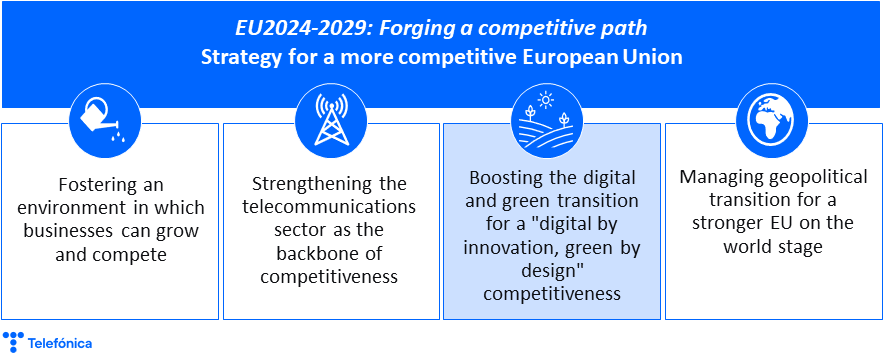

In June, we began a series entitled EU 2024-2029: Boosting competitiveness where we analyse Telefónica’s vision on how to strengthen competitiveness and better position the society and economy of the European Union (EU) on the global stage. This series coincides with the start of the institutional cycle that runs from 2024 to 2029 after the European Parliament elections. Undoubtedly, competitiveness will be the central priority guiding the EU’s forthcoming policy and legislative initiatives in this period.

The first post analysed the current state of competitiveness in the EU, the second focused on the first axis of Telefónica’s proposed competitiveness strategy and the third focused on the second strategic axis, the importance of strengthening the telecommunications sector as a lever for competitiveness in society. The fourth post analysed the third axis, which we have divided into two: Driving the digital and green transition for “digital by innovation” competitiveness, “green by design”. Then, in this fifth post we focus on the second part: “green by design”.

The opportunities of the green transition for competitiveness

Although green transition is not always directly linked to competitiveness, the two European priorities are highly compatible.

Environmental sustainability aims, among other things, to promote decarbonisation though strategies such as efficiency, circularity, and energy transition.

A more efficient use of resources not only reduces the company’s environmental impact on its surroundings, but also helps to reduce costs. This also allows more resources to be allocated to other innovative activities, thus supporting economic growth.

In addition, the reuse of a product, equipment or its components means that no more raw materials need to be extracted and no new products need to be manufactured. This results in lower greenhouse gas emissions in the value chain, as well as a reduction in new purchases, which also means lower costs.

Finally, greater energy efficiency also leads to savings, moderating the impact for companies of possible unexpected energy price rises, which are highly likely in the current geopolitical context. In turn, the local nature of renewable energy production gives Europe greater strategic autonomy by reducing its dependence on third countries, thus increasing its economic security.

On the other hand, the green transition contributes to economic growth through the generation of new jobs in activities such as manufacturing, research and development or administration. The World Economic Forum’s “The Future of Jobs 2023” report shows that hiring for sustainability-related jobs has outpaced the overall global hiring rate for four consecutive years.

The role of connectivity and digitisation in the green transition

Connectivity and digital solutions play a crucial role in maximising efficiencies, promoting the circular economy and accelerating the energy transition.

On the one hand, IoT devices and artificial intelligence (AI) are two key technologies for collecting data on activity and the environment, interpreting it and generating scenarios that favour a more efficient use of resources. For example, Telefónica has developed a digital solution that enables agricultural technicians to understand what is happening in the crop environment and what its needs are. This has made it possible to reduce the use of water and pesticides. Another example is the case of street lighting in Santiago de Compostela. The installation of more than 10,000 nodes with NB-IoT connectivity in the municipality’s luminaires has enabled the collection and sending of data to a central platform for advanced analysis and management. Thanks to this innovation, significant improvements in the efficiency and energy savings of public lighting have been achieved.

Regarding circularity, digital solutions based on IoT and AI also enable predictive maintenance of facilities to be able to act in time in the event of breakdowns and accurately detect components that may be failing. This facilitates the repair of equipment, extending its lifespan and reducing potential electronic waste. In addition, digitisation can also be applied to specific circular economy projects, such as recycling. As an example, Telefónica has worked with Ecoembes on a reward system project for recycling plastics. The rings on the bins, which are connected via 5G Narrow Band connectivity, recognise the barcode on the container and identify what type of waste is deposited inside them. The data collected is then analysed and the citizen is rewarded through the RECICLOS Return and Reward System (RRS).

Finally, digitalisation contributes to the energy transition through the design of a transport and distribution model adapted to the new realities of the energy sector. Previously, energy flowed in only one direction, from the producer to the consumer. Now, with self-generation promoting the installation of renewable energy sources in homes and other facilities, certain consumers are now small producers, pouring excess energy produced into the electricity grid. This calls for a redesign of the electricity grid. In this context, the adoption of digital solutions has become a key element in the energy sector to manage energy flows and establish a real-time dialogue between traditional producers, self-generation producers and consumers.

Why is sustainability perceived as an obstacle to competitiveness?

In the quest to drive the green transition, European over-regulation has resulted in a regulatory tsunami that has eroded the link between sustainability and competitiveness. Some negative effects of this over-regulation are increased reporting obligations; lack of consideration of private sector initiatives aligned with European objectives; and disinterest among investors and entrepreneurs.

Firstly, the European Union has adopted various regulations introducing reporting obligations. In the case of the telecommunications sector, these include the Corporate Sustainability Reporting Directive (CSRD), the Due Diligence Directive and the Energy Efficiency Directive. These obligations entail higher costs, such as the implementation of new systems to capture this data, the training of staff to adapt to the new model or the hiring of external professionals, such as auditors, consultants or lawyers. These costs do not offer added value from a consumer perspective.

Secondly, certain regulations create new sustainability standards that could hinder the work companies have done and the resources they have devoted to it. For example, the Eco Rating initiative (launched by Telefónica, Deutsche Telekom, Orange, Telia Company and Vodafone) was created with the aim of helping customers make more informed and sustainable choices when purchasing their devices, as well as to encourage suppliers to reduce the environmental impact of their devices. This initiative follows a rigorous methodology, considering international standards and with the participation of specialists in sustainability and product life cycle analysis. However, following this industry effort, the Green Claims Directive introduces new requirements on green labelling that could potentially undermine such an ambitious and holistic industry-led initiative like Eco Rating. This lack of recognition of the industry’s efforts may result in deterring future voluntary actions to advance European green goals since, after commitment to investment, they may be dismantled by regulation.

Finally, regulation creates administrative hurdles and legal constraints that create uncertainty for firms regarding the viability of a new product or service. This uncertainty reduces private capital available for innovation activities, as it is unclear whether the company will be able to successfully bring its product or service to market. Moreover, investors prefer to shy away over-regulated sectors because of the risk that regulatory changes could impact the profitability of their investments.

Innovation as a link between green transition and competitiveness

Innovation is companies’ response to the ongoing pursuit of maximising efficiencies in accordance with consumer demand, resulting in more sustainable and competitive products and services. For instance, the telecommunications sector has firmly committed to innovating its digital infrastructure by deploying fixed and mobile networks that are increasingly more efficient than previous generations in terms of energy consumption, capacity, and speed. Without this innovation, the environmental impact of networks would be significantly higher than it is today. Specifically, in the case of fixed networks it would be up to 18 times higher, while in the case of mobile networks it would be up to 7 times higher.

However, innovation is held back by regulation –as explained in the previous section– and by investment. Public funds are not sufficient to carry out the green transition, which makes it necessary to mobilise private capital. In this context, the EU pushed for the adoption of the Taxonomy regulation to redirect investments to activities aligned with European green objectives, which will serve as a benchmark for receiving sustainable finance in Europe. However, while the Taxonomy recognises the role of the ICT sector, it does not fully acknowledge the importance of deploying next generation networks to achieve the EU’s Green Deal objectives. As a result, this slows down progress and diminishes the benefits that these networks offer in decarbonizing the economy and enhancing societal welfare.

To sum up, the introduction of excessive regulation in the field of sustainability leads to increased costs, discourages private initiative and reduces the attractiveness of investment. This also has a negative impact on innovation, which thrives in favourable and flexible market environments. Ultimately, this results in the erosion of the sustainability-competitiveness nexus, leading to a slowdown of the green transition and a loss of competitiveness for European companies and, consequently, for the region.

In the next post we will delve deeper into the last strategic axis for a more competitive EU: managing the geopolitical transition for a stronger EU on the international stage.