprocity) were met; 49 non-EU countries (and territories) joined the system.

During the pandemic, thousands of consumers were affected by flight and package travel cancellations with cross-border consumer disputes increasing significantly. In response, the European Commission, assisted by the European Consumer Centre Network, developed information for cancelled accommodation, car rentals and events that had been booked as individual services and gave guidance about alternative dispute resolution bodies (which could be used to help consumers and traders find amicable solutions out-of-court).

On 10 March 2020, the European Commission adopted a European industrial strategy, which was updated in May 2021 to take account of circumstances following the COVID-19 crisis. The strategy highlights how 14 industrial ecosystems – of which tourism is one – may lead green and digital transformations, boosting the EU’s global competitiveness. To do so, the European Commission proposed launching a number of ‘transition pathways’: tourism was selected as the first of these, given it was among those activities hardest hit by the pandemic. The Transition Pathway for Tourism describes measures and outputs needed to accelerate green and digital transitions, while improving the resilience of tourism. To remain competitive, the EU’s tourism sector will need to invest in the up/reskilling of its professional workforce. In December 2021, the EU Pact for Skills – Skills Partnership for the Tourism Ecosystem was launched. It brings together businesses, social partners (representatives of workers and of businesses), vocational and education training providers, and regional/municipal authorities with the aim of supporting commitments for reskilling and upskilling the European tourism workforce.