Summary

At its meeting on 25 January 2024, the Governing Council decided to keep the three key ECB interest rates unchanged. The incoming information broadly confirmed its previous assessment of the medium-term inflation outlook. Aside from an energy-related upward base effect on headline inflation, the declining trend in underlying inflation has continued, and the past interest rate increases keep being transmitted forcefully into financing conditions. Tight financing conditions are dampening demand, and this is helping to push down inflation.

The Governing Council is determined to ensure that inflation returns to its 2% medium-term target in a timely manner. Based on its current assessment, the Governing Council considers that the key ECB interest rates are at levels that, maintained for a sufficiently long duration, will make a substantial contribution to this goal. The Governing Council’s future decisions will ensure that its policy rates will be set at sufficiently restrictive levels for as long as necessary.

The Governing Council will continue to follow a data-dependent approach to determining the appropriate level and duration of restriction. In particular, the Governing Council’s interest rate decisions will be based on its assessment of the inflation outlook in light of the incoming economic and financial data, the dynamics of underlying inflation and the strength of monetary policy transmission.

Economic activity

The euro area economy is likely to have stagnated in the final quarter of 2023.[1] The incoming data continue to signal weakness in the near term. However, some forward-looking survey indicators point to a pick-up in growth further ahead.

The labour market has remained robust. The unemployment rate, at 6.4% in November, has fallen back to its lowest level since the start of the euro and more workers have entered the labour force. At the same time, demand for labour is slowing, with fewer vacancies being advertised.

Governments should continue to roll back energy-related support measures to avoid driving up medium-term inflationary pressures. Fiscal and structural policies should be designed to make the euro area economy more productive and competitive, as well as to gradually bring down high public debt ratios. Structural reforms and investments to enhance the euro area’s supply capacity – which would be supported by the full implementation of the Next Generation EU programme – can help reduce price pressures in the medium term, while supporting the green and digital transitions. Following the recent ECOFIN Council agreement on the reform of the EU’s economic governance framework, the legislative process should be concluded swiftly so that the new rules can be implemented without delay. Moreover, it is imperative that progress towards capital markets union and the completion of banking union be accelerated.

Inflation

Inflation rose to 2.9% in December 2023 as some of the past fiscal measures to cushion the impact of high energy prices dropped out of the annual inflation rate, although the rebound was weaker than expected.[2] Aside from this base effect, the overall trend of declining inflation continued. Food price inflation dropped to 6.1% in December. Inflation excluding energy and food also declined again, to 3.4%, due to a fall in goods inflation to 2.5%. Services inflation was stable at 4.0%.

Inflation is expected to ease further over the course of 2024 as the effects of past energy shocks, supply bottlenecks and the post-pandemic reopening of the economy fade, and tighter monetary policy continues to weigh on demand.

Almost all measures of underlying inflation declined further in December. The elevated rate of wage increases and falling labour productivity are keeping domestic price pressures high, although these too have started to ease. At the same time, lower unit profits have started to moderate the inflationary effect of rising unit labour costs. Measures of shorter-term inflation expectations have come down markedly, while those of longer-term inflation expectations mostly stand around 2%.

Risk assessment

The risks to economic growth remain tilted to the downside. Growth could be lower if the effects of monetary policy turn out stronger than expected. A weaker world economy or a further slowdown in global trade would also weigh on euro area growth. Russia’s unjustified war against Ukraine and the tragic conflict in the Middle East are key sources of geopolitical risk. This may result in firms and households becoming less confident about the future and global trade being disrupted. Growth could be higher if rising real incomes mean spending increases by more than anticipated, or if the world economy grows more strongly than expected.

Upside risks to inflation include the heightened geopolitical tensions, especially in the Middle East, which could push energy prices and freight costs higher in the near term and hamper global trade. Inflation could also turn out higher than anticipated if wages increase by more than expected or profit margins prove more resilient. By contrast, inflation may surprise on the downside if monetary policy dampens demand by more than expected, or if the economic environment in the rest of the world worsens unexpectedly. Moreover, inflation could decline more quickly in the near term if energy prices evolve in line with the recent downward shift in market expectations of the future path for oil and gas prices.

Financial and monetary conditions

Market interest rates have moved broadly sideways since the Governing Council’s monetary policy meeting on 14 December 2023. The Governing Council’s restrictive monetary policy continues to transmit strongly into broader financing conditions. Lending rates on business loans declined slightly, to 5.2% in November, while mortgage rates increased further to 4.0%.

High borrowing rates, with the associated cutbacks in investment plans and house purchases, led to a further drop in credit demand in the fourth quarter of 2023, as reported in the January 2024 euro area bank lending survey. While the tightening of credit standards for loans to firms and households moderated, they remained tight, with banks concerned about the risks faced by their customers.

Against this background, credit dynamics have improved somewhat but overall remain weak. Loans to firms stagnated in November 2023 compared with a year earlier – after contracting in October – as the monthly flow of short-term loans rebounded. Loans to households grew at a subdued annual rate of 0.5%.

Monetary policy decisions

The interest rate on the main refinancing operations and the interest rates on the marginal lending facility and the deposit facility remain unchanged at 4.50%, 4.75% and 4.00% respectively.

The asset purchase programme portfolio is declining at a measured and predictable pace, as the Eurosystem no longer reinvests the principal payments from maturing securities.

The Governing Council intends to continue to reinvest, in full, the principal payments from maturing securities purchased under the pandemic emergency purchase programme (PEPP) during the first half of 2024. Over the second half of the year, it intends to reduce the PEPP portfolio by €7.5 billion per month on average. The Governing Council intends to discontinue reinvestments under the PEPP at the end of 2024.

The Governing Council will continue applying flexibility in reinvesting redemptions coming due in the PEPP portfolio, with a view to countering risks to the monetary policy transmission mechanism related to the pandemic.

As banks are repaying the amounts borrowed under the targeted longer-term refinancing operations, the Governing Council will regularly assess how targeted lending operations and their ongoing repayment are contributing to its monetary policy stance.

Conclusion

At its meeting on 25 January 2024, the Governing Council decided to keep the three key ECB interest rates unchanged. The Governing Council is determined to ensure that inflation returns to its 2% medium-term target in a timely manner. Based on its current assessment, the Governing Council considers that the key ECB interest rates are at levels that, maintained for a sufficiently long duration, will make a substantial contribution to this goal. The Governing Council’s future decisions will ensure that the key ECB interest rates will be set at sufficiently restrictive levels for as long as necessary. The Governing Council will continue to follow a data-dependent approach to determining the appropriate level and duration of restriction.

In any case, the Governing Council stands ready to adjust all of its instruments within its mandate to ensure that inflation returns to its medium-term target and to preserve the smooth functioning of monetary policy transmission.

1 External environment

Global economic activity moderated in the fourth quarter of 2023. Tailwinds to consumer spending as a result of tight labour markets are beginning to wane, while past monetary policy tightening continues to be transmitted to the economy. Core inflation continued to decline in the fourth quarter, but further progress might be sluggish as wage growth is still high, remaining above long-term averages. Oil prices rose during the period between the Governing Council’s monetary policy meetings in December and January, amid some volatility, as attacks on tankers in the Red Sea have intensified geopolitical tensions in the Middle East, while European gas prices have fallen amid continued low demand and high levels of gas storage in the EU.

Global economic growth moderated at the turn of the year. The global composite output Purchasing Managers’ Index (PMI) points to a decline in the rate of real GDP growth in the fourth quarter of 2023. High frequency indicators, such as global retail sales, also suggest a slowdown in consumer spending towards the end of the year. This reflects waning tailwinds to consumption across large advanced economies as labour markets are gradually becoming less tight, nominal wage growth is moderating and the stock of excess savings built up by households has been subsiding. At the same time, past monetary policy tightening continues to be transmitted to the global economy.

Global trade growth is expected to improve further, but disruptions to shipping pose downside risks. Merchandise trade growth momentum returned to positive territory in October 2023, amid broad-based improvements across countries globally. Global trade has been supported by the unwinding of post-pandemic factors that had weighed on trade last year, such as companies’ reduction of inventories built up in 2022. However, there are downside risks to this normalisation of trade growth as some shipping companies have suspended services through the Red Sea and the Suez Canal following attacks on cargo vessels. Delivery times are lengthening as ships are being rerouted around the Cape of Good Hope, while spot rates for container shipping have increased, particularly between China and Europe (Chart 1). Although the situation remains highly uncertain, it has so far had much less of an impact on trade flows than the pandemic-related trade disruptions seen in 2021-22. This is due to the comparatively lower growth in demand for goods, higher spare shipping capacity and reduced congestion in ports currently being observed.

Chart 1

Global shipping costs

(indices: January 2019 = 100 (left-hand panel), November 2023 = 100 (right-hand panel))

Sources: Bloomberg, Freightos, HARPER PETERSEN and ECB staff calculations.

Notes: The Freightos Baltic Index (FBX) tracks directional freight costs (for forty-foot equivalent unit shipping container prices) between China and the United States, and between China and Europe, among others. The global charter rate (HARPEX) is the HARPER PETERSEN Charter Rates Index, which tracks the cost of chartering container vessels operating on all routes globally. The latest observations are for 21 January 2024.

In December 2023 core inflation across member countries of the Organisation for Economic Co-operation and Development (OECD) continued to decline, but further normalisation could be sluggish. Annual headline consumer price index (CPI) inflation across OECD member countries excluding Türkiye decreased to 3.4% in November, down from 3.6% in October, owing to some easing in food price inflation (Chart 2). Core inflation (headline inflation excluding food and energy) also declined in November, falling 0.2 percentage points to 4.1%, but remains elevated. The PMI input and output price indices, which have strong leading indicator properties for global core goods and services inflation, point to core services inflation continuing to be persistent and slow to return to its long-term average. This partly reflects easing, albeit still tight, labour markets.

Chart 2

OECD consumer price inflation

(annual percentage changes; percentage point contributions)

Sources: OECD and ECB staff calculations.

Notes: OECD inflation excludes Türkiye and is calculated based on national consumer price indices and annual private final consumption expenditure weights expressed in purchasing power parity (PPP) terms. Core inflation refers to headline inflation excluding food and energy. The latest observations are for November 2023.

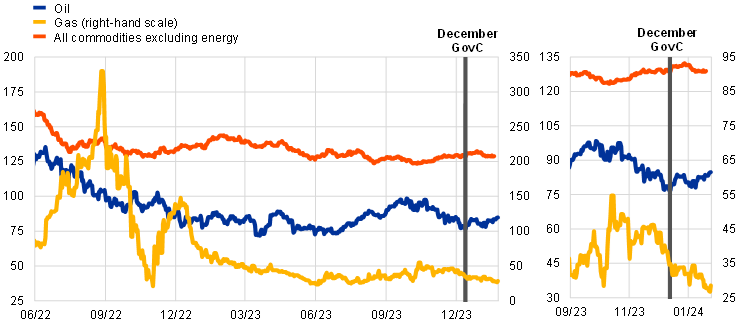

Developments in energy commodity prices have been mixed since the Governing Council’s meeting in December 2023, amid higher oil prices and lower gas prices. Oil prices in US dollars have risen by 10.4% amid concerns that attacks on ships in the Red Sea could affect shipments of oil through the Suez Canal, which serves as a key passage for global oil traded by sea (Chart 3). According to the International Energy Agency, the global oil market is expected to remain balanced in the first quarter of 2024, amid deeper voluntary production cuts implemented at the start of the year by some member countries of the Organisation of the Petroleum Exporting Countries plus other oil-producing countries (OPEC+). However, the supply of oil is likely to be in surplus for the rest of the year, reflecting upward revisions to US oil supply and weakening demand from advanced economies, among other factors. European gas prices have fallen, down by 18.2%, amid continued low demand, with gas consumption remaining below historical norms for the heating season, owing to a combination of mild winter weather, changes in consumer behaviour and weak industrial activity. At the same time, central and eastern European countries made use of their ability to draw gas from Ukrainian storage facilities, which also helped to keep EU gas storage levels high.

Chart 3

Commodity price developments

(left-hand scale: USD/barrel (oil), index: 2020 = 100 (all commodities excluding energy); right-hand scale: EUR/MWh (gas))

Sources: LSEG, HWWI and ECB calculations.

Notes: “Gas” refers to the Dutch TTF gas price. The vertical line marks the date of the Governing Council’s monetary policy meeting in December 2023. The latest observations are for 24 January 2024 for oil and gas, and 19 January 2024 for commodities excluding energy.

Non-energy commodity prices have been stable amid slightly higher metal prices, but lower food prices. Since the December meeting of the Governing Council, metal prices have increased by 1%, driven mainly by higher prices for tin, lead and aluminium. Some volatility was seen in aluminium prices owing to worries about growing tightness in the aluminium market as the UK government imposed sanctions on Russian metals trading, and an explosion at a fuel depot in Guinea in December raised fears of a bauxite shortage that could affect aluminium production in China. Food commodity prices have declined by 1.7% on the back of falling soybean and grain prices.

In the United States, economic growth was expected to show some signs of moderation at the end of last year, following strong growth in the third quarter.[3] High frequency indicators, such as credit card spending, suggest a deceleration in consumer spending at the turn of the year. At the same time, rising consumer loan delinquencies indicate that household balance sheets are coming under increasing pressure. In December 2023 US headline CPI inflation rose by 0.3 percentage points, up to 3.4%, as the contribution of energy prices became less negative. Core inflation fell by 0.1 percentage points to 3.9%, as core services inflation continued to recede, albeit slowly. Meanwhile, the Federal Reserve System left interest rates unchanged at its December meeting for the second time in a row. It also revised downwards its projections for inflation and interest rates in 2024, signalling that demand is likely to weigh on the economy during the year.

In China, economic activity slowed in the fourth quarter of 2023 as the real estate sector continues to pose headwinds. Quarter-on-quarter real GDP growth slowed to 1.0% in the fourth quarter of 2023, down from 1.5% in the previous quarter. For the year 2023 as a whole, GDP growth reached 5.2%, which is well in line with the government’s growth target of “around 5%” for 2024. The real estate sector is still acting as a drag on the economy. House prices continue to decline, while construction activity remains low, weighing on overall investment. Although consumer spending growth is positive in year-on-year terms, consumption of goods and services related to housing (such as furniture) is still contracting. Meanwhile, annual headline CPI inflation rates remained in negative territory in the fourth quarter, with prices falling by 0.3% in December, owing primarily to lower food prices. By contrast, annual core inflation remained positive at 0.6% in the same month. In the near term, inflationary pressures are likely to remain subdued, reflecting low food prices alongside weak domestic and external demand.

In Japan, consumer spending is showing signs of a modest recovery, while inflationary pressures persist. Economic activity indicators point to a gradual strengthening of domestic demand, as consumer confidence is improving amid expectations of higher wages. Nevertheless, uncertainty related to the economic impact of the New Year’s Day earthquake in central Japan prevails, but at this stage supply chain disruptions appear to be relatively limited. Meanwhile, headline consumer price inflation slowed in December to 2.6%, down from 2.8% in the previous month. At the same time, core inflation picked up slightly by 0.1 percentage points, to reach 2.8% in December, signalling persistent underlying price pressures. While the Bank of Japan kept its policy rate unchanged in December, a shift towards a tighter monetary policy stance in 2024 is widely expected.

In the United Kingdom, economic activity remains modest, while inflation is expected to ease further. GDP growth in the third quarter of 2023 was revised downwards to ‑0.1% in quarter-on-quarter terms. Recent high frequency data signal greater resilience, suggesting that GDP growth improved modestly in the fourth quarter of the year. Looking ahead, economic activity is expected to remain subdued in the coming quarters, as past monetary policy tightening and higher financing costs for firms are expected to weigh on demand. However, a recent fall in mortgage rates has stimulated new mortgage borrowing and could boost consumer spending to some extent. Headline CPI inflation surprised mildly on the upside in December, rising by 0.1 percentage points year on year, up to 4.0%, having fallen sharply in previous months. Inflation is expected to continue to decline in the months ahead, albeit more slowly, as pressures stemming from still elevated wage growth are expected to persist, reflecting continued tightness in the labour market.

2 Economic activity

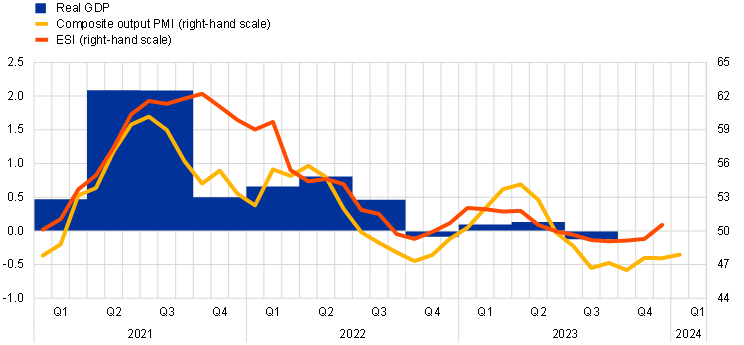

The euro area economy is likely to have stagnated in the final quarter of 2023, following a year of broadly flat growth.[4] This comes on the back of the prolonged weakness in global trade and of strong monetary policy transmission. Incoming data show signs of a modest strengthening of growth in the first quarter of 2024. The labour market remains resilient, although more recent indicators suggest signs of cooling following the protracted period of weak economic activity. The euro area economy is expected to start gradually improving over the course of this year. Growth is expected to be supported by rising real disposable income, which in turn should benefit from declining inflation and robust wage growth. At the same time, exports should catch up with improvements in foreign demand.

Euro area real GDP growth is expected to have remained weak in the final quarter of 2023. The euro area economy contracted slightly in the third quarter of 2023 (Chart 4), following a period of stagnation over the past year. Changes in inventories were the main negative driver behind the third quarter outcome. Domestic demand contributed positively, while net trade had a neutral impact. Incoming data for the fourth quarter point to continued weak output growth. In October and November 2023, euro area industrial production stood 1.2% below its average level for the third quarter, a decline that was widespread across various industrial sectors. Moreover, services production shrank by 0.9% month on month in October, to stand 0.7% below its third-quarter average, indicating that the feeble growth dynamics spread throughout the economy. More timely survey data, encompassing the full fourth quarter, corroborate this picture of slow growth – or even falling output – during that period. The composite output Purchasing Managers’ Index (PMI) for the euro area declined from 47.5 in the third quarter to 47.2 in the fourth quarter, but recovered from 46.5 in October to 47.6 in December 2023, reflecting developments in both industry and services (see Box 2).

Chart 4

Euro area real GDP, composite output PMI and ESI

(left-hand scale: quarter-on-quarter percentage changes; right-hand scale: diffusion index)

Sources: Eurostat, European Commission, S&P Global Market Intelligence and ECB calculations.

Notes: The two lines indicate monthly developments; the bars show quarterly data. The European Commission’s Economic Sentiment Indicator (ESI) has been standardised and rescaled to have the same mean and standard deviation as the composite output PMI. The latest observations are for the third quarter of 2023 for real GDP, December 2023 for the ESI and January 2024 for the composite output PMI.

Although euro area output growth remains weak, it is expected to show some improvement at the beginning of 2024. PMI data for January show continued weakness at the beginning of the year, on the back of the growing impact of weak global trade and of strong monetary policy transmission. However, the composite output PMI improved slightly, further reflecting a robust increase in manufacturing output, alongside a small decline in services sector business activity (Chart 5). New orders for both the manufacturing and services sectors continued to increase between December 2023 and January 2024, signalling a slight improvement in the first quarter of this year. The main findings from the ECB’s recent contacts with non-financial companies (see Box 3) also suggest that growth will gradually strengthen. In the same vein, the results from the most recent ECB Survey of Professional Forecasters (conducted in January) indicate that economic activity will slowly start to recover in the first quarter of 2024.

Chart 5

PMI indicators across sectors of the economy

|

a) Manufacturing |

b) Services |

|---|---|

|

(diffusion indices) |

(diffusion indices) |

|

|

Source: S&P Global Market Intelligence.

Note: The latest observations are for January 2024.

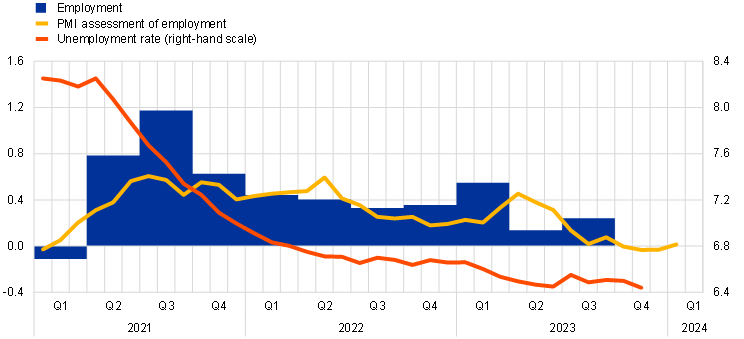

The labour market remains resilient, albeit recent indicators signal a cooling following weaker economic activity. Employment growth continued to be robust in the third quarter of the year, at a quarterly rate of 0.2%. The rise in employment levels masked a decline in working hours as a result of continued high levels of sick leave and some labour hoarding. As the labour force continued to grow, the unemployment rate returned to its lowest level since the beginning of the euro, standing at 6.4% in November, down from 6.5% in October 2023 (Chart 6). Recent short-term indicators suggest a further loss of momentum in job creation amid weaker economic developments overall. In the same vein, the PMI employment indicator for the whole economy suggests a slowdown in employment dynamics in the second half of 2023. According to the flash estimate, the PMI for employment in January stood at 50.1, slightly above its neutral value of 50. In terms of the different sectors, this estimate suggests that employment has been declining in the manufacturing sector but has continued to moderately increase in the services sector. The improvement compared with December 2023 notwithstanding, the PMI composite employment indicator has, overall, followed a downward trend since April 2023. Contacts from the corporate telephone survey reported weaker employment growth in the fourth quarter of 2023. An increasing number of firms reported slight reductions in employment rates overall, mainly as a result of not replacing staff who had either retired or left the company.

Chart 6

Euro area employment, the PMI assessment of employment and the unemployment rate

(left-hand scale: quarter-on-quarter percentage changes, diffusion index; right-hand scale: percentages of the labour force)

Sources: Eurostat, S&P Global Market Intelligence and ECB calculations.

Notes: The two lines indicate monthly developments; the bars show quarterly data. The PMI is expressed in terms of the deviation from 50 divided by 10. The latest observations are for the third quarter of 2023 for employment, January 2024 for the PMI assessment of employment and November 2023 for the unemployment rate.

Private consumption growth remained weak in the last quarter of 2023, reflecting continued subdued spending on goods. This was indicated by the ongoing weakness in retail sales volumes, which in October and November stood, on average, at the same level as in the third quarter of 2023. At the same time, in the fourth quarter of 2023, new passenger car registrations stood 0.6% below their third-quarter level, after a strong recovery in the third quarter resulting mainly from orders of electric cars that had previously been delayed. While the European Commission’s indicator for consumer confidence improved further in December, it remains well below its long-term average.

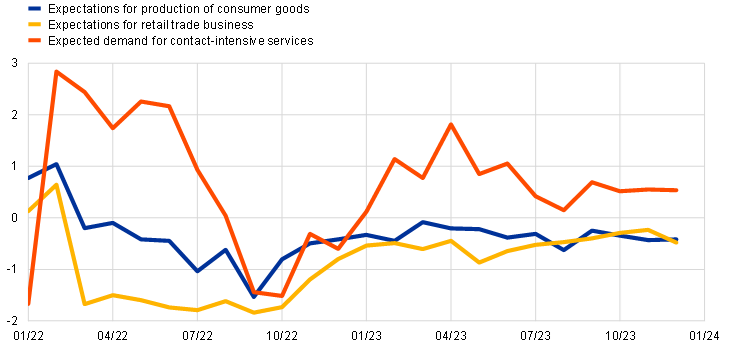

Incoming survey data continue to point to overall weakness in spending on goods alongside strong spending on services at the beginning of the year. The Commission’s indicators for expected retail trade business and for expected major purchases by consumers remained subdued in December 2023, despite a small improvement in the latter. By contrast, there was no strong downward correction in expected demand for contact-intensive services, which continued to hold up in December, remaining above its historical average (Chart 7). Similarly, the ECB’s Consumer Expectations Survey for December suggests resilient expected demand for holiday bookings. Likewise, the ECB’s recent contacts with the non-financial sector indicate that demand for contact-intensive services is likely to remain relatively strong, while demand for goods, particularly durable goods, is expected to remain weak. The transmission of tighter financing conditions to the real economy is likely to continue to curb household borrowing, resulting in high savings and keeping consumer spending growth subdued in the near term. At the same time, consumer spending should benefit from improving purchasing power on the back of falling inflation and a still resilient labour market.

Chart 7

Expectations for the production of consumer goods, retail trade business and services demand

(percentage balances)

Sources: European Commission and ECB calculations.

Notes: “Contact-intensive services” refers to the weighted average of accommodation, food and travel services. The latest observations are for December 2023.

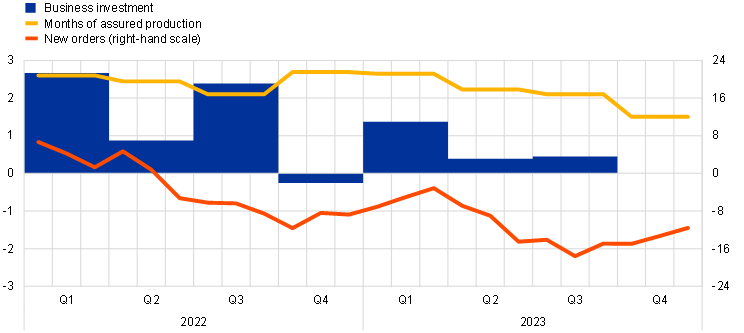

Business investment growth is likely to have slowed in the fourth quarter amid weak demand and tight financing conditions. Following an increase of 0.5%, quarter on quarter, in the third quarter of 2023, subdued capital goods indicators suggest that business investment growth, excluding intangible investment in Ireland, is set to have weakened in the fourth quarter. At the same time, while PMI new orders remained in contractionary territory in the fourth quarter of 2023, the existing stock of orders still assured capital goods production for a longer period than they did in pre-pandemic times, according to the European Commission’s business and consumer survey (Chart 8, panel a). This may have supported investment at the end of last year. At the same time, bankruptcies in the euro area increased in the first three quarters of 2023 compared with the same period in 2022, albeit from low levels. This came as policy support related to the pandemic and energy crises was phased out and financing conditions tightened. Such corporate vulnerabilities, together with weak demand and high uncertainty about geopolitical and financing conditions, could weigh on investment this year, as suggested by the weaker investment outlook reported by corporate contacts (see Box 5).

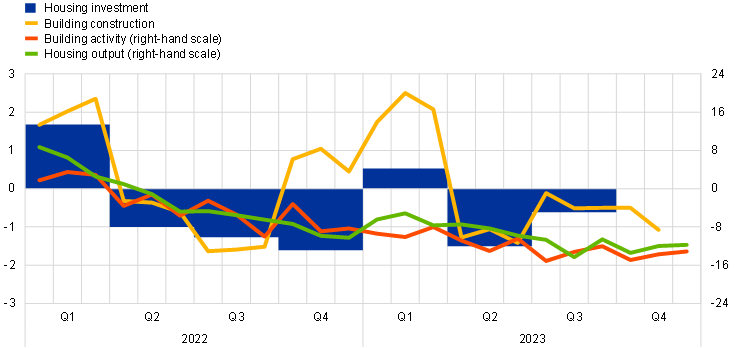

Chart 8

Business and housing investment and short-term indicators

a) Business investment

(quarter-on-quarter percentage changes, deviations from the mean)

b) Housing investment

(quarter-on-quarter percentage changes, deviations from the mean)

Sources: Eurostat, European Commission, S&P Global Market Intelligence and ECB calculations.

Notes: The lines indicate monthly developments; the bars show quarterly data. Business investment is proxied by non-construction investment and excludes Irish intellectual property products. Business investment and PMI new orders for capital goods are expressed as deviations from the 1999-2019 average. Months of assured capital goods production out of existing orders are expressed as deviations from the 1999-2019 average. The latest observations are for the third quarter of 2023 for investment, the fourth quarter of 2023 for the months of assured production and December 2023 for the other variables. The index for building construction production is computed as the percentage change over the average level in the previous quarter. The European Commission’s index for building construction activity over the past three months is calculated as the change from the average level in the fourth quarter of 2021. The PMI for housing (i.e. residential construction) output is expressed as deviations from 50. The latest observations are for the third quarter of 2023 for housing investment, November 2023 for building construction and December 2023 for the other variables.

Housing investment is likely to have fallen further in the fourth quarter of 2023, as shown by hard and soft indicators. Building construction output – a leading indicator for housing investment – fell by an average of 1.1% in October and November compared with its average level in the third quarter. In addition, survey-based activity measures, such as the European Commission’s indicator for building construction activity in the last three months and the PMI for residential construction, remained in contractionary territory until December 2023, although they improved slightly in the last two months of the fourth quarter of the year (Chart 8, panel b). According to the European Commission business and consumer survey on factors limiting construction activity, insufficient demand was cited by firms more frequently in the fourth quarter than in the third quarter of 2023 and remained the most cited factor, followed by labour shortages. Building permits for residential buildings (measured by floor space) increased in September but continued to fall significantly overall in the third quarter after five consecutive quarters of decline. This sustained downward trend in building permits indicates that the momentum in housing investment is likely to remain weak in the near future, which is consistent with subdued household borrowing for house purchases.

Euro area trade momentum remained subdued at the end of the year. In November, extra-euro area goods export volumes contracted by 0.4% in three-month-on-three-month terms. While the easing of supply bottlenecks continued to provide some support, exports were dragged down by weak foreign demand and reduced competitiveness related to the past appreciation of the euro, as well as the energy shock which is still weighing on some sectors. At the same time, the global inventory cycle has also had an impact on export demand (see Box 1). Looking ahead, as global activity recovers and the inventory drawdown diminishes, the drag on euro area exports should gradually fade. In the near term, forward-looking indicators – for both goods and services exports – still point to moderation. Moreover, the situation in the Red Sea poses additional downside risks to the outlook. Extra-euro area goods import volumes contracted again by 2.4%, three-month on three-month, following a weakening of activity and a sharp destocking of inventories in the euro area.

Beyond the near term, GDP growth is expected to gradually strengthen. The euro area economy is expected to start steadily improving over the course of this year. Growth should be supported by rising real disposable income, which in turn should benefit from declining inflation and robust wage growth. In addition, exports should catch up with improvements in foreign demand. The gradually fading impact of the ECB’s monetary policy tightening and of adverse credit supply conditions should also support this recovery over the medium term.

3 Prices and costs

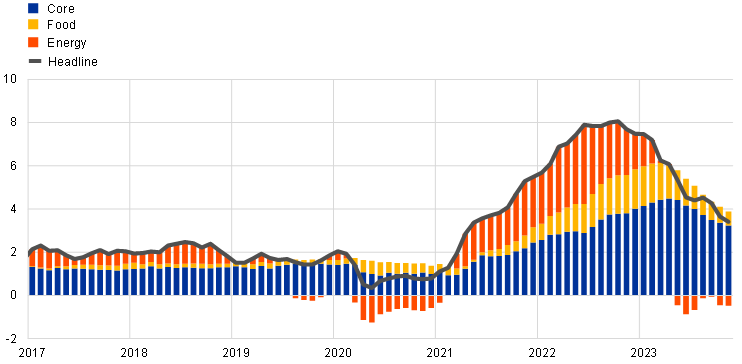

Euro area headline inflation rose to 2.9% in December from 2.4% in November 2023 due to energy-related base effects, although the rebound was weaker than expected and the declining trend in underlying inflation continued. [5] Inflation excluding energy and food declined again, from 3.6% in November to 3.4% in December, driven by the decline in goods inflation. Almost all measures of underlying inflation decreased further in December. The elevated rate of wage increases and falling labour productivity are keeping domestic price pressures high, although these too have started to ease. Measures of longer-term inflation expectations stand at around 2%, while measures of shorter-term expectations have come down markedly.

Euro area headline inflation rose to 2.9% in December from 2.4% in November, after falling substantially during the course of the year (Chart 9). The increase was driven by a less negative energy inflation rate, mainly due to base effects. Meanwhile food inflation and HICP inflation excluding energy and food declined further.

Chart 9

Headline inflation and its main components

(annual percentage changes; percentage point contributions)

Sources: Eurostat and ECB calculations.

Notes: NEIG stands for non-energy industrial goods. The latest observations are for December 2023.

As expected, energy inflation saw an increase in December, but the change to -6.7% from -11.5% in November was smaller than anticipated. The main driver of the less negative annual rate of change was a large base effect. This was related to both the one-off gas support measures in Germany and a substantial drop in fuel prices in December 2022.

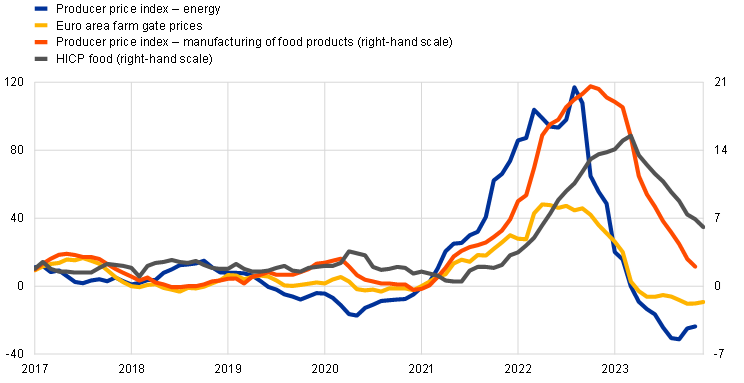

Food inflation continued to decline, to 6.1% in December from 6.9% in November, but remained elevated (Chart 10). The decrease was driven by slower dynamics in processed food prices (5.9% year-on-year growth after 7.1% in November). This reflected declines in energy costs and food commodity prices as measured by, for instance, euro area farm gate prices. While unprocessed food price inflation increased from 6.3% in November to 6.8% in December, this reflected a base effect from developments one year earlier rather than the latest price dynamics.

HICP inflation excluding energy and food (HICPX) decreased further from 3.6% in November to 3.4% in December. In terms of components, non-energy industrial goods (NEIG) inflation declined from 2.9% to 2.5%, reflecting the gradually fading impact of past shocks. Services inflation was unchanged at 4.0% in December. The relatively greater persistence in services inflation is in line with strong wage growth and the more prominent role that labour costs play in the production of services.

Chart 10

Energy and food input costs, and HICP food prices

(annual percentage changes)

Source: Eurostat.

Note: The latest observations are for November 2023 for the producer price indices and December 2023 for euro area farm gate prices and HICP food inflation.

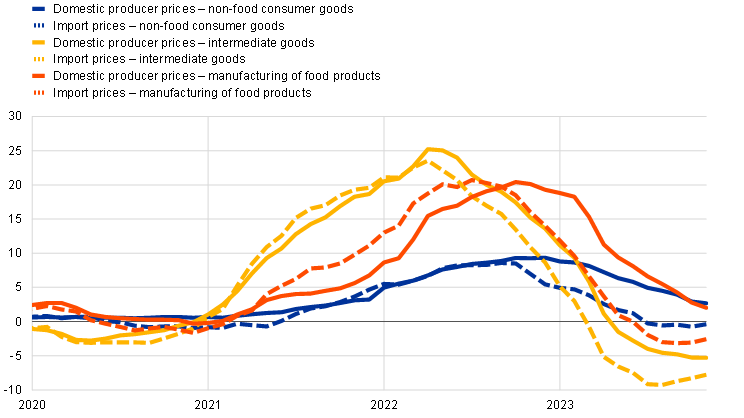

Producer and import price pressures continued to remain negative across all main industrial categories (Chart 11). At the early stages of the pricing chain, producer price inflation for domestic sales of intermediate goods was negative and unchanged (-5.3% in November and October). The annual growth rates of import prices for intermediate goods also remained significantly negative, although slightly less so than in the previous month (-7.8% after -8.3% in October). At the later stages of the pricing chain, the annual growth rates of producer prices for non-food consumer goods continued to decline to 2.7% in November, down from 3.0% in October, reaching the lowest level since September 2021. Import price growth for non-food consumer goods edged down from -0.4% to -0.6%. The same unwinding tendencies hold for producer prices and import prices in the manufactured consumer goods segment, confirming the general gradual easing of pipeline pressures on consumer goods prices.

Chart 11

Indicators of pipeline pressures

(annual percentage changes)

Sources: Eurostat and ECB calculations.

Note: The latest observations are for November 2023.

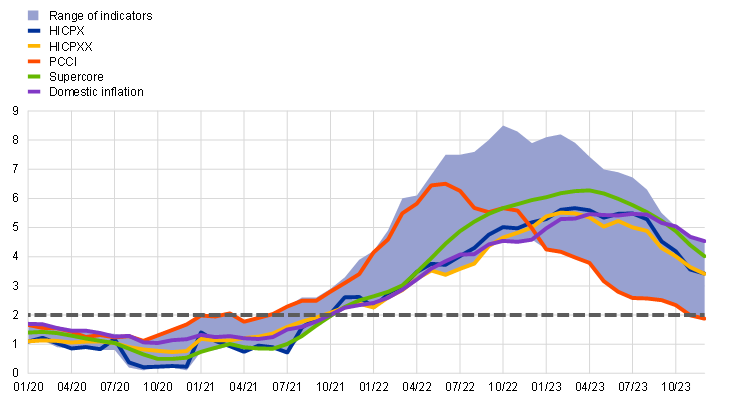

Measures of underlying inflation in the euro area continued to decrease, as the impact from past shocks fades and demand eases amid tighter monetary policy (Chart 12). The range has been declining and narrowing since July 2023, but remains relatively high, as the impact of past shocks has yet to fully dissipate for most measures. The Persistent and Common Component of Inflation (PCCI) remained at the bottom of the range, declining further to 1.9% in December. HICPXX inflation (HICPX excluding travel-related items, clothing and footwear) decreased at the same rate as the HICPX, to 3.4% in December from 3.6% in November. The Supercore indicator, which includes cyclically sensitive HICP items, continued its decline from 4.4% in November to 4.0% in December, but remains relatively high. Domestic inflation (comprising items with a low import content) is also moderating from more elevated levels than other measures. It declined to 4.5% in December from 4.7% in November. The higher level and more gradual easing of this indicator primarily reflects the large share of services items included in it, particularly those sensitive to wage pressures.

Chart 12

Indicators of underlying inflation

(annual percentage changes)

Sources: Eurostat and ECB calculations.

Notes: The range of indicators of underlying inflation includes HICP excluding energy, HICP excluding energy and unprocessed food, HICPX, HICPXX, domestic inflation, 10% and 30% trimmed means, PCCI, the Supercore indicator and a weighted median. The grey dashed line represents the ECB’s inflation target of 2% over the medium term. The latest observations are for December 2023.

Wage growth measures had been moving broadly sideways recently, at elevated levels. The latest available data refer to the third quarter of 2023 and show an increase in the annual growth rate of negotiated wages to 4.7% from 4.4% in the second quarter of 2023. The forward-looking wage trackers signal continued high wage pressures, although with some tentative signs of a cooling down by the end of 2023. Actual wage growth, as measured by compensation per employee and compensation per hour, decreased in the third quarter of 2023 to 5.3% and 5.2% respectively, down from 5.5% and 5.3% in the second quarter. Labour costs meanwhile account for the largest contribution to domestic price pressures, as measured by the annual growth rate of the GDP deflator, while the contribution of unit profits weakened in the third quarter of 2023 from a historical high in the first half of the year.

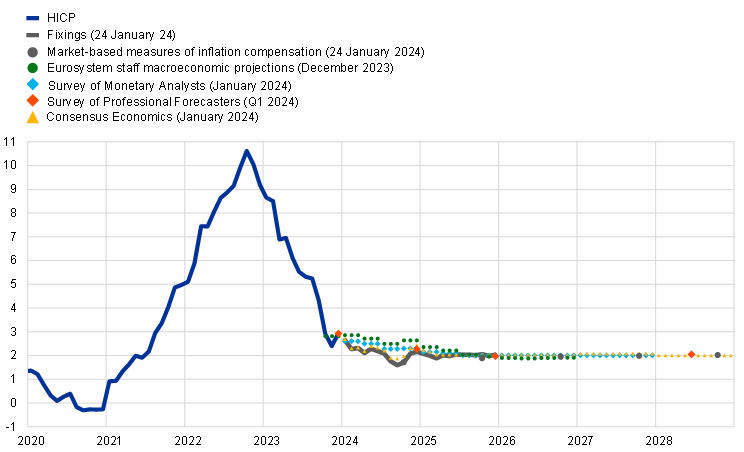

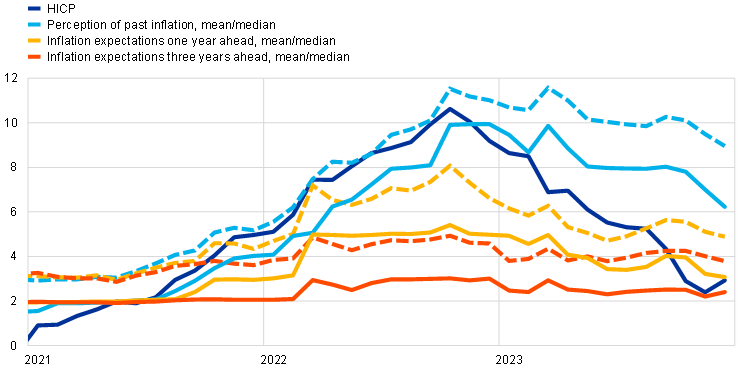

Most survey-based indicators of longer-term inflation expectations in the euro area, as well as market-based measures of inflation compensation adjusted for risk premia, are at around 2% (Chart 13). The ECB Survey of Professional Forecasters (SPF) for the first quarter of 2024 sees average longer-term inflation expectations (for 2028) at 2.0%, revised downward from 2.1% in the fourth quarter of 2023. Longer-term inflation expectations also stood at 2.0% in the January 2024 Consensus Economics survey. The median longer-term expectations remained unchanged at 2.0% in the January 2024 ECB Survey of Monetary Analysts (SMA). In the ECB Consumer Expectations Survey (CES) for December 2023, median expectations over the next year decreased from 3.2% in November to 3.1% in December, while those for three years ahead rose to 2.4%, up from 2.2%.[6] With regard to perceptions of past inflation, they did not follow the decline in HICP inflation between June and October 2023. However, they eased considerably from October 2023 onwards, with the median declining from 8.0% in September to 6.2% in December. Euro area market-based measures of inflation compensation (based on the HICP excluding tobacco) stayed broadly unchanged between mid-December 2023 and 24 January 2024 after decreasing substantially over the preceding months. At the short end of the yield curve, the one-year forward inflation-linked swap (ILS) rate one year ahead stood at around 2.1% in late January, down by 9 basis points from the levels prevailing in mid-December. Meanwhile the euro area five-year forward ILS rate five years ahead stayed broadly unchanged at 2.3%. However, it should be noted that these market-based measures of inflation compensation are not a direct gauge of the genuine inflation expectations of market participants, as these measures include inflation risk premia, which compensate for inflation risks.

Chart 13

Headline inflation, inflation projections and expectations

a) Headline inflation, survey-based indicators of inflation expectations, inflation projections and market-based measures of inflation compensation

(annual percentage changes)

b) Headline inflation and ECB Consumer Expectations Survey

(annual percentage changes)

Sources: Eurostat, Refinitiv, Consensus Economics, CES, SPF, SMA, Eurosystem staff macroeconomic projections for the euro area, December 2023, and ECB calculations.

Notes: The market-based measures of inflation compensation series are based on the one-year spot inflation rate, the one-year forward rate one year ahead, the one-year forward rate two years ahead and the one-year forward rate three years ahead. The observations for market-based measures of inflation compensation are for 24 January 2024. Inflation fixings are swap contracts linked to specific monthly releases in euro area year-on-year HICP inflation ex. tobacco. The SPF for the first quarter of 2024 was conducted between 5 and 10 January 2024. The cut-off date for the Consensus Economics long-term forecasts was January 2024. For the CES, dashed lines represent the mean and solid lines the median. The cut-off date for data included in the Eurosystem staff macroeconomic projections was 23 November 2023. The latest observations are for December 2023.

4 Financial market developments

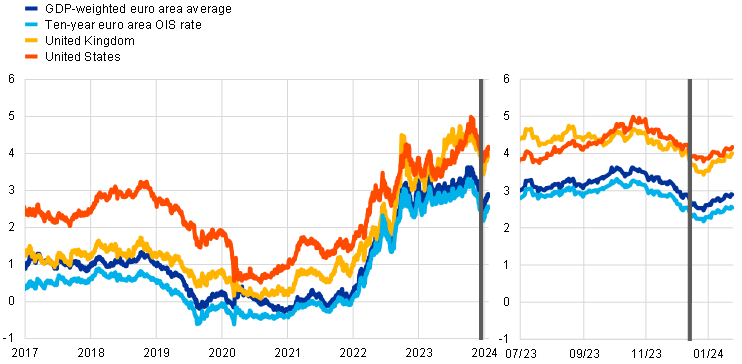

Over the review period (14 December 2023 to 24 January 2024), developments in the euro area financial markets reflected evolving policy rate expectations as markets continued to focus on the pace of disinflation and the expected monetary policy adjustments. Following the Governing Council’s widely expected monetary policy decision in December 2023 to leave the key ECB policy rates unchanged, the short end of the euro area risk-free curve varied only marginally over the review period, reflecting stable expectations for no change in ECB policy rates at the January meeting. By contrast, policy rate expectations over longer horizons fluctuated more markedly, but ended the review period close to their mid-December levels. Sovereign bond yields in the euro area moved in line with risk-free rates, which increased slightly, and the announcement made at the December meeting to start gradually reducing pandemic emergency purchase programme (PEPP) reinvestments by mid-2024 had no visible impact on sovereign yields. Equity prices remained range bound as declines in earnings expectations were offset by a reduction in the equity risk premium. Euro area corporate bond markets were broadly unchanged, with some decline in the high-yield segment. In foreign exchange markets, the euro appreciated slightly in trade-weighted terms.

Euro area near-term risk-free rates ended the review period broadly in line with the levels prevailing around the time of the December Governing Council meeting. The euro short-term rate (€STR) averaged 3.90% over the review period. Excess liquidity decreased by around €63 billion to stand at €3,521 billion. The overnight index swap (OIS) forward curve, which is based on the benchmark €STR, remained stable for short-term maturities after the Governing Council’s widely expected monetary policy decision in December to keep the key ECB policy rates unchanged. Short-term forward rates for horizons beyond the January 2024 Governing Council meeting were, however, subject to heightened volatility over the review period as markets continued to focus on the pace of disinflation and the expected monetary policy adjustments. Overall, the priced probability of a first rate cut in March and April 2024 edged down. At the end of the review period markets had fully priced in a rate cut of 25 basis points for June and cumulative rate cuts of 133 basis points by the end of 2024. Euro area longer-term risk-free rates increased slightly in the review period, after falling in the days following the December Governing Council meeting and returning to their previous levels in the first weeks of 2024. The euro area ten-year nominal risk-free rate, for instance, decreased to 2.2% at the end of December before rebounding to around 2.5%, ending the review period with an overall increase of 16 basis points.

Long-term sovereign bond yields moved broadly in line with risk-free rates amid overall stable sovereign spreads (Chart 14). On 24 January the euro area GDP-weighted average ten-year sovereign bond yield stood at around 2.9%, around 19 basis points above its level at the beginning of the review period. Sovereign spread movements across euro area jurisdictions were closely contained throughout the review period, and the announcement at the December 2023 meeting to start gradually reducing PEPP reinvestments by mid-2024 did not appear to leave a notable mark. The increase in euro area long-term rates followed similar dynamics globally: the ten-year US sovereign bond yield increased by 26 basis points to stand at 4.2%, and the UK sovereign bond yield rose by 23 basis points to 4.0%.

Chart 14

Ten-year sovereign bond yields and the ten-year OIS rate based on the €STR

(percentages per annum)

Sources: LSEG and ECB calculations.

Notes: The vertical grey lines denote the start of the review period on 14 December 2023. The latest observations are for 24 January 2024.

Corporate bond spreads were largely unchanged over the review period, with spreads in the high-yield segment narrowing. The spreads for investment-grade firms ended the review period broadly unchanged, while spreads in the high-yield segment were more volatile, narrowing by 34 basis points.

Euro area equity prices remained range bound as declines in earnings expectations were offset by a reduction in the equity risk premium. Broad stock market indices in the euro area were largely unchanged over the review period, amid declining earnings expectations, whereas they increased by 2.7% in the United States. Equity price losses in the euro area were concentrated in the non-financial sector, with interest rate-sensitive sectors, such as technology and real estate, underperforming, while the financial sector continued to outperform the broad index. Overall, the equity prices of euro area non-financial corporations decreased by around 0.9%, while euro area banks’ equity prices and other euro area financials increased by 2.4% and 3.1% respectively. In the United States, equity prices increased by 3.1% for non-financial corporations and were broadly unchanged for banks.

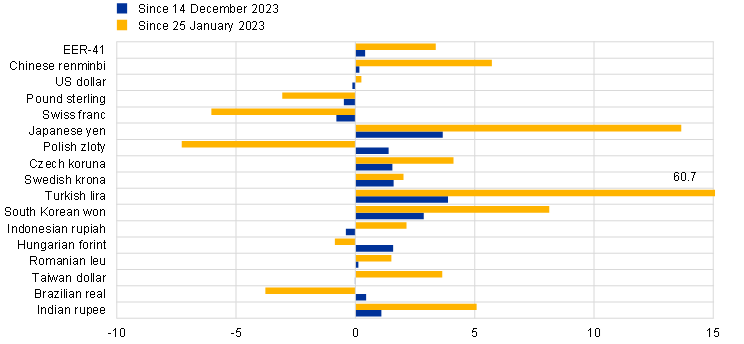

In foreign exchange markets, the euro appreciated slightly in trade-weighted terms (Chart 15). The nominal effective exchange rate of the euro – as measured against the currencies of 41 of the euro area’s most important trading partners – appreciated by 0.4% over the review period. Expected monetary policy developments remained a major driver of exchange rate fluctuations and generated some volatility. That said, the euro was fairly stable against the US dollar, depreciating by only 0.1% as expectations for lower US rates were partly dialled back from the start of the year following the Federal Open Market Committee meeting in December 2023. In terms of bilateral exchange rate movements against other major currencies, the euro appreciated against the Turkish lira (by 3.9%) and the Japanese yen (by 3.7%), while it depreciated against the Swiss franc (by 0.8%) and the Pound sterling (by 0.5%).

Chart 15

Changes in the exchange rate of the euro vis-à-vis selected currencies

(percentage changes)

Source: ECB calculations.

Notes: EER-41 is the nominal effective exchange rate of the euro against the currencies of 41 of the euro area’s most important trading partners. A positive (negative) change corresponds to an appreciation (depreciation) of the euro. All changes have been calculated using the foreign exchange rates prevailing on 24 January 2024.

5 Financing conditions and credit developments

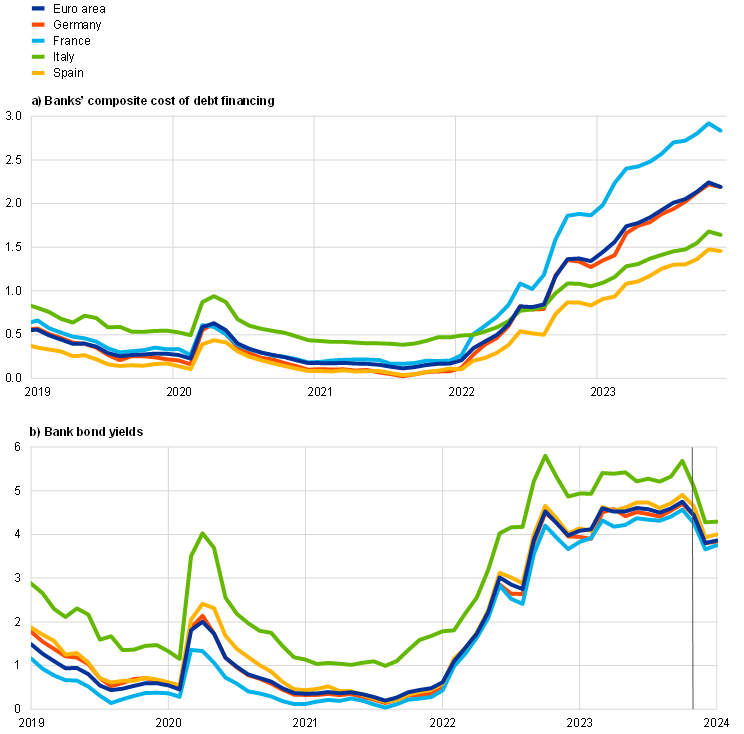

In November 2023 composite bank funding costs and bank lending rates for firms declined slightly, while mortgage rates increased further. After declining significantly in November, the cost to non-financial corporations (NFCs) of market-based debt increased from 14 December 2023 to 24 January 2024, while the cost of equity financing continued to decline over this period. The most recent euro area bank lending survey indicates that there was a further but moderate net tightening of credit standards for loans to firms, with more tightening expected in the first quarter of 2024. Demand for loans by firms and households continued to decrease substantially, albeit less steeply than in the previous quarter. In the second half of 2023, bank lending conditions for firms tightened more in the real estate and construction sectors than in others. The weakness in bank lending to firms and households continued in November, reflecting the strong pass-through of policy tightening to lending rates, combined with lower loan demand and tighter credit standards. Money growth continued to contract, with annual rates close to historical lows, owing to high opportunity costs, subdued credit growth and the reduction in the Eurosystem balance sheet.

Euro area bank funding costs decreased slightly in November 2023, driven by declining bank bond yields. The composite cost of debt financing for euro area banks in November stood slightly below that in the previous month, amid considerable cross-country heterogeneity (Chart 16, panel a). The substantial decrease in bank bond yields (Chart 16, panel b) reflected the pass-through of similar declines in risk-free rates. At the same time, deposit rates continued to rise, with some variation across instruments and sectors. The rates offered to firms for holding time deposits were close to the ECB’s deposit facility rate and remained above those for households. Moreover, the composition of bank funding continued to shift towards more expensive sources, namely bank bonds and time deposits, given that the increasing opportunity cost of holding overnight deposits has led depositors to substitute large volumes with time deposits and other instruments with higher remuneration.

The ongoing contraction of the Eurosystem balance sheet has contributed to a reduction in excess liquidity, but system-wide liquidity remains ample. Although there were no repayments of targeted longer-term refinancing operation (TLTRO) funds over the review period, the discontinuation in July of reinvestment by the Eurosystem of principal payments from maturing securities has continued to mechanically drain liquidity from the financial system. To make up for the lower liquidity provided by the ECB, banks have increased their issuance of debt securities and money market instruments. Issuance of bank bonds, which are more expensive for banks than deposits, has increased in volume since September 2022, amid the Eurosystem balance sheet contraction and the decline in overnight deposits.

Chart 16

Composite bank funding costs in selected euro area countries

(annual percentages)

Sources: ECB, S&P Dow Jones Indices LLC and/or its affiliates, and ECB calculations.

Notes: Composite bank funding costs are a weighted average of the composite cost of deposits and unsecured market-based debt financing. The composite cost of deposits is calculated as an average of new business rates on overnight deposits, deposits with an agreed maturity and deposits redeemable at notice, weighted by their respective outstanding amounts. Bank bond yields are monthly averages for senior-tranche bonds. The vertical grey line in panel b) denotes 30 November 2023. The latest observations are for November 2023 for banks’ composite cost of debt financing and for 24 January 2024 for bank bond yields.

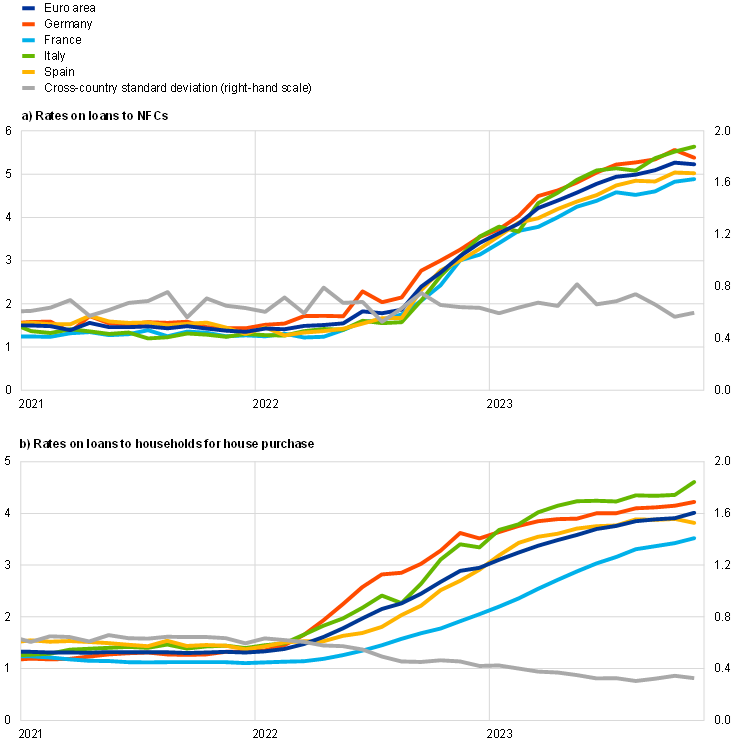

In November 2023 lending rates for firms declined slightly for the first time since July 2022, while the rates for housing loans increased further. Although lending rates for firms and households have reacted strongly to the increase in policy rates since the beginning of the tightening cycle, the response to the recent declines in market rates has been relatively muted so far. Between early July 2022 and September 2023, the ECB’s policy rates rose substantially and rapidly, by a total of 450 basis points. This led to a sharp increase in lending rates for both firms and households across euro area countries (Chart 17). Since May 2022, i.e. before the ECB signalled the first rate hike in the current tightening cycle, lending rates for firms and for housing loans have risen by 368 basis points and 223 basis points respectively. In November 2023 lending rates for firms declined to 5.23%, compared with 5.27% in October. The small decline could be an early indication that lending rates to firms have passed a peak, following the start of the decline in risk-free rates in autumn 2023. This decrease was driven mainly by large loans, with substantial cross-country heterogeneity. Bank rates on new loans to households for consumption decreased from 7.90% in October to 7.85% in November. Lending rates on new loans in the category “other lending to households”, which includes sole proprietors, also decreased slightly in November to 5.55%, down from 5.58% in October. At the same time, lending rates on new loans to households for house purchase continued to increase, reaching 4.01% in November, up from 3.91% in October. This increase was widespread across euro area countries and interest rate fixation periods and is explained by margins on riskier loans and other factors, despite the sizeable decreases seen in market rates for medium and longer-term maturities. The results of the ECB’s Consumer Expectations Survey for November 2023 suggest that consumers expect mortgage rates to decline from their current levels over the next 12 months. A large, but declining, net percentage of survey respondents perceived credit standards to be tight and expected housing loans to become harder to obtain over that same period. The cross-country dispersion of lending rates for firms and households remained at a low level (Chart 17), suggesting smooth monetary policy transmission across euro area countries.

Chart 17

Composite bank lending rates for NFCs and households in selected countries

(annual percentages; standard deviation)

Sources: ECB and ECB calculations.

Notes: Composite bank lending rates for non-financial corporations (NFCs) are calculated by aggregating short and long-term rates using a 24-month moving average of new business volumes. The cross-country standard deviation is calculated using a fixed sample of 12 euro area countries. The latest observations are for November 2023.

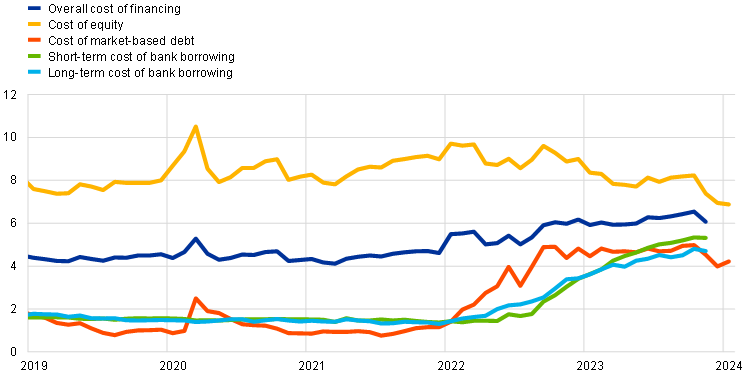

After declining significantly in November, the daily data for the review period – 14 December 2023 to 24 January 2024 – show that the cost to NFCs of market-based debt increased, while the cost of equity financing declined somewhat. In November the overall cost of financing for NFCs – i.e. the composite cost of bank borrowing, market-based debt and equity – declined significantly from the multi-year high reached in October and stood at 6.07%, which is almost 50 basis points lower than in the previous month (Chart 18).[7] All components contributed to the decline in the cost of financing in November, with the cost of market-based debt and cost of equity being the main drivers. Based on the daily data, the cost of market-based debt increased between 14 December 2023 and 24 January 2024, owing to a rise in the risk-free rate, while spreads on bonds issued by NFCs remained stable or even declined in the investment-grade and high-yield segments respectively. A significant decline in the equity risk premium more than compensated for the higher risk-free rate (approximated by the ten-year overnight index swap rate), thus leading to a decline in the cost of equity financing (see Section 4).

Chart 18

Nominal cost of external financing for euro area NFCs, broken down by component

Sources: ECB and ECB calculations, Eurostat, Dealogic, Merrill Lynch, Bloomberg and Thomson Reuters.

Notes: The overall cost of financing for non-financial corporations (NFCs) is based on monthly data and is calculated as a weighted average of the cost of borrowing from banks (monthly average data), market-based debt and equity (end-of-month data), based on their respective outstanding amounts. The latest observations are for 24 January 2024 for the cost of market-based debt and the cost of equity (daily data), and for November 2023 for the overall cost of financing and the cost of borrowing from banks (monthly data).

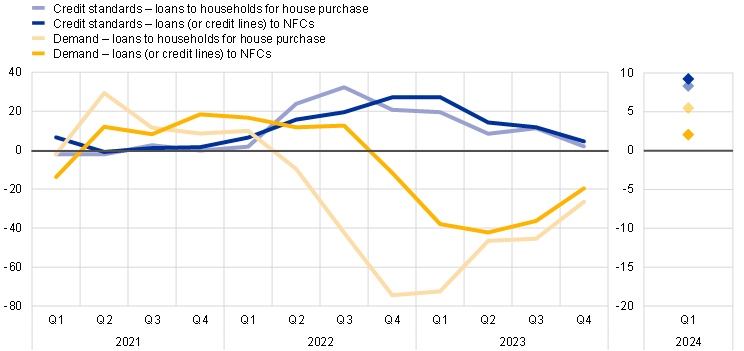

According to the January 2024 euro area bank lending survey, credit standards for loans to firms tightened moderately further in the fourth quarter of 2023 (Chart 19). The tightening adds to the substantial cumulative tightening since 2022, which has contributed, together with weak demand, to the strong fall in loan growth to firms. Risks related to the economic outlook and the financial situation of firms continued to have a tightening impact, whereas the impact of banks’ cost of funds and balance-sheet situations, competition and risk tolerance was broadly neutral at the euro area level in the fourth quarter of 2023. The impact of past tightening will continue to dampen loan growth in the coming quarters. In line with the leading indicator properties of credit standards – about five to six quarters ahead of actual loan growth developments – weakness in lending to firms can be expected to continue in 2024. Euro area banks expect the tightening of credit standards for loans to firms to pick up in the first quarter of 2024.

Chart 19

Changes in credit standards and net demand for loans to NFCs and loans to households for house purchase

(net percentages of banks reporting a tightening of credit standards or an increase in loan demand)

Source: Euro area bank lending survey.

Notes: NFC stands for non-financial corporation. For survey questions on credit standards, “net percentages” are defined as the difference between the sum of the percentages of banks responding “tightened considerably” and “tightened somewhat” and the sum of the percentages of banks responding “eased somewhat” and “eased considerably”. For survey questions on demand for loans, “net percentages” are defined as the difference between the sum of the percentages of banks responding “increased considerably” and “increased somewhat” and the sum of the percentages of banks responding “decreased somewhat” and “decreased considerably”. The diamonds denote expectations reported by banks in the current survey round. The latest observations are for the third quarter of 2023.

Banks reported a further net tightening of credit standards for loans to households in the fourth quarter of 2023, which was small for housing loans and more pronounced for consumer credit. Risk perceptions were a major driver of the tightening of credit standards in both categories, with banks’ lower risk tolerance also driving the tightening of credit standards for consumer credit. While the slight tightening in the housing loan segment was driven by smaller euro area countries, credit standards for consumer credit tightened across the four largest euro area economies. For both loan categories, the net tightening was lower than in the third quarter, in line with banks’ expectations. For the first quarter of 2024, euro area banks’ expectations point to a pick-up in the net tightening of credit standards for housing loans, while for consumer credit they point to a net tightening similar to that reported for the last quarter of 2023.

Demand for loans by firms and households continued to decrease substantially in the fourth quarter of 2023, albeit less steeply than in the previous quarter. The drop in demand for loans to firms was due mainly to higher interest rates and lower fixed investment, consistent with the strong net decrease in demand for long-term loans. For housing loans and consumer credit, the decrease was driven by higher interest rates and low consumer confidence, with housing market prospects also exerting substantial downward pressure on demand for housing loans. Banks also reported a further net increase in the share of rejected loan applications for loans to firms and for housing loans. For the first quarter of 2024, banks expect a small net increase in demand for loans to firms (for the first time since the second quarter of 2022) and rising housing loan demand (for the first time since the first quarter of 2022), but a further decrease in consumer credit demand.

Bank lending conditions tightened more in the real estate and construction sectors than in others, based on the results of ad hoc questions to survey respondents on the second half of 2023. Lending conditions for firms continued to tighten moderately in most economic sectors in the second half of 2023, ranging from almost nil net tightening in services to relatively large net tightening in commercial real estate, construction and residential real estate. Loan demand decreased in net terms across all economic sectors, especially in real estate and construction. Banks also reported that their access to wholesale funding had improved somewhat in the fourth quarter of 2023, but had tightened slightly for short-term retail funding and securitisation. Supervisory and regulatory measures contributed to an increase in banks’ capital, as well as their liquid and risk-weighted assets, which in turn contributed to a tightening of credit standards and credit margins across most loan categories in 2023. Perceived credit quality in banks’ loan portfolios had a moderate tightening impact on their credit standards for loans to firms and for consumer credit in the second half of 2023, whereas the impact was neutral for housing loans. Banks reported that the decline in excess liquidity held with the Eurosystem in the second half of 2023 had had only a limited impact on bank lending conditions.

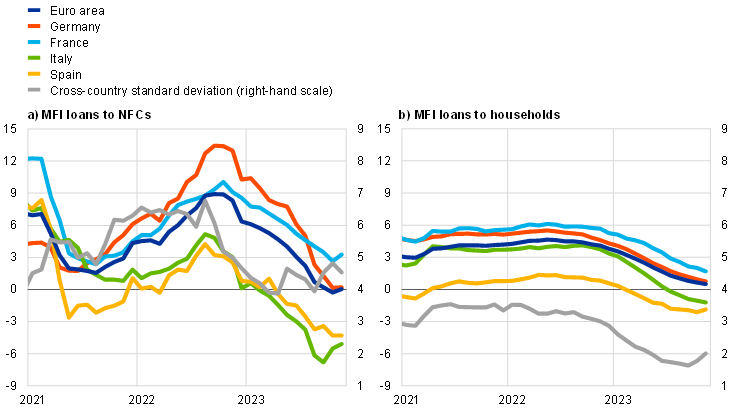

Weakness in bank lending to firms and households continued in November 2023, reflecting the strong pass-through of policy tightening to bank lending rates, together with lower loan demand and tighter credit standards. Reflecting a large monthly flow, annual growth in loans to NFCs rebounded slightly to stand at 0.0% in November, up from ‑0.3% in October (Chart 20, panel a), amid considerable heterogeneity across countries and maturities. Overall, the stagnation in loan demand is explained by high borrowing rates and associated spending plan cuts. Moreover, loan supply also plays a role, as suggested by the moderate further tightening of credit standards in the fourth quarter of 2023. The annual growth rate of loans to households edged down to 0.5% in November, after 0.6% in October (Chart 20, panel b), amid negative housing market prospects, somewhat tighter credit standards and higher lending rates. The decline was driven mainly by housing loans and loans to sole proprietors (i.e. unincorporated small businesses), while consumer loans remained more resilient, despite a further tightening of credit standards and low consumer confidence.

Chart 20

MFI loans in selected euro area countries

(annual percentage changes; standard deviation)

Sources: ECB and ECB calculations.

Notes: Loans from monetary financial institutions (MFIs) are adjusted for loan sales and securitisation; in the case of non-financial corporations (NFCs), loans are also adjusted for notional cash pooling. The cross-country standard deviation is calculated using a fixed sample of 12 euro area countries. The latest observations are for November 2023.

Households continued to reallocate overnight deposits to time deposits in November, while firms moderated these shifts as their deposit allocation normalised. The annual growth rate of overnight deposits continued its double-digit decline to stand at ‑10.9% in November, up from ‑11.5% in October (Chart 21). For households, November saw another large monthly shift from overnight to time deposits, whereas firms switched between these two instruments at a considerably slower pace. The strong preference for time deposits is explained by the widening spread between rates on time and overnight deposits during the tightening cycle given that, as in previous tightening cycles, interest rates on overnight deposits have adjusted to policy rate changes more slowly than those on time deposits.[8] However, households’ share of overnight deposits relative to their total deposit holdings still remains well above historical levels, reflecting the legacy effects of the low opportunity cost of holding such deposits during a low interest rate period, while this share is now smaller for firms.

Chart 21

M3, M1 and overnight deposits

(annual growth rate, adjusted for seasonal and calendar effects)

Source: ECB.

Note: The latest observations are for November 2023.

In November 2023 money growth continued to contract at annual rates close to recent historical lows driven by high opportunity costs, subdued credit growth and the reduction in the Eurosystem balance sheet. Annual broad money (M3) growth in the euro area stabilised around historically low rates, standing at ‑0.9% in November, up from ‑1.0% in October and ‑1.2% in September (Chart 21). Annual narrow money (M1) growth continued to decline at a close to double-digit rate, with weak monetary dynamics being reinforced by portfolio shifts. In November it stood at ‑9.5%, up from ‑10.0% in October and ‑10.4% in September. As in previous months, the Eurosystem’s balance sheet reduction and bond acquisitions by money holders continued to have a contractionary effect on monetary dynamics in November. In addition, repayments of TLTRO funds and the higher opportunity cost for depositors of holding liquid assets are leading banks to issue bonds with longer maturities not included in M3. At the same time, a growing current account surplus amid weak imports has led to higher monetary inflows from the rest of the world.

1 Global trade in the post-pandemic environment

Global trade dynamics in 2023 were still influenced by the legacy of the pandemic shock. When global activity collapsed at the start of the pandemic, triggering the deepest global recession (albeit short-lived) since the Second World War amid large-scale policy support, there was also a sweeping fall in world trade. In the first two quarters of 2020, global trade contracted by 16%, exceeding even the shock observed during the global financial crisis. In 2021 and 2022 it staged a rapid recovery, growing by 12.8% and 5.5% respectively and reaching pre-pandemic levels by the first quarter of 2021 (Chart A, panel a). However, during the second half of 2022 world trade growth started to decelerate markedly and, after dipping into negative territory in the fourth quarter, only began to gradually recover during 2023. According to the December 2023 Eurosystem staff macroeconomic projections, global trade may have grown by just 1.1% in 2023, well below its average annual growth over the pre-pandemic period (2012 to 2019) and subpar compared with global GDP growth in 2023 (Chart A, panel b).[9]

2 Is the PMI a reliable indicator for nowcasting euro area real GDP?

The euro area composite output Purchasing Managers’ Index (PMI) tends to be strongly correlated with real GDP growth (Chart A). The composite output PMI is a diffusion index, which measures the sum of the percentage of month-on-month “higher” output responses and half the percentage of “no output change” responses. The PMI survey output question asks about the actual unit volume of output this month compared to the previous month. It indicates the degree to which output changes are diffused throughout the panel of respondents and has a no-change benchmark of 50. A simple PMI-based rule of thumb, hereafter referred to as the PMI-based tracker rule, calculates euro area quarterly real GDP growth as 10% of the quarterly average level of the composite output PMI from which a value of 50 is subtracted. This rule-of-thumb exhibited a good nowcasting performance during the pre-coronavirus (COVID-19) period.[10] However, since the composite output PMI is a diffusion index, it provides information on the extensive margin of change (the number of firms that reported a change in output) but not on the intensive margin of change (the amount by which output changed). It implies that in periods of extreme volatility in output, such as during the COVID-19 pandemic, the level of the composite output PMI might become less informative. Another limitation of the composite output PMI is the incomplete sector coverage; the index is a weighted average of the services business activity PMI and the manufacturing output PMI, while other important sectors such as retail, construction and government are missing. Moreover, the euro area composite output is based solely on the four largest euro area countries and Ireland.

3 Main findings from the ECB’s recent contacts with non-financial companies

This box summarises the findings of recent contacts between ECB staff and representatives of 70 leading non-financial companies operating in the euro area. The exchanges took place between 2 and 10 January 2024.[11]

Contacts painted a largely unchanged picture of activity stagnating or contracting slightly in the fourth quarter of 2023, with little or no pick-up expected in the first quarter of 2024 (Chart A). There was still a lot of variation both within and across sectors in terms of reported dynamics. Manufacturing and construction activity were seen as remaining weak as were related transport and logistics services, while leisure-oriented consumer services and digital services were the main areas of growth. A year-long inventory correction has reportedly now largely come to an end, resulting in a bottoming out of demand for many intermediate goods. But long order backlogs caused by earlier supply disruption have dissipated, prompting a slowing of growth, or contraction, in capital goods production. Consequently, developments in manufacturing activity were now considered to better reflect the evolution of final consumption and investment demand.

4 Assessing the macroeconomic effects of climate change transition policies

This box gauges the macroeconomic impact of climate change policies aimed at reducing greenhouse gas emissions. To meet the goal of reducing emissions in the European Union (EU) by at least 55% in 2030 compared with 1990 levels, governments have started implementing different sets of measures. The EU has recently adopted the “Fit for 55” package, which will be progressively implemented between 2024 and 2034.[12] This box first assesses the impact of green fiscal discretionary measures, as included in the latest December 2023 Eurosystem staff macroeconomic projections on euro area real GDP and inflation. Such measures are unlikely to be sufficient to fully achieve the EU’s targets for emission reduction, energy efficiency and renewable energy production in the Fit for 55 package. The box therefore goes on to illustrate the medium-term impact of alternative transition policy scenarios using model simulations.

5 Corporate vulnerabilities as reported by firms in the SAFE

This box analyses corporate vulnerabilities as derived from firm-level replies to the Survey on the Access to Finance of Enterprises (SAFE). A firm is considered vulnerable if it simultaneously reports lower turnover, lower profits, higher interest expenses and a higher or unchanged debt-to-assets ratio over the past six months.[13] The concept is particularly relevant when assessing the implications for the transmission of monetary policy as it provides strong signals on the financial health of firms.

6 Policy expectation errors during the recent tightening cycle – insights from the ECB’s Survey of Monetary Analysts

Information from the Survey of Monetary Analysts (SMA) on respondents’ expectations about the future evolution of the ECB’s monetary policy measures can provide insights into the source of expectation errors during the recent tightening cycle. Since July 2022 the Governing Council has raised the key ECB interest rates by a total of 450 basis points in response to the extraordinary surge in inflation. After a protracted period of policy rates close to the effective lower bound, financial markets and analysts expected an interest rate path that was much flatter than the one ultimately realised. Accordingly, policy expectation errors have been large and have only recently started to diminish. SMA data can help to determine whether these errors are due to a misperception of the ECB’s reaction function or to miscalculations about the macroeconomic environment.[14]

7 Estimates of the natural interest rate for the euro area: an update

The natural rate of interest, r* (or “r-star”), is defined as the real rate of interest that is neither expansionary nor contractionary.[15] In the wake of the 2008 global financial crisis, real interest rates (as measured by deducting inflation expectations from a nominal rate of interest) slumped to exceptionally low levels in advanced economies, including the euro area. They have moved higher only recently as monetary policy was tightened following the post-pandemic surge in inflation.

8 Fiscal policy measures in response to the energy and inflation shock and climate change

This box provides estimates and projections of discretionary fiscal measures taken by euro area governments relating to the energy crisis, high inflation, and climate change, updated as part of the December 2023 Eurosystem staff macroeconomic projections.

The discretionary fiscal measures to support households and companies in response to the energy price and high inflation shocks are projected to largely wind down in the coming years. They are estimated to amount to 1.3% of GDP in 2023, down from 1.8% in 2022, and to remain below 0.5% per annum over the 2024-26 projection horizon (Chart A). Specifically, about two-thirds of support measures in place in 2023 are expected to expire in 2024, and another 20% in 2025. The remaining measures are projected to stay in place in 2026. As regards the type of measures, in 2023 almost half were subsidies. Of these, more than half related to the energy price caps in Germany, France and the Netherlands. The share of subsidies in total energy and inflation support measures is expected to fall significantly in 2024 and to be negligible as of 2025.

1 The Eurosystem policy response to developments in retail payments

Retail payments – those made between consumers, businesses and public administrations – are undergoing profound changes that are reshaping the European payments landscape. Digitalisation is playing a major role in this, with a trend towards the increased use of cashless payment instruments, instantaneity and a truly seamless payment experience. Numerous innovative payment solutions are being developed and offered. These are made possible through the use of new technology and are further characterised by the need to enhance global and cross-border use cases, as well as the consideration that solutions can be rolled out globally.[16] These trends and developments are not only driven by existing players in the payments market. The payments business also attracts start-up firms, as well as established firms that are new to payments.

Morehttps://www.ecb.europa.eu/pub/pdf/ecbu/ecb.eb_annex202401~3e7fe6e271.en.pdf

© European Central Bank, 2024

Postal address 60640 Frankfurt am Main, Germany

Telephone +49 69 1344 0

Website www.ecb.europa.eu

All rights reserved. Reproduction for educational and non-commercial purposes is permitted provided that the source is acknowledged.

For specific terminology please refer to the ECB glossary (available in English only).

The cut-off date for the statistics included in this issue was 24 January 2024.

PDF ISSN 2363-3417, QB-BP-24-001-EN-N

HTML ISSN 2363-3417, QB-BP-24-001-EN-Q