Main conclusions

International trade in high-tech products has increased in the last decade. Several studies show that both imports and exports of high-tech products have a positive effect on competitiveness. High-tech products also play an important role in the European Commission’s policy goals of ‘Environment and climate’, ‘Our digital future’ and ‘Jobs and economy’. Regarding the extra-EU trade of high-tech products, the main conclusions of this article are:

- Total extra-EU trade in high-tech products increased between 2012 and 2022 with annual average increase of 6.1 %.

- The share of high-tech products in total extra-EU trade increased from 14.7 % in 2012 to 16.6 % in 2022.

- China was the main partner for imports of high-tech products into the EU.

- The United States was the main partner for exports of high-tech products from the EU.

- Sold production of high-tech products increased from €275 billion in 2012 to €355 billion in 2022.

EU trade in high-tech products

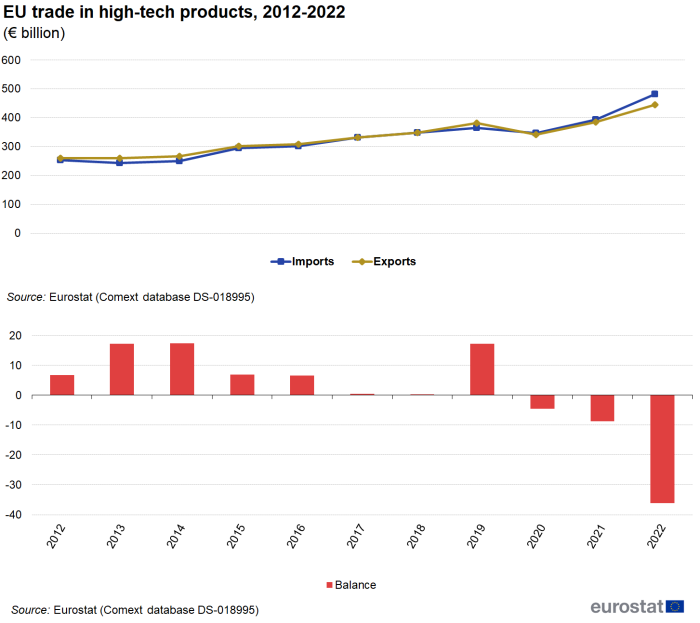

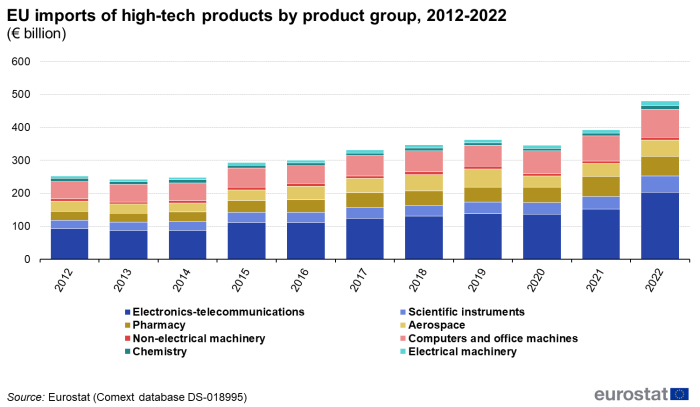

Between 2012 and 2022, total extra-EU trade (imports + exports) in high-tech products increased from €512 billion to €927 billion, equivalent to an annual average increase of 6.1 %. Imports grew from €252 billion to €481 billion, equivalent to an annual average increase of 6.7 % while exports grew from €259 billion to €445 billion, equivalent to an annual average increase of 5.6 %. Consequently the trade surplus changed from €7 billion in 2012 to a deficit of €36 billion in 2022 (see Figure 1).

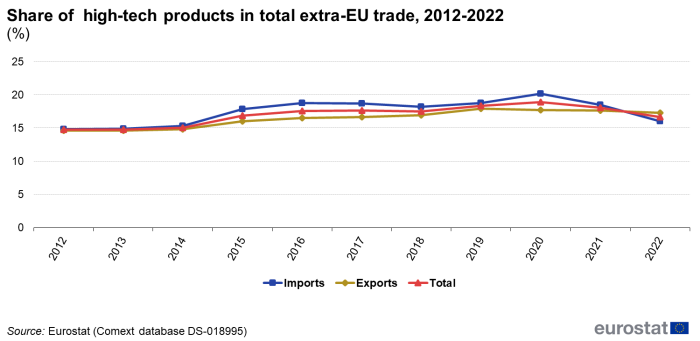

The share of high-tech products in total (imports + exports) extra-EU trade increased from 14.7 % in 2012 to 16.6 % in 2022. Between 2012 and 2021, the share was higher for imports than for exports. However, in 2022, the share for imports was 16.0 % and for exports it was 17.3 % (see Figure 2).

EU imports of high-tech products

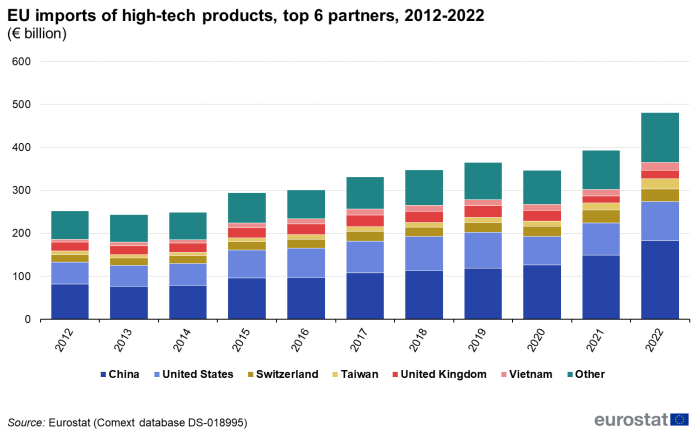

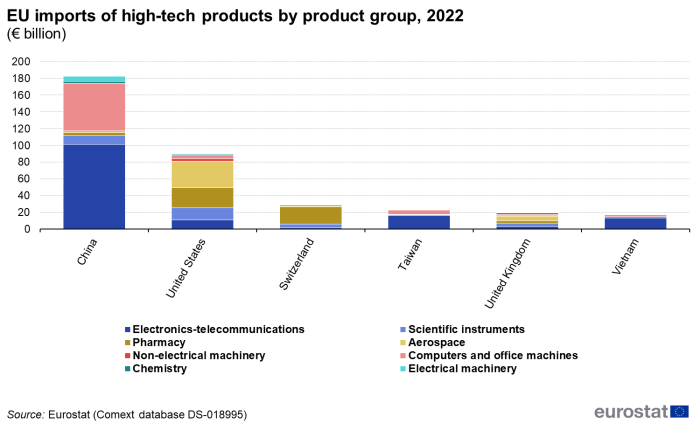

In 2022 more than half of the EU imports of high-tech products from non-EU countries came from China (36 %) and the United States (19 %) combined, as shown in Figure 3. Between 2012 and 2022 imports increased from €252 billion to €481 billion, equivalent to an average annual growth rate of 6.7 %. Among the top six partners, imports from China increased the most in absolute terms, from €81 billion to €183 billion, while Taiwan (11.0 %) and Vietnam (10.8 %) had the highest average annual growth rate.

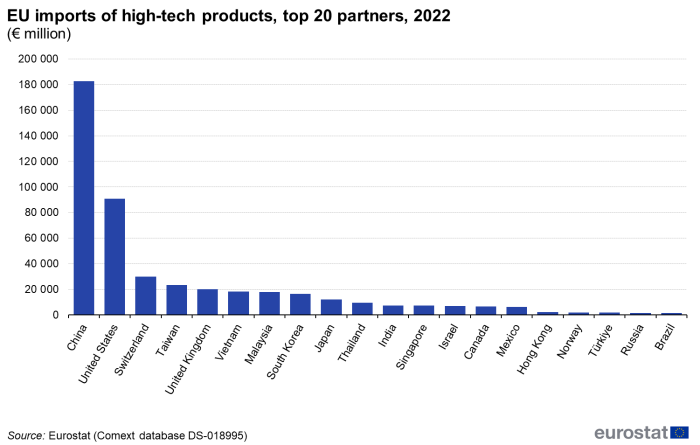

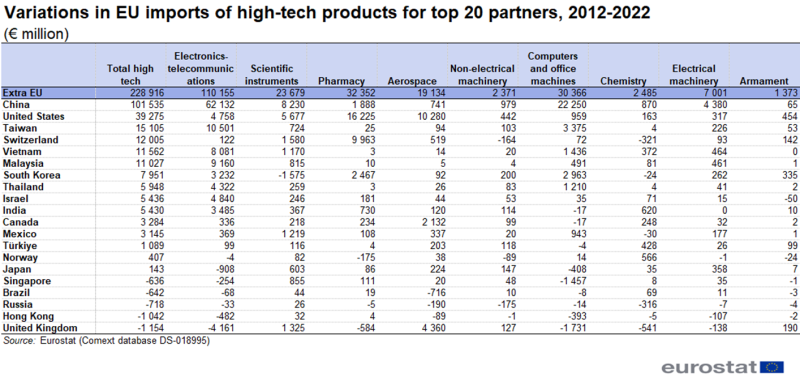

Figure 4 shows the top 20 partners (in 2022) from which the EU imported high-tech products. The first 12 partners accounted for 90 % of the total imports. Combined, the top 20 accounted for 96 % of total imports.

In 2022, the largest category in EU imports of high-tech products was electronics-telecommunications with €202 billion (Figure 5). The category with the highest average annual growth rate between 2012 and 2022 was pharmacy and electronics-telecommunications (both 8.2 %).

In 2022, for three (China, Taiwan and Vietnam) of the six top partners, the largest category in EU imports of high-tech products was electronics-telecommunications (Figure 6); for Switzerland it was pharmacy and for both the United States and the United Kingdom it was aerospace. The United States was the top partner in scientific instruments, pharmacy, non-electrical machinery, aerospace and armament. For electronics-telecommunications, computers and office machines, chemistry and electrical machinery the largest partner was China.

Between 2012 and 2022 high-tech imports from China (€102 billion), the United States (€39 billion) and Taiwan (€15 billion) increased most (Table 1). The main contributing category to the increase of imports from China and Taiwan was electronics-telecommunications with €62 billion and €11 billion respectively. The main contributing category to the increase of imports from the United States was pharmacy with €16 billion.

EU exports of trade in high-tech products

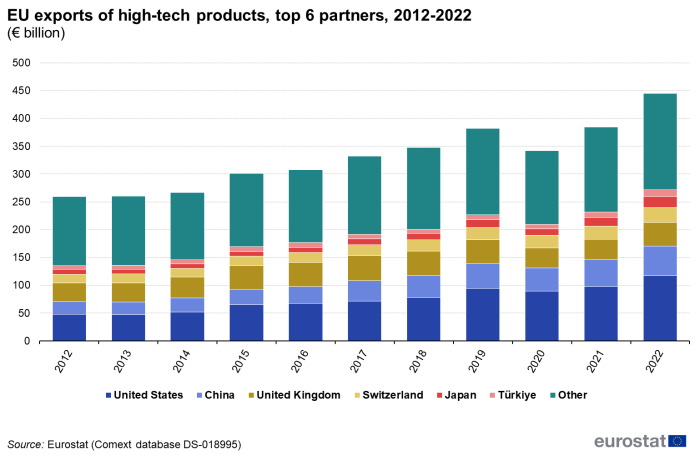

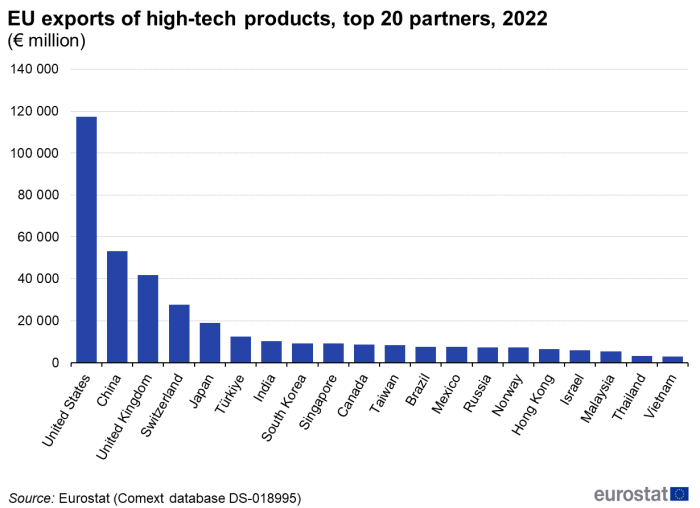

In 2022 over a quarter of the EU exports of high-tech products to non-EU countries went to the United States (26 %) followed at some distance by China (12 %) and the United Kingdom (9 %). Between 2012 and 2022 these exports increased from €259 billion to €445 billion, equivalent to an annual average growth rate of 5.6 %. Among the top six partners, exports to the United States increased the most in absolute terms, from €48 billion to €117 billion and with 9.5 % also had the highest average annual growth rate (Figure 7).

Figure 8 shows the top 20 partners to which the EU exports high-tech products in 2022. The top 20 export destinations account for 83 % of total exports.

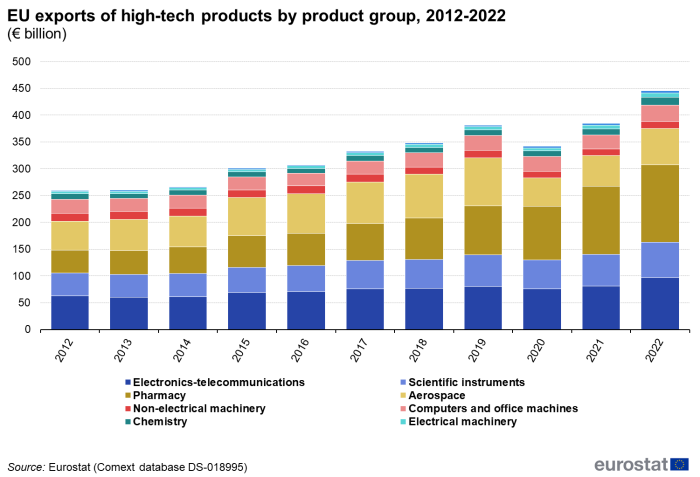

In 2022, the largest category in the exports of high-tech products was pharmacy with €145 billion (Figure 9). This was also the category with the highest average annual growth rate (13.0 %) between 2012 and 2022, followed by armament (9.6 %). Only in non-electrical machinery (-1.1 %) did exports decrease, while the other categories all grew less than 5 %.

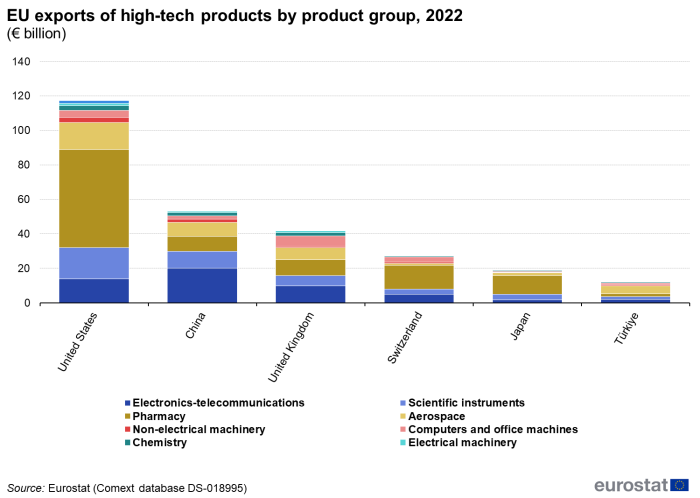

In 2022, for the United States, Switzerland and Japan, the largest category in EU exports of high-tech products was pharmacy (Figure 10). For China and the United Kingdom it was electronics-telecommunication and for Türkiye it was aerospace. In seven categories the United States was the largest export destination for EU exports. A different top partner was only seen in electronics-telecommunication (China) and computers and office machines (the United Kingdom).

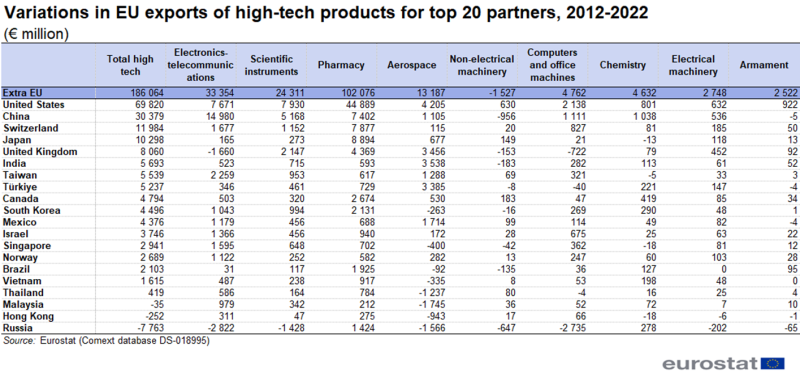

Between 2012 and 2022, the largest increases in high-tech exports were to the United States (€70 billion), China (€30 billion) and Switzerland (€12 billion) as shown in Table 2. The main contributing category to the increase of exports to the United States and Switzerland was pharmacy with €45 billion and €8 billion respectively. The main contributing category to the increase of exports to China was electronics-telecommunications with €15 billion.

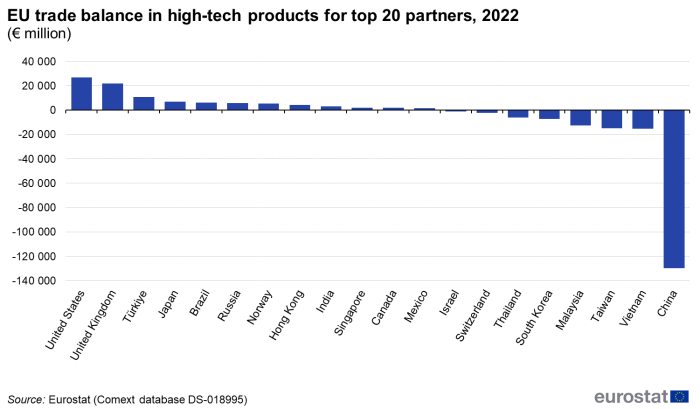

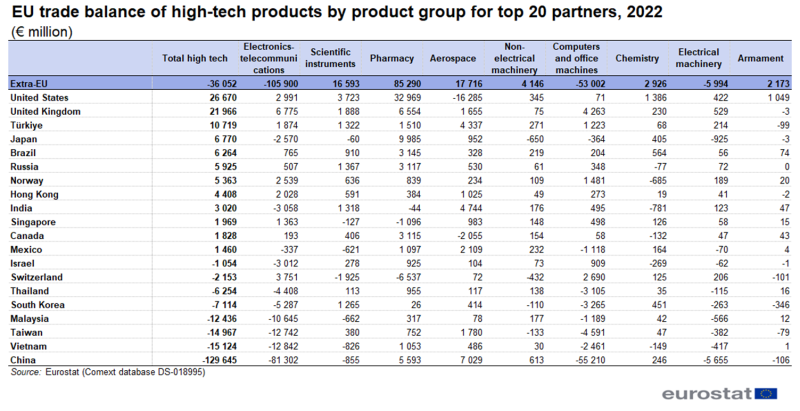

EU trade balance in high-tech products

The EU had a large trade deficit with China (€130 billion) in 2022 (Figure 11). The only other partners with a trade deficit exceeding €10 billion were Vietnam, Taiwan (both €15 billion) and Malaysia (€12 billion). The EU had a trade surplus above €10 billion with Türkiye (€11 billion), the United Kingdom (€22 billion) and the United States (€27 billion).

The trade deficit with China in 2022 is largely due to deficits in electronics-telecommunications (€81 billion) and computers and office machines (€55 billion) as shown in Table 3. The surplus with the United Kingdom was spread over several categories. With the United States there is a large deficit in aerospace (€16 billion) but an even greater surplus in pharmacy (€33 billion).

Manufacturing of high-tech products

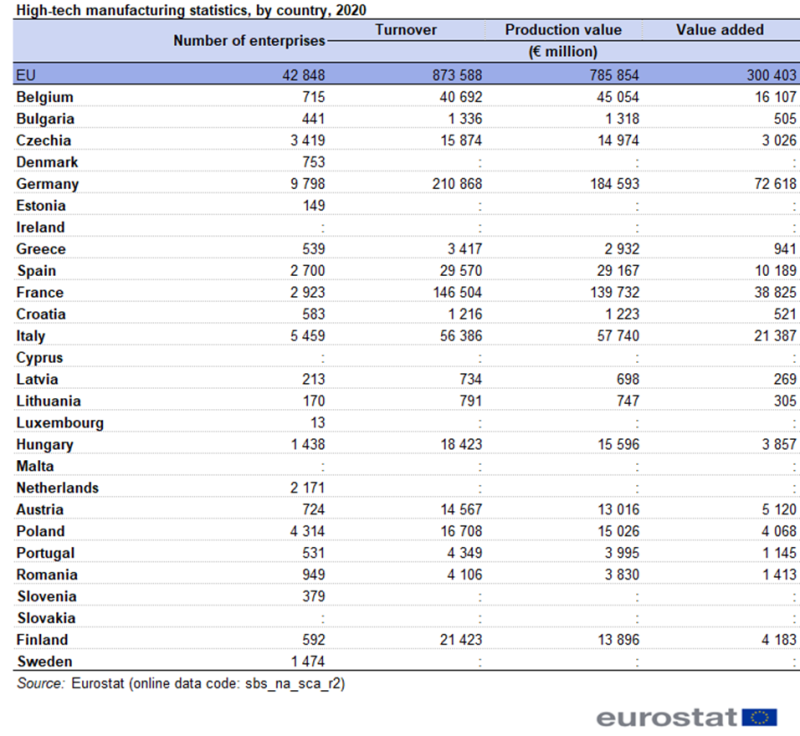

In 2020 the EU had an estimated number of 42 848 enterprises in the high-tech manufacturing sector (Table 4), which represents 0.2 % of the total number of enterprises in the EU. High-tech manufacturers were most numerous in Germany (9 798), Italy (5 459) and Poland (4 314). They had the highest turnover in Germany (€211 billion), France (€147 billion) and Italy (€56 billion) and the highest value added in Germany (€73 billion), France (€39 billion) and Italy (€21 billion). Relative to the total business population, the share of high-tech manufacturers was highest in Germany (0.4 %), Czechia, Denmark, Croatia, Slovenia and Finland (all 0.3 %). Relative to the turnover in the total business population the share of high-tech manufacturers was highest in Hungary (5.8 %), Finland (5.4 %) and France (4.0 %). Relative to the value added in the total business population, the share of high-tech manufacturers was highest in Belgium (6.9 %), Hungary (5.5 %), France and Finland (both 4.0 %).

Source: Eurostat (sbs_na_sca_r2)

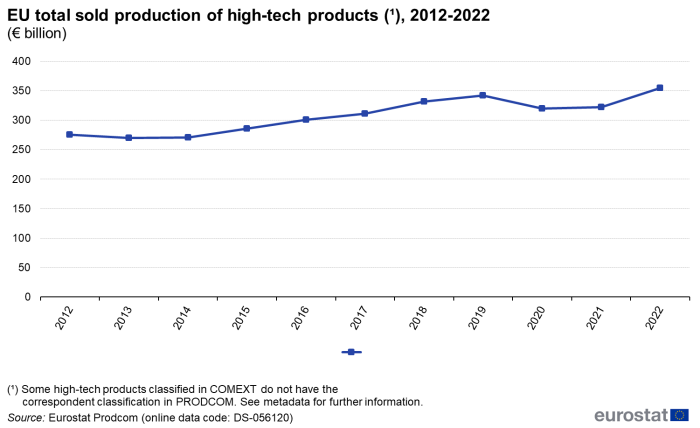

Sold production of high-tech products

Sold production of high-tech products increased from €275 billion in 2012 to €355 billion in 2022. This was equivalent to an average annual increase of 2.6 % (Figure 12).

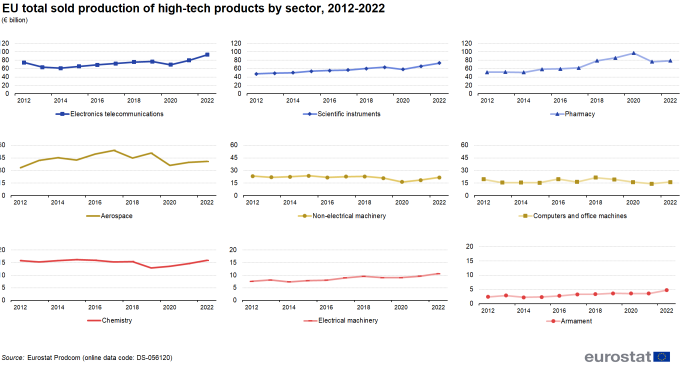

Figure 13 shows the development over time of high-tech sold production by group. Between 2012 and 2022, sold production of high tech pharmaceutical products grew most in absolute terms from €48 billion to €73 billion, equivalent to an annual average growth of 4.4 % (Figure 13). Sold production also grew in armament (7.0 %), scientific instruments (4.4 %), electrical machinery (3.4 %), electronics-telecommunications (2.2 %), aerospace (2.0 %). Sold production did not change much in chemistry and decreased in computers and office machines (-1.8 %) and non-electrical machinery (-0.7 %).

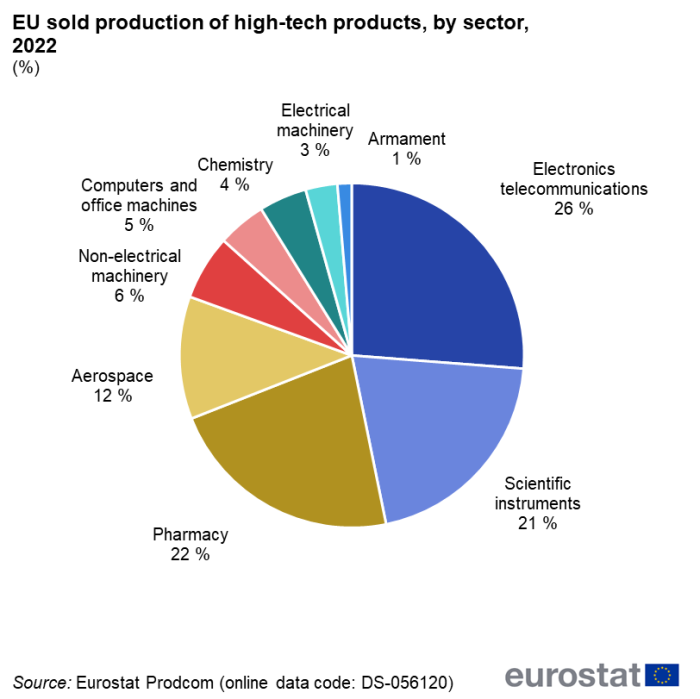

In 2021, there were three categories with a share above 10 % in total sold production of high-tech products (Figure 14). These were electronics-telecommunications (26 %) scientific instruments and pharmacy (both 22 %).

Source data for tables and graphs

![]() Production and international trade in high-tech products: graphs and tables

Production and international trade in high-tech products: graphs and tables

Data sources

Multiple data sources

High-tech statistics uses various other domains and sources mainly within Eurostat’s official statistics:

- International trade in goods statistics (COMEXT);

- Statistics on the production of manufactured goods (PRODCOM);

- Community innovation survey (CIS);

- Human resources in science and technology (HRST);

- Labour force survey (LFS);

- Structural business statistics (SBS);

- Research and development (R & D);

- Structure of earnings survey (SES);

- Patent database (PATSTAT).

The coverage and availability of high-tech statistics are then dependent on these other primary sources.

Trade in high-tech products

EU data is taken from Eurostat’s COMEXT database. COMEXT is the reference database for international trade in goods. It provides access not only to both recent and historical data from the EU Member States but also to statistics of a significant number of non-EU countries. International trade aggregated and detailed statistics disseminated via the Eurostat website are compiled from COMEXT data according to a monthly process.

Data are collected by the competent national authorities of the EU Member States and compiled according to a harmonised methodology established by EU regulations before transmission to Eurostat. For trade, the statistical information is mainly provided by the traders on the basis of customs declarations.

EU data are compiled according to Community guidelines and may, therefore, differ from national data published by the Member States. Statistics on trade are calculated as the sum of trade of each of the 27 EU Member States with countries outside the EU. In other words, the EU is considered as a single trading entity and trade flows are measured into and out of the area, but not within it.

The United Kingdom is considered as a partner country for the EU for the whole period covered by this article. However, the United Kingdom was still part of the internal market until the end of the transitory period (31 December 2020), meaning that data on trade with the United Kingdom are still based on statistical concepts applicable to trade between the EU Member States. Consequently, while imports from any other trade partner are grouped by country of origin, the United Kingdom data reflect the country of consignment. In practice this means that the goods imported by the EU from the United Kingdom were physically transported from the United Kingdom but part of these goods could have been of other origin than the United Kingdom. For this reason, data on trade with the United Kingdom are not fully comparable with data on trade with other trade partners.

The product approach is used for data on high-tech trade. The product list is based on the calculations of R & D intensity by groups of products (R & D expenditure/total sales). The groups classified as high-technology products are aggregated on the basis of the Standard international trade classification (SITC). Due to the revision of SITC from SITC Rev. 3 to SITC Rev. 4, the definition of high-tech products also changed in 2011. The data in this article use the high-tech aggregation by SITC Rev. 4. This list, based on the OECD definition, contains technical products of which the manufacturing involved a high intensity of R & D.

Production of high-tech products

Industrial production data comes from PRODCOM. Prodcom provides statistics on the production of manufactured goods. The Prodcom data includes:

- the physical volume of production sold during the survey period;

- the value of production sold during the survey period;

- for some products, the volume of total production during the survey period;

The Prodcom data is obtained by the National Statistical Institutes (NSIs) that conduct a survey of enterprises. Eurostat calculates EU totals at EU-27 level from the national data.

Data limitations

List of the COMEXT products without correspondence in PRODCOM:

| 2844 10 10 | 2844 30 51 | 8523 49 25 | 8523 51 99 |

| 2844 10 30 | 2844 30 55 | 8523 49 31 | 8710 00 00 |

| 2844 10 50 | 2844 30 61 | 8523 49 39 | 9301 10 00 |

| 2844 10 90 | 2844 30 69 | 8523 49 45 | 9301 20 00 |

| 2844 20 25 | 2844 30 91 | 8523 49 51 | 9301 90 00 |

| 2844 20 35 | 2844 30 99 | 8523 49 59 | 9305 91 00 |

| 2844 20 51 | 2844 40 10 | 8523 49 91 | 9306 30 30 |

| 2844 20 59 | 2844 40 20 | 8523 49 93 | 9306 90 10 |

| 2844 20 99 | 2844 40 30 | 8523 49 99 | |

| 2844 30 11 | 2844 40 80 | 8523 51 91 | |

| 2844 30 19 | 2844 50 00 | 8523 51 93 |

Context

In the context of economic globalisation, technology is a key factor in enhancing growth and competitiveness in business. High-tech industries are expanding most strongly in international trade and their dynamism helps to improve performance in other sectors. Investment in research, development, innovation and skills constitutes a key policy area for the EU as it is essential to economic growth and to the development of a knowledge-based economy.

Certain WTO Members including the EU have joined the Information Technology Agreement (ITA) which provides duty free access to high-tech products, including computers, telephones and inputs and components such as semiconductors. The new, expanded ITA agreement concluded recently will reduce the costs for consumers and for manufacturing IT products in Europe. It will offer new market access for many of Europe’s high-tech companies – some of which are leaders in their fields – and encourage innovation by simplifying access to state-of-the-art technology. As such, it will contribute to the further development of the digital economy in the EU.