(Bloomberg) — New European Union fiscal rules will only work if countries with high levels of debt and wide budget deficits make a real material and political effort to get their public finances in order, the International Monetary Fund said.

Most Read from Bloomberg

“The new EU economic governance framework will require significant fiscal adjustment in many member-states as well as sustained political support to be implemented as envisioned,” the IMF said in a report published Thursday.

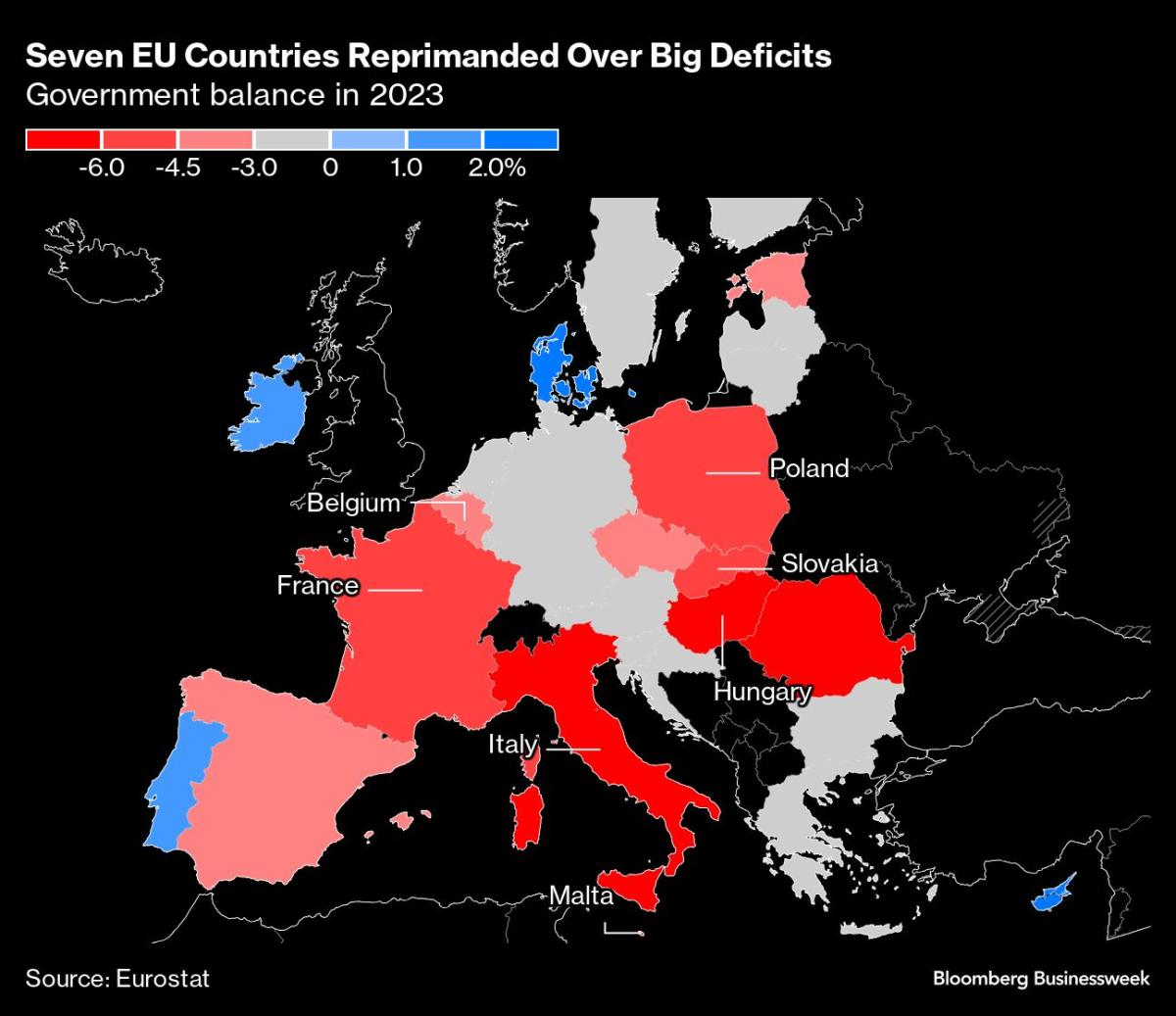

France, Italy and five other countries were reprimanded by the EU on Wednesday for running large fiscal shortfalls — the first stage in a process that will test nations’ willingness to comply with requests and the bloc’s resolve to enforce its new system.

EU budget rules were reactivated early this year after being suspended since 2020 to facilitate the extraordinary national spending required to weather the Covid-19 pandemic and the energy crisis. Countries can face censure by officials for running deficits that breach the bloc’s 3% limit, leaving them subject to the so-called Excessive Deficit Procedure, which requires remedial action and can lead to fines for non-compliance.

“The medium-term fiscal-structural plans due in September 2024, should be underpinned by a clear fiscal strategy, growth- and resilience-enhancing structural reforms, and high-quality measures,” the IMF said.

The reprimand from the European Commission comes as France faces legislative elections and the prospect of a winner from either far-right or far-left parties — raising market concerns that there’ll be less effort to restrain public finances.

“Countries that have relatively higher debt and deficit burden, at this time we’re now, when the economy is better than we anticipated, they should take advantage of it and be more forceful to bring down debt and deficit,” IMF Managing Director Kristalina Georgieva told reporters in Luxembourg on Thursday.

“It is possible for France and other countries to achieve more,” she said. “The euro zone economy is doing better this year and will do even better next year.”

Meanwhile Italian Prime Minister Giorgia Meloni has made expensive promises to voters, including tax cuts on wages totaling about 10 billion euros ($10.7 billion) that could complicate plans to bring public finances under control.

Both countries have high deficits and debt well above 100% of economic output. Other nations facing reprimand are Belgium, Hungary, Malta, Poland and Slovakia. Romania was already facing an EDP.

“It’s very important to ensure credibility for the new fiscal framework,” Finland’s Finance Minister Riikka Purra told journalists Thursday before a meeting of her EU counterparts in Luxembourg.

The IMF also encouraged the EU to continue on the path of financial-market integration, to avoid dropping behind global peers and falling short of its ambitions for energy security, climate-change mitigation and the digital transition.

“Integrating fragmented national capital markets in a capital-markets union would help advance these goals by boosting finance for innovative long-term investment projects, increasing risk-sharing opportunities, enhancing the allocation of savings in the EU, and reaping EU-wide economies of scale in financial markets,” the report said. Furthering the banking union and ratifying the EU’s ESM backstop treaty should also “be given priority.”

(Adds IMF Georgieva’s comments from the seventh paragraph.)

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.