Adoption of e-business: highlights

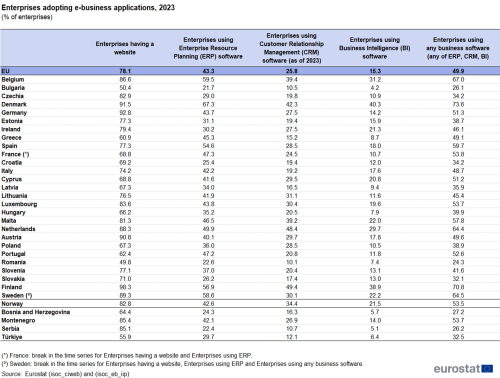

In 2023, 78.1 % of EU enterprises reported having a website, 43.3 % used ERP software applications, 25.8 % used CRM software, and 15.3 % used BI software (Table 1).

(% of enterprises)

Source: Eurostat (isoc_ciweb) and (isoc_eb_iip)

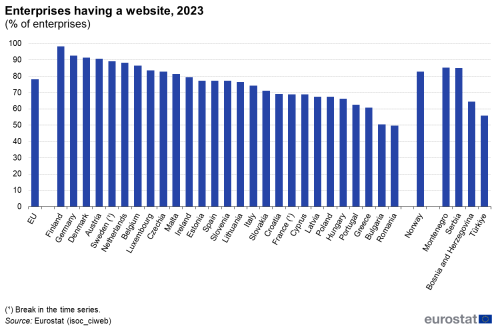

As shown in Figure 1, the share of enterprises with a website (78.1 %) grew slightly in 2023 compared with 2021 (77.8 %). The use of ERP software recorded an increase by 5.4 percentage points (pp). As presented in Table 1, in 2023, almost half of EU enterprises (49.9 %) used any of ERP, CRM, or BI software.

(% of enterprises)

Source: Eurostat (isoc_ciweb) and (isoc_eb_iip)

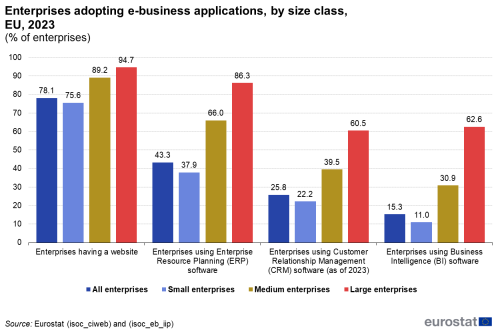

The adoption of e-business applications varies among enterprise size classes. Figure 2 shows that the gap between small and large enterprises is reportedly bigger for those using the ERP, CRM or BI software applications than for those having a website. The percentage of enterprises with a website ranged from 75.6 % for small enterprises to 94.7 % for large enterprises, but from 37.9 % to 86.3 % respectively for those using ERP software and from 22.2 % to 60.5 % for the enterprises using CRM software. The biggest gap was recorded for BI software with 62.6 % of large enterprises using this type of software compared to 11 % of small enterprises. Among large enterprises however BI software (62.6 %) was used slightly more that CRM software (60.5 %).

(% of enterprises)

Source: Eurostat (isoc_ciweb) and (isoc_eb_iip)

Enterprises’ presence on the internet

Use of websites is still slightly growing

Enterprises consider it important to be visible on the internet. Consequently, enterprises’ websites increasingly offer various functionalities, such as online ordering, product catalogues and information, order tracking, customisation of products, links to social media. Importantly, the use of a website involves a more active role than just having an internet connection. In 2023, 78.1 % of enterprises reported having a website. As shown in Figure 1, a slight increase can be observed compared to 2021 (by 0.3 percentage points).

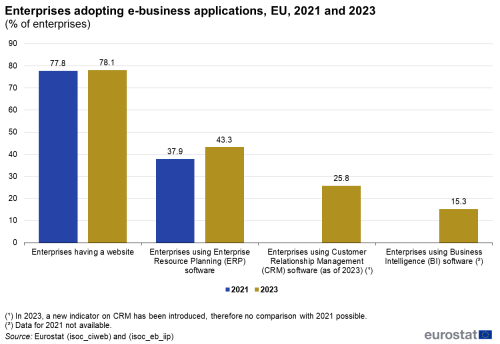

The shares of enterprises reporting to have a website ranged from over 90 % in Finland, Germany, Denmark and Austria to less than 60 % in Bulgaria and Romania (Figure 3).

Functionalities of enterprises’ websites

Description of goods or services and price information was the most common functionality of enterprises’ websites

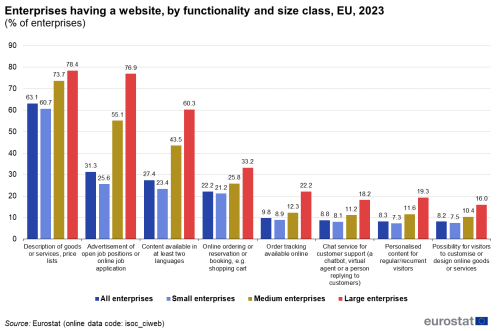

As shown in Figure 4, more than three in five (63.1 %) of the enterprises in the EU used their website to provide description of goods or services and price information. For almost a third of enterprises (31.3 %) the purpose of the website was also to advertise about open job positions or to provide opportunity for an online job application. With a share of 76.9 % this functionality was particularly significant for large enterprises compared with 25.6 % for small enterprises. 27.4 % of enterprises reported that their websites provide content available in at least two languages. Again, the share recorded for large enterprises (60.3 %) was significantly higher than the one for small enterprises (23.4 %). More than one fifth (22.2 %) of EU enterprises used their website as a direct sales channel and offered the functionality for online ordering, reservation or booking. The possibility for order tracking was provided on the websites of 9.8 % of enterprises.

(% of enterprises)

Source: Eurostat (isoc_ciweb)

Enterprise resource planning (ERP)

More than two in five enterprises uses enterprise resource planning software applications

Internal e-business integration refers to sharing information electronically and automatically between different business functions within an enterprise as opposed to external integration, in which other business partners are involved. Internal integration potentially streamlines and boosts the efficiency of an enterprise. Integration is implemented in various forms. One of them is data linking between various software applications, using a common database. The use of a single modular ERP software application is another commonly-used alternative. ERP software applications aim to facilitate the flow of information and offer the potential to integrate internal and external management of information across several functions of an enterprise. A characteristic of ERP is that it is delivered in ‘modules’ that typically integrate processes relevant to planning, purchases, marketing, sales, customer relationship, finance and human resources. The percentage of EU enterprises that used ERP software applications reached 43.3 % in 2023, an increase by 5.4 pp compared with 2021 (Figure 1).

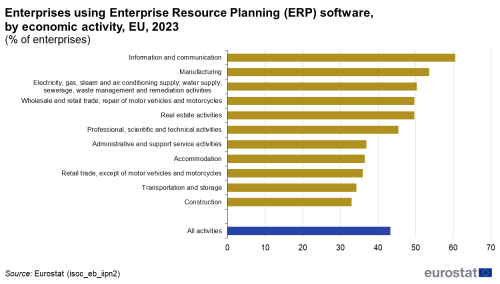

A comparison across the different economic sectors shows that, in 2023, more than half of enterprises in information and communication sector (60.5 %), in manufacturing (53.6 %) and in electricity, gas, steam and air conditioning (50.3 %) used ERP. Shares of enterprises using ERP higher than 40 % were registered also in professional, scientific and technical activities (45.4 %), in wholesale and retail trade (49.7 %) and in real estate activities (49.7 %). The lowest rates of adoption of ERP software were recorded in construction (33 %) (Figure 5).

(% of enterprises)

Source: Eurostat (isoc_eb_iipn2)

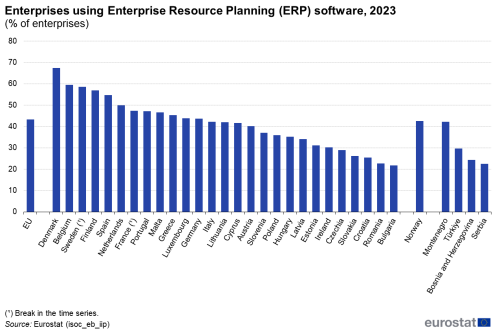

In 2023, more than half of the enterprises in Denmark (67.3 %), Belgium (59.5 %), Sweden (58.6 %), Finland (56.9 %) and Spain (54.6 %) used ERP software to share information between different functional areas. On the other hand, ERP software was used by 22.6 % of enterprises in Romania and 21.7 % in Bulgaria (Figure 6).

(% of enterprises)

Source: Eurostat (isoc_eb_iip)

Customer relationship management (CRM)

One in four enterprises uses operational customer relationship management software

Enterprises streamline their marketing efforts and target their customers to maximise business potential. For this specific purpose, they use software applications for managing information about their customers, i.e. customer relationship management (CRM) applications. It is believed that the adoption of CRM increases marketing and sales performance by improving customer service and customer relationships. Enhancements come, for instance, from providing user-friendly mechanisms for receiving complaints, identifying potential problems before they occur, in general, by facilitating communication with the customer and by anticipating customer preferences. These technology-enabled improvements lead to long-term customer satisfaction and can ensure increased customer loyalty, decreasing marketing costs and increasing sales. The share of EU enterprises using CRM stood at 25.8 % in 2023. These results are not comparable to 2021 figures due to some changes in the question on CRM and the introduction of a new indicator (Figure 1).

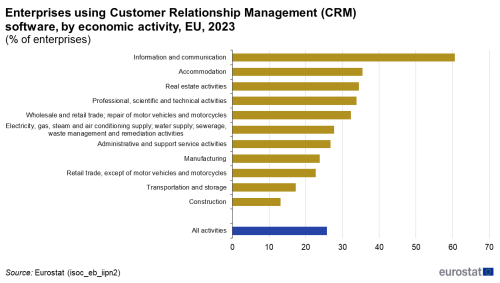

As regards the activity of enterprises, in 2023 the adoption levels of CRM were highest in information and communication with 60.6 % of enterprises. The lowest shares of enterprises using CRM were recorded in the transportation and storage sector (17.3 %) and in the construction sector (13.1 %) (Figure 7).

(% of enterprises)

Source: Eurostat (isoc_eb_iipn2)

Figure 8 presents the adoption levels of CRM by countries. The highest shares of enterprises using CRM were recorded in Finland (49.9 %), the Netherlands (48.4 %) and Denmark (42.3 %). Less than 15 % of enterprise used CRM in Bulgaria (10.5 %) and Romania (10.1 %).

(% of enterprises)

Source: Eurostat (isoc_eb_iip)

Business intelligence software (BI)

One in four enterprises uses customer relationship management software

Business intelligence (BI) software accesses and analyses data from internal IT systems and external sources and presents analytical findings in reports, summaries, dashboards, graphs, charts and maps, to provide users with detailed insights for decision-making and strategic planning. In 2023, 15.3 % of enterprises reported using of BI software, a lower ratio compared to ERP and CRM. This was however not the case for large enterprises, where the share of enterprises using BI software (62.6 %) was higher than the share of enterprises using CRM (60.5 %).

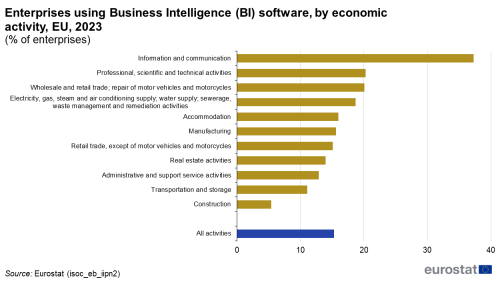

The adoption levels of BI software were quite different depending on the economic activity of the enterprises. Similar to CRM, in 2023 the use of BI solutions was the highest in information and communication with 37.3 % of enterprises. The lowest shares of enterprises using BI were recorded in the transportation and storage sector (11.1 %) and the construction sector (5.4 %) (Figure 9).

(% of enterprises)

Source: Eurostat (isoc_eb_iipn2)

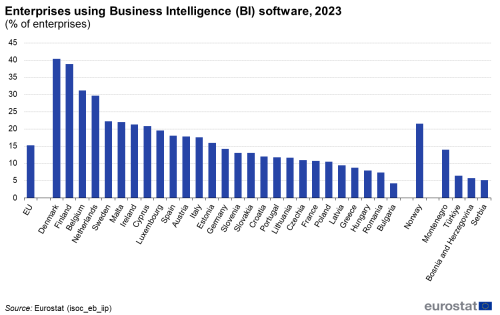

In 2023, the use of BI software varied significantly among EU Member States. Shares higher than 30 % were reported in Denmark (40.3 %), Finland (38.9 %) and Belgium (31.2 %). On the other hand, BI solutions were used by fewer than one in twenty enterprises in Bulgaria (4.2 %) (Figure 10).

(% of enterprises)

Source: Eurostat (isoc_eb_iip)

Source data for tables and graphs

Data sources

Data presented in this article are based on the results of the 2023 survey on ‘ICT usage and e-commerce in enterprises’. Statistics were obtained from enterprise surveys conducted by National Statistical Authorities in the first months of each year. The survey’s reference period is the current situation of the survey period or for some questions the preceding calendar year.

In 2023, 150 400 of the 1.47 million enterprises in the EU were surveyed. Of the 1.47 million enterprises, approximately 83 % were small enterprises (10-49 employees and self-employed persons), 14 % medium (50-249 employees and self-employed persons) and 3 % large (250 or more employees and self-employed persons).

The observation statistical unit is the enterprise, as defined in Council Regulation 696/93 of 15 March 1993. The survey covers enterprises with at least 10 employees and self-employed persons. Economic activities correspond to the classification NACE Revision 2. The sectors covered are manufacturing, electricity, gas and steam, water supply, construction, wholesale and retail trades, repair of motor vehicles and motorcycles, transportation and storage, accommodation and food service activities, information and communication, real estate, professional, scientific and technical activities, administrative and support activities and repair of computers and communication equipment. Enterprises are broken down by size: small, medium and large enterprises.

Data in some tables are shown as ‘:’ and refer to data that are unavailable, unreliable or confidential. Unreliable data are included in the calculation of European aggregates. Data presented in this article may differ from the data in the database on account of updates made after the data extractions used for this article. Data in the database are organised according to the survey year.

Context

ICT has fast become an integral part of enterprise functioning and its extensive and intensive use, combined with new ways of accessing and using the internet efficiently is decisive for the way that enterprises run their business, organise internal communication, share information with business partners and communicate with customers. In this context enterprises are particularly concerned with their presence on the internet via their websites and use increasingly ERP and CRM software applications for the organisation of their internal business processes.

Digital transformation is high on the European policy agenda, with making Europe fit for the digital age and empowering its citizens and businesses with a new generation of technologies being one of the main political priorities of the European Commission for the coming years. In 2021, the Digital Compass for the EU’s Digital Decade (COM(2021)118 final), set the EU’s digital targets for 2030, evolving around four cardinal points: skills, digital transformation of businesses, secure and sustainable digital infrastructures, and digitalization of public services.