(Bloomberg) — The US stock market has emerged as the most exposed to divestment after the European Union unveiled new rules limiting how freely asset managers can attach ESG labels to their funds.

Most Read from Bloomberg

The European Securities and Markets Authority said last month that investment funds with ESG labels or equivalent terms will need to have at least 80% of their assets under management in something that’s actually related to environmental, social or governance goals. They also can’t invest in certain assets such as the largest oil and gas producers.

For fund managers overweight US stocks, that requirement looks set to have outsize implications, according to an analysis by Morningstar Inc.

“The US could see the largest impact in terms of stock market value,” Morningstar said in a report.

Some 42% of the potential stock divestments that may be triggered by ESMA’s new rule will hit the US, measured in terms of stock market value, Morningstar estimates. France is a distant second, at 17%, followed by China at 12%, the research shows.

Another alternative is that fund managers decide not to go to the trouble of redesigning their portfolios and instead rename their products.

Arthur Carabia, director of ESG policy research at Morningstar Sustainalytics, said in a post on LinkedIn that the researcher expects “many funds to drop ‘ESG’ and related terms from their names.” Some will opt for terms that carry less onerous minimum requirements under the EU’s new rules, such as “transition,” he said.

Morningstar identified about 4,300 EU funds with ESG or sustainability-related terms in their names that may be affected by ESMA’s new guidelines. Noting that funds can’t invest in companies on an exclusion list under the EU’s Paris-aligned benchmark rules, Morningstar estimates that more than 1,600 funds will need to divest stocks worth a total of up to $40 billion, if they want to keep their current names.

The sectors that are most vulnerable to divestment as a result of ESMA’s new rules include energy, industrials such as railroads and defense, and basic materials, Morningstar said. Among US companies identified by Morningstar as being at risk of divestment from EU-domiciled ESG funds are Exxon Mobil Corp., Schlumberger NV, Wells Fargo & Co. and Chevron Corp.

Regulatory authorities in EU member states must incorporate the guidelines in their supervision of the market, or state why they don’t intend to comply. Hortense Bioy, head of sustainable investing research at Morningstar Sustainalytics, says she doesn’t expect them to provide a comprehensive list of ESG or sustainability terms.

“There will be some room for interpretation,” she said in an interview.

The naming requirements are among the latest efforts by the EU to address gaps in its landmark Sustainable Finance Disclosure Regulation. The finance industry will shortly find out if they’ll have to abandon almost five years of work figuring out SFDR and start anew.

The EU’s regulators for banks, insurers and the market said this week they are finalizing a joint opinion on SFDR, including proposed changes. Their conclusions will weigh heavily on how the European Commission and lawmakers tackle the problems plaguing SFDR once the upcoming elections are over and a new parliament is seated.

In the meantime, asset managers will look to the naming requirements to stay on the right side of regulators. Given the regularity of greenwashing accusations, asset managers “will want to be careful,” Bioy said.

(For more on ESG news, click on TOP ESG.)

NEWS ROUNDUP

More ESMA | New rules limiting how freely asset managers can attach the ESG label to funds sold in Europe promise to trigger a widespread purge across the industry, according to a fresh analysis by Morningstar Sustainalytics.

ECB Fines | The European Central Bank confirmed that it’s preparing to fine a number of lenders after they failed to make adequate progress in addressing risks posed to their business by climate change.

AI | The US Treasury Department is seeking more information on how financial firms are using artificial intelligence, as well as opportunities and risks the technologies pose for the sector.

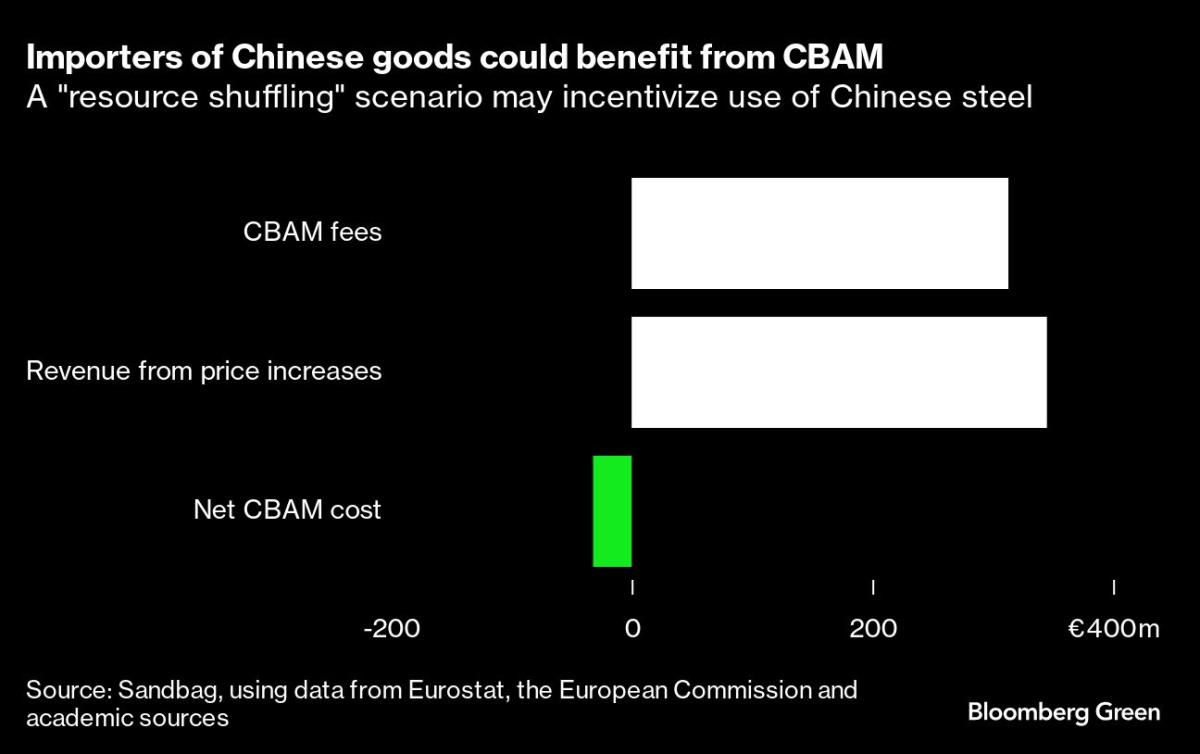

CBAM | The European Union law meant to protect local industry from foreign undercutting in the transition to a greener economy may do more harm than good, according to a study.

Tariffs | European Union tariffs on Chinese electric vehicles would likely cost Beijing roughly $4 billion of trade with the bloc, according to a new analysis.

Restrictions | Credit Agricole SA has become the latest European bank to cease underwriting conventional bonds for oil and gas producers, amid stricter regulations.

Greenwashing | Europe’s markets watchdog renewed its call to better arm regional and national regulators supervising the ESG market, saying they lack the power and resources to stop greenwashing.

CRE Risk | At some of the world’s biggest banks, loans to commercial real estate face new litmus tests that promise to shape the sector’s access to financing.

Barclays Estimate | Analysts at Barclays Plc are warning that a growing number of stocks will be consigned to exclusion lists as new European Union rules for ESG funds are enforced.

UK Rules | Banks and asset managers in the UK have a new reality, as the country enforces some of the most far-reaching anti-greenwashing rules ever seen.

Divestment | Europe’s biggest pension fund, Stichting Pensioenfonds ABP, has exited all liquid assets in oil, gas and coal worth about €10 billion ($10.8 billion), in an effort to be greener.

ISSB | Companies across jurisdictions are about to face the same requirements for reporting the impact on their operations of climate change and environmental degradation.

Warning | Corners of Europe’s fund industry have been routinely touting their ESG credentials without providing documentation, fueling fresh concerns about greenwashing, the bloc’s markets regulator said.

FDIC | Martin Gruenberg will step down as head of the Federal Deposit Insurance Corp. after findings of a toxic work environment put the regulator at the center of a heated political fight and fueled calls for his removal.

BLOOMBERG RESEARCH

Carbon | Declining emissions in the EU have kept the total permits circulating in the bloc’s carbon market high in 2023, requiring additional intervention to ensure the market stays on course. (BloombergNEF)

ETS | Confidence in the European carbon market’s ability to drive decarbonization appears to have somewhat dwindled, by around 6%, from record levels last year. (BloombergNEF)

SEC | Implementation of the SEC’s climate rule — announced in March after a two-year wait — may be further delayed after the commission put the rule on hold on April 4, pending litigation. The final regulation was already watered down, anticipating the legal and political pushback. It requires public issuers to outline how they identify and manage material climate risks, while Scope 3 emissions reporting was nixed and Scope 1 and 2 standards scaled back to large companies. Though financial materiality may still fall within the SEC’s purview, challengers have a way to quash the rule due to a conservative federal judiciary concerned with administrative overreach. (Bloomberg Intelligence)

ETFs | Stumbling dark and light green ESG ETF inflows should remain challenged in 2024 ahead of the EU investing regime overhaul and uncertainty over major elections, while the overall ETF market keeps growing at pace. (Bloomberg Intelligence)

SFDR ETF Flows: Quarterly Trend

OFF THE SHELF

ABC | In one sense, defining ESG is easy — it’s an approach to finance and investing focused on managing risks from environmental factors, social issues and questions of corporate governance. Sorting out the differences between ESG and similar, sometimes overlapping strategies is harder, in part because the term has come to mean different things to different people. The widespread use of ESG factors has fed skepticism that the approach is nothing more than a marketing gimmick, fueling a backlash and a regulatory crackdown.

‘Greenwashing’ | Over the last decade, companies and investors have come to pay more attention to environmental concerns, often with a goal of offering “green” products or making “green” investments. But the companion of green is often what’s known as greenwashing. In some countries, regulators are trying to clean up the field, launching investigations and levying fines. They have the backing of some advocates of environmentally minded investing worried that greenwashing’s taint may undermine the field.

Central Banks | Some of the world’s largest central banks are joining the fight against climate change. Though melting glaciers may be a huge leap from monetary policy, policymakers say they must respond to threats that have the potential to disrupt the global economy. Some critics say climate policy is better left to politicians, particularly in countries where central banks are hemmed in by explicit government mandates.

Taxonomies | Floods, droughts and food shortages are just some of the effects of climate change, as exploitation and corruption drive social injustice around the world. Governments tackling these issues are realizing that to solve them, they need to first define and measure them. Some are turning to so-called taxonomies that establish which economic practices and products are harmful to the planet and which aren’t. The idea is the price of goods and services must reflect the human and environmental cost of both production and disposal, which in turn would spur much-needed change. But designing a code is fiendishly difficult.

Double Materiality | Should a business or an investment fund care only about making money, or should it also worry about the environment, social justice and good governance? Can the two goals overlap? Do they already? These questions get to the heart of something called “double materiality.” While the concept has been built into new European regulations, it has yet to make significant inroads in the US — even as Wall Street behemoths like JPMorgan Chase & Co. embrace the idea. At issue is what information should be mandatory to report, and who decides?

OTHER ESG-FOCUSED FIXTURES

Run NSUB ESG to subscribe to the ESG newsletters listed below:

-

For the ESG Daily newsletter, click here

-

For the daily “Green Insight” newsletter, click here

-

For the weekly wrap of ESG bond sales, click here

-

For the weekly ESG Investing digest, click here

-

For the weekly wrap of Equality news, click here

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.