Explore the latest amendments in the Bulgarian Corporate Income Tax Act, including the introduction of an additional tax for multinational and large national enterprise groups, effective from January 1, 2024.

European Union

Tax

To print this article, all you need is to be registered or login on Mondaq.com.

Explore the latest amendments in the Bulgarian Corporate Income

Tax Act, including the introduction of an additional tax for

multinational and large national enterprise groups, effective from

January 1, 2024. Learn about the global minimum taxation rules,

types of additional taxes, calculation procedures, and the European

Directive’s influence.

Global Minimum Taxation

The key feature of these amendments is the implementation of a

global minimum level of taxation. Here are the details:

- Applicability: The global minimum tax applies

to both multinational and large national enterprise groups. - Turnover Threshold: To fall within the scope

of this taxation, a group must have a turnover of at least

€750,000,000 according to consolidated financial statements

for at least two of the last four tax periods.

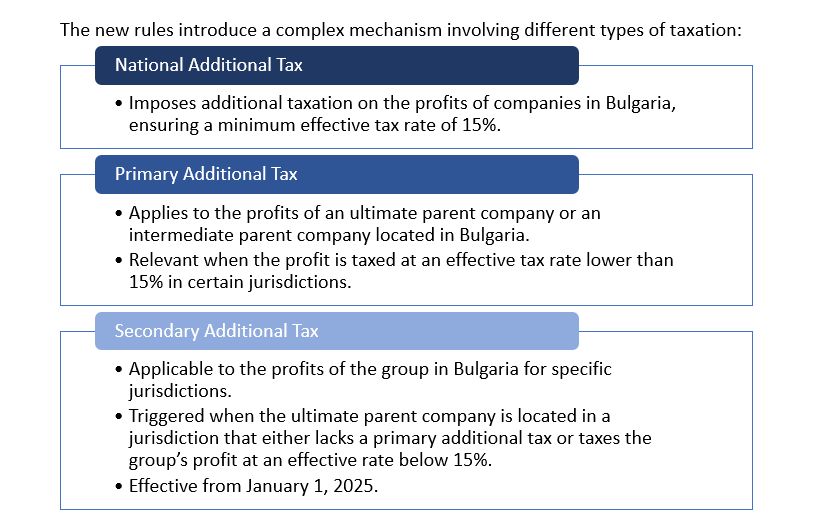

Types of Additional Taxation

Calculation, Declaration, and Payment

- The Corporate Income Tax Act outlines the procedure for

calculating, declaring, and paying corporate tax. - Entities subject to the additional tax must submit an

informative declaration for each separate jurisdiction. - Payment to the National Revenue Agency (NRA) for the national

additional tax, primary, and secondary additional tax is due within

15 months after the tax period (18 months for the initial tax

period falling under minimum taxation).

Tax Base and Amount

- The amended CITA defines the tax base and payable taxes.

- Calculations involve adjusted included taxes and allowable

profit or loss. - Based on this, the effective tax rate for a specific

jurisdiction is determined. - If the effective rate is below 15%, a corresponding additional

tax is levied.

European Directive Influence

These amendments align with the European Directive (EU)

2022/2523, which aims to establish a global minimum level of

taxation for multinational enterprise groups and large-scale

domestic groups within the Union.

The content of this article is intended to provide a general

guide to the subject matter. Specialist advice should be sought

about your specific circumstances.