Following the EU’s parliamentary elections on 6-9 June 2024 and with the war in Ukraine showing no sign of slowing, a pressing issue demands attention: the EU’s continuing active participation in, and facilitation of, Russia’s fossil fuel shipping and exports. This article delves into critical analysis and proposes strategies for reducing dependency on, and support of, the Russian fossil fuel industry, supported by data and statistics highlighting the impact of these exports on the Russian economy, the war in Ukraine and the global climate crisis.

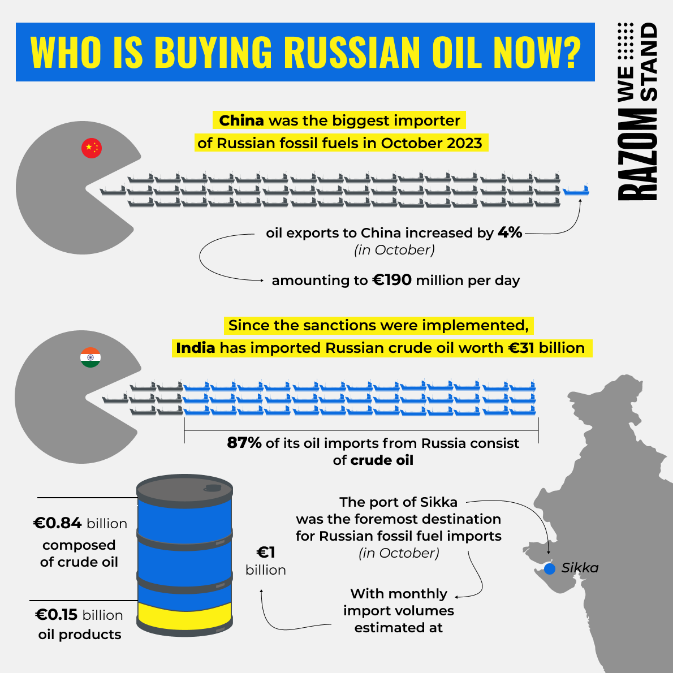

(Credit: Razom We Stand, All rights reserved.)

The absence of an embargo on Russian liquefied natural gas (LNG) in the EU supports Russia by helping fill its war chest and funding its ongoing bombardment of Ukraine, which in March 2024, left 700,000 without electricity in Ukraine’s second-largest city, Kharkiv, and has caused rolling blackouts across the country, as well as massive human casualties and suffering.

The war in Ukraine continues to rage on with relentless Russian rocket attacks, leaving scores of Ukrainians dead and wounded. Before recent attacks, 50% of the energy system had already been damaged or destroyed, and now the situation is drastically worse. Ukraine’s largest private energy company, DTEK, reported an 85% loss of its coal-fired generation capacity and a massive loss of life for its staff. Russia’s brutality has destabilised geopolitical landscapes worldwide. Since March 2024, Russia’s increased attacks on energy infrastructure have led to electricity shortages in at least five regions.

Russia’s major LNG ‘carbon bombs’ also escalate the climate crisis, contributing to overall global climate disruption that has cost the EU over EUR 650 billion since 1980. Carbon bombs refer to large-scale fossil fuel extraction projects that have been identified as holding at least 1 billion metric tons of carbon dioxide (CO2) emissions, three times the total CO2 emissions produced by the entire United Kingdom in a year.

Researchers say that climate disruption may cost USD 38 trillion a year in damages by 2049, and Europe needs to start incorporating such costs into its energy financial planning. The European Union faces a pivotal moment in its energy security and sustainability quest. Central to this discourse is the EU’s relationship with Russia, particularly concerning the trade of fossil fuels. With Russia holding significant oil, gas and coal reserves, its energy exports have profound implications for Europe’s economy, security and environmental integrity.

The dominance of Russian fossil fuels

Russia’s reliance on fossil fuel exports is undeniable, and it is one of the primary sources of income for the Kremlin’s seemingly limitless war chest. Despite 13 different sanctions packages adopted by the EU since the full-scale invasion, the EU remains a significant importer of Russian fossil fuels – mainly LNG – with substantial volumes flowing into European markets. According to CREA estimates, since the beginning of the war, Russia has earned a staggering EUR 644 billion in revenue from fossil fuel exports alone. European Union Member States have purchased Russian fossil fuels for more than EUR 190 billion, most of which came from dirty LNG.

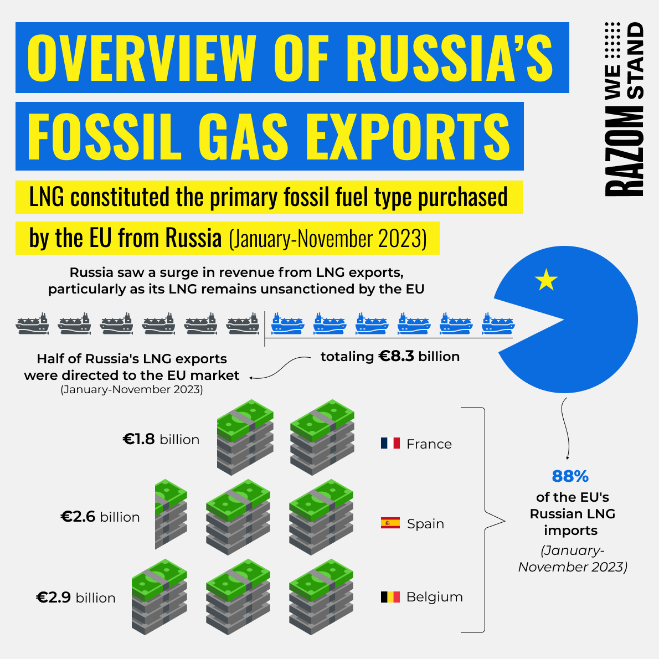

(Credit: Razom We Stand, All Rights reserved.)

The share of oil and gas in the Russian gross domestic product (GDP) in the first two quarters of 2023 accounted for 16–17%. By the third quarter of 2023, the proportion of fossil fuel export earnings in the Russian federal budget plunged to its lowest level in 16 years, yet still represented over 28% of the Kremlin’s total income.

Russia also plans to almost triple its LNG export capacity by 2030, to 100 million tons annually. Putin’s pet project, Arctic LNG 2, is a critical part of these expansion plans to increase the transportation and sale of Russian gas on international markets. This project, if implemented, could double Russian gas company Novatek’s LNG export capacity. The climate-damaging carbon bomb that is Arctic LNG 2 is now at a critical development stage, teetering on the edge of failure. If completed, however, the project could provide tens of billions of euros for Putin’s war machine and help put Russia in a position to manipulate the global LNG gas market strategically.

(Credit: Razom We Stand, All Rights reserved.)

The EU should take note of the fact that a large percentage of Russian commercially viable sources ready for production (and not just on balance sheets) are in in the west of the country. If the EU stops buying and facilitating Russian exports, these energy sources would often not be profitable as it is not economically as competitive to ship them via the Arctic Circle to much farther potential markets like China than it is to Europe.

What the EU must do next?

Ban the transhipment of Russian LNG

As a first step, EU Member States should immediately ban the transhipment of Russian LNG in their ports that will further travel onwards to non-EU destinations. Russia relies on these ports for the logistics and storage of LNG. Banning transhipment of Russian LNG \ would make the logistics of their LNG exports difficult, without negatively impacting EU energy security or prices, whilst lowering Russia’s profits and volumes.

Amidst the fallout of the full-scale invasion in Ukraine, the European Union has embarked on a journey to reduce its reliance on Russian fossil fuels. Initiatives like the REPowerEU plan, launched in May 2022, aim to counter Russia’s energy leverage by diversifying energy sources and banning Russian oil imports. However, while there has been a growth in cheap European renewable energy supply, and a noticeable decrease in pipeline gas imports from Russia, the influx of Russian LNG into European ports has continued to surge. This trend exposes the weaknesses of existing sanctions targeting Russia’s energy sector – its main revenue stream.

A case in point is Germany’s decision to halt direct imports of Russian gas in the summer of 2022. Yet recent data from environmental organisations Urgewald and Bond Beter Leefmilieu highlight a concerning loophole: significant volumes of Russian LNG has continued to enter Germany indirectly via the Netherlands and Belgium. The research reveals that as much as 11% of the gas flowing into Germany from Belgium originated as Russian LNG in 2022.

(Credit: Razom We Stand, All Rights reserved.)

Similarly, Spain and Belgium emerged as the second- and third-largest importers of Russian LNG in 2023. LNG from Russia’s arctic gas fields regularly makes its way to European ports, including Zeebrugge in Belgium and Montoir-de-Bretagne in France. Despite public declarations by European officials advocating for tighter restrictions on Russian LNG flows into the EU, the on-the-ground reality paints a starkly different picture.

The European Commission should broaden the list of banned items for export to include all equipment supporting Russia’s fossil fuel industry, to limit Russia’s further capacity to develop new upstream gas projects and hinder its ability to build infrastructure along the Northern Sea Route. EU Member States must ban suppliers from signing new gas contracts from Russia’s Arctic LNG 2 project, to reduce locking in long-term reliance on Russian fossil gas.

Stop EU companies investing in Russian LNG projects

European companies have supplied over USD 630 million worth of equipment to Russia’s Arctic LNG 2 project since the invasion of Ukraine, despite it being under Western sanctions. The largest suppliers include Italy (EUR 112 million), France (EUR 31.6 million), Germany (EUR 25 million), the Netherlands (EUR 12.8 million) and Spain (EUR 8 million). The ongoing collaboration of EU-based companies with Russia in the LNG sector helps to fund the aggressor’s efforts to brutalise Ukraine further. At the same time, it is clear these nations do not need to continue investing in Russian LNG, with the UK and the rest of Europe seeing unprecedented falls in the use of fossil fuels by transitioning to cleaner and more sustainable energy sources.

European countries must swiftly adopt complete sanctions targeting Russia’s fossil gas expansion plans. Such measures are crucial not only for achieving peace in Ukraine but also for European and global energy security and stability, sending a powerful message to deter any further wars of aggression funded by exports of fossil fuels. We can’t allow Russia to take Europe hostage again with a third Nord Stream.

Transition to renewables

Europe has ended the winter season with record-high levels of fossil gas in storage, partly due to the increasing success of renewable production growth, putting the region in a much better position to move on from its previous reliance on Russian fossil fuels and start working towards a clean energy future, one free from fossil fuel addiction.

Beyond divesting from Russian fossil fuels, the EU must accelerate its transition to renewable energy sources. Bloomberg has reported that climate disruption may cause USD 38 trillion a year in damages by 2049, and stopping carbon bombs in Russia should be a priority to help avoid such high costs. By prioritising investments in renewables and energy savings, the EU can reduce its reliance on Russian fossil fuels and mitigate costly climate disruption and geopolitical risks.

Renewables have proven cheaper and more reliable. They free Europe from fossil fuels, which have caused problems like funding petro-dictators’ budgets, contributing to desertification and famine, causing negative impacts on health, and spurring inflation. It is time for the EU to recognise the economic advantages of renewable energy sources and view this sector as an economically advantageous one, further investing in it to accelerate its energy transition. With the recent decline in energy prices and cost-effective clean-energy production at record levels, EU leaders have the power to shape the world’s energy security for the better.

The EU’s climate targets can only be met with a reduced fossil gas demand of at least 35%, compared with 2019 levels, by 2030. Expanding gas export and import infrastructure with taxpayer handouts to private firms makes no sense at a time when the world needs to rapidly move away from fossil fuels to stop the massively expensive and destructive impacts of climate change, which are costing trillions. Today, it is a frivolous waste of public money to support investments in gas infrastructure when gas demand is falling over the long term as cheaper renewable energy production booms.

Empower Ukraine’s green energy transition

The total investment needed to rebuild Ukraine’s power sector based on clean technologies is estimated at around USD 17 billion, which is an economically advantageous expenditure in comparison to repairing or replacing war-damaged Soviet-era energy production.

By empowering Ukraine’s energy transition, the EU can contribute to regional stability and resilience, while truly signalling its commitment to climate justice and solidarity with Ukraine. Investing in decentralised energy infrastructure, such as solar panels, wind turbines and battery storage systems, can enhance Ukraine’s energy resilience and reduce its dependence on traditional power generation plants.

The financial toll of the attacks on Ukraine’s energy infrastructure as of February 2024 was estimated to be between USD 10.7 billion and USD 13 billion. When reconstruction efforts commence, Ukraine must swiftly shift away from reliance on ageing fossil energy sources, like coal, oil and gas, and transition towards decentralised alternatives such as wind and solar energy.

Conclusion

With the recent parliamentary elections concluded, the Russian fossil fuel trade issue looms large on the agenda. By prioritising joint efforts to divest from Russian fossil fuels, supported by data-driven insights into the impact of these exports, the EU can strengthen sanctions on Russian fossil fuels to improve EU energy security, cut off one of the main income sources for Russia’s war of aggression and more actively assert its leadership in the global transition to renewable energy.

As well as the above-mentioned actions of stopping transshipments of Russian LNG and investments of EU companies in Russian LNG projects, while also increasing investment in the transition to renewables, we make the following recommendations to boost the EU’s enforcement of sanctions:

- Establish a dedicated, well-resourced and trained sanctions enforcement agency with investigative powers within each Member State. The EU should dedicate common resources to provide capacity building and funding for domestic enforcement agencies to prevent circumventions of EU sanctions against Russia.

- Human, financial and technological resources for border crossings, ports and airports should be provided by the EU and its Member States to enable a rigorous control of shipments destined for Russia and Belarus.

- EU-wide criminal offences of violating and circumventing sanctions should be brought into law as soon as possible. When incorporating these into national law, the EU Member States should go beyond just minimum rules in order to effectively prevent any loopholes within the Union. The laws should criminalise negligent, as well as intentional, rule-breaking, and have broad modes of liability.

Now is the time for bold action and solidarity with Ukraine to pursue a sustainable and resilient future for Europe and beyond.

The views and opinions in this article do not necessarily reflect those of the Heinrich-Böll-Stiftung European Union.