(Bloomberg) — The European Commission is raising concerns that its chipmakers are at risk of losing substantial market share in China as Beijing hikes investment in the semiconductor industry and tries to achieve self-sufficiency in critical technologies.

Most Read from Bloomberg

The Netherlands-based NXP Semiconductors NV, Germany’s Infineon Technologies AG and Japanese chipmaker Renesas Electronics Corp. could all be hit by China’s efforts to foster domestic rivals, according to people familiar with the matter and a report from the European Commission seen by Bloomberg News. While the companies don’t make the industry’s most advanced semiconductors, like the processor used in Apple Inc.’s iPhone, they make microcontrollers and other chips essential for key sectors of the economy, including automobiles, industrial applications and consumer electronics.

“Discriminatory standards, local content requirements, and other non-tariff barriers could be used (and are being used already) to incentivise the growth of domestic MCU companies in China, that can leverage its vast EV market, at the detriment of European and Japanese suppliers of chips,” European officials wrote in the report that was prepared for a meeting between them and their counterparts from the US, Japan and South Korea earlier this week.

Microcontrollers, or MCUs, are effectively small computers on a single chip that usually control a single function within a piece of electronics, for example activating an airbag in a car or controlling the water temperature in a washing machine. China already accounts for 30% of the global MCU demand, the report said.

The Chinese government has quietly asked electric-vehicle makers from BYD Co. to Geely Automobile Holdings Ltd. to sharply increase their purchases from local auto chipmakers, part of a campaign to reduce reliance on Western imports and boost China’s domestic semiconductor industry, Bloomberg News reported earlier this year.

European chipmakers also could feel impact from China’s heavy investments in capacity for components like analog, discrete, mixed-signal and power semiconductors, according to the analysis.

China is on track to spend more than $100 billion to build new chip plants to make semiconductors required for everything from home appliances to smartphones. Beijing has sharply hiked spending on domestic capacity after the US imposed controls on Chinese companies’ ability to buy high-end chips and the equipment to make them. The country is focused on legacy chips, which are less advanced and not under US restrictions, but where demand is still increasing because of growing EV and renewable energy markets.

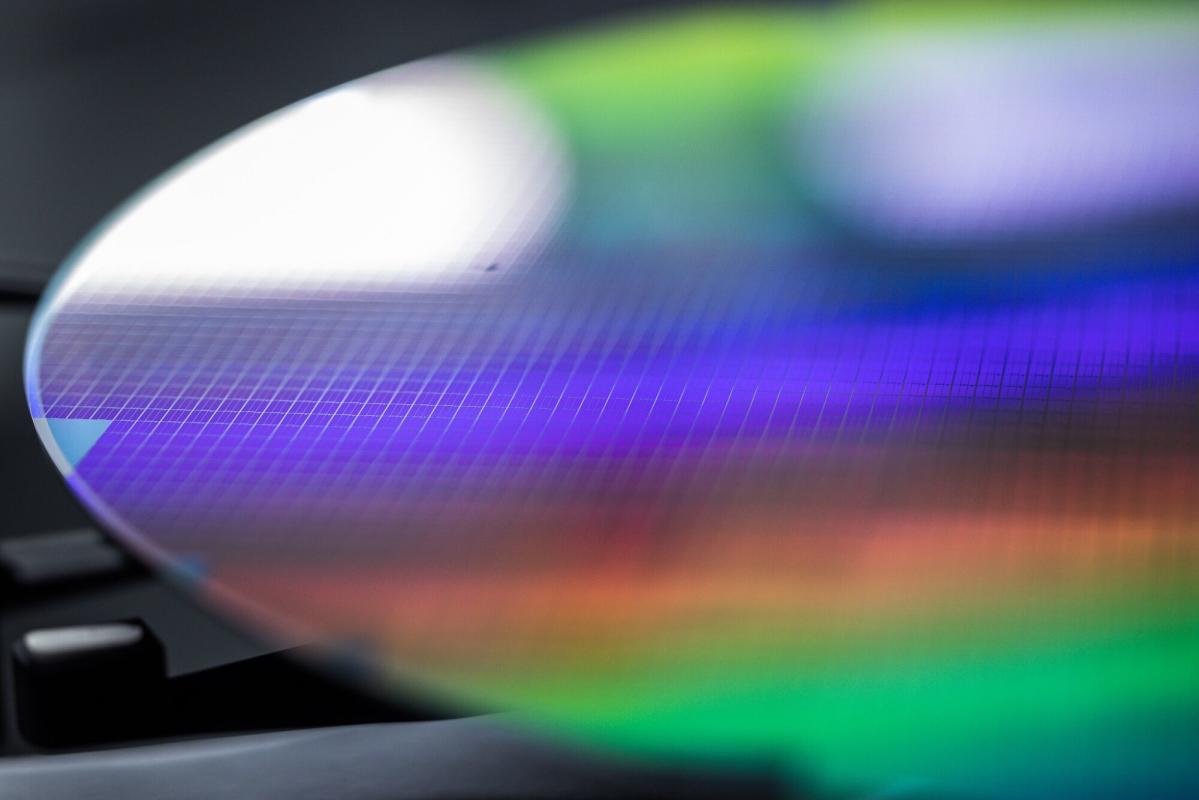

The SEMI trade group forecasts that China will have 41 chip fabs coming online between 2023 and 2027, more than any other region in the world. That includes 34 fabs that will handle 300 millimeter wafers and seven for 200 mm wafers, where larger wafers allow companies to produce more chips.

Earlier this week, Chinese President Xi Jinping called on China to step up innovation because other countries dominate certain key technologies including semiconductors, underscoring his nation’s escalating technology confrontation with the US.

Washington has been concerned that Chinese chipmakers will gradually flood the global market with their products as China has done in the solar and steel markets. American officials have raised such concerns with their European counterparts.

The European Union’s executive arm is reviewing how widely its businesses use mature or lower-end chips from China, but its latest analysis found the concern that Chinese chips will systematically flood the global market is “less likely” to become reality.

Demand is so high in China that any additional capacity will be absorbed by the domestic market until at least 2030, according to the report, partly citing data from Dutch equipment maker ASML Holding NV. Chinese foundries usually making chips exclusively for companies headquartered there.

Chinese chipmakers may also reduce their capacity as they enter price wars with their domestic competitors due to oversupply, European officials wrote.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.