Introduction

While it has overcome numerous difficulties in the past decade,

the restaurant industry requires careful navigation through

unchartered territory in 2023. Obvious hurdles include rising

interest rates, the cost-of-living crisis, staffing shortages,

country-specific industrial action, increasing energy costs, and of

course global inflation. So, what can business leaders do to manage

this?

The industry ended 2022 in a tough position. The UK saw a 64%

increase in restaurant closures in the 12 months to May last year,

and a 56% rise in insolvencies over the same period1 .

Governmental support such as VAT reductions across Europe and the

‘Eat Out to Help Out’ scheme in the UK gave short-term

lifelines but no substantial solutions.

Meanwhile, the inflation rate for restaurants across the

European Union was 9.6%, the highest figure reported since

20172 . This comes after 42,500 restaurants were

reported to have permanently closed in eight eurozone countries

between June and August of 20203 .

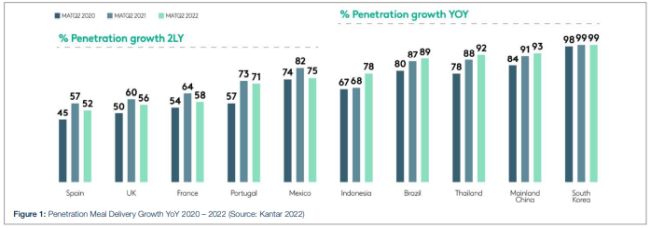

The varying restrictions on customer interactions caused by the

pandemic saw delivery platforms take advantage of this opportunity,

seeing unprecedented growth as restaurants sought new channels to

reach their audience. This further disrupted the market allowing

for some restaurants to stay solvent, or even grow top line

revenue, but at a big cost of margin. The delivery market is now an

established distribution channel for the industry, despite the

decline in penetration from 2021 levels in Europe4 (see figure

1).

In mid-2022 the UK restaurant investor Luke Johnson stated that

the industry was in for “two years of hell” and that the

cost-of-living crisis, rampant inflation, brands falling into

arrears with HMRC, landlords, and CBILS loans were creating a

“perfect storm” in the UK5 . The UK is not

alone in these pressures, with the war on Ukraine causing surges in

the price of food and energy, in addition to labour shortages and

supply chain issues across Europe resulting in a loss of sales for

restaurants in many countries.

Challenges to come in 2023

The cost-of-living crisis

is being felt in many countries, reducing

customers’ disposable income and driving down repeat visits;

with 53% of customers stating they will be decreasing spending into

2023. Restaurant spending fell by as much as 12% YoY by the end of

20226.

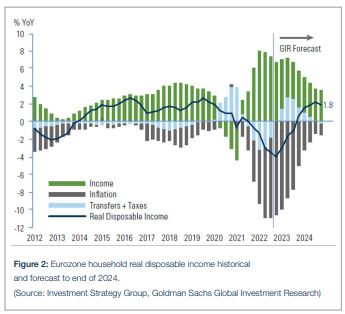

General inflation

in the UK is estimated to fall from 10.9% in Q4 2022

but remain high at 5.2% in Q4 of 20237 . In Europe,

there is a forecast it will decrease from 9.2% to 3.25% across the

same period8 . While an improvement on last year,

inflationary pressures will still impact the cost of goods and

services to a degree, posing restaurants with a decision of whether

to pass this on to the customer via price rises.

Energy costs

will likely require further government intervention

to support or will result in continued dramatic impact on

restaurants’ income statement. In London, restaurants are among

those facing the prospect of a rise of nearly £4,500 in

annual energy bills once government support is

withdrawn9.

Staffing shortages and wage inflation

will continue to be impacted as other industries will

be able to pay higher wages, luring talent away from the restaurant

industry.

Rising base rates

have increased interest costs significantly.

Operators facing a maturity date (or trying to agree an amendment)

are likely to find that refinancing takes significantly more

management bandwidth with much less certainty on the outcome.

Industrial action

s prevalent in many European countries across a variety of linked

sectors such as aviation, rail and fuel, resulting in disruption of

trade in many cities. This is expected to continue into 2023, with

several scheduled across sectors in various EU countries for the

first few months10.

Potential solutions and opportunities

Despite negative forces that are likely to continue to occur

during 2023, there are levers that can positively impact business

operations such as:

Revenue protection

- Control and manage no-shows with deposits and interactive

automated booking systems - Focus on customer retention by concentrating on existing

customers first before seeking potential new buyers

Execution and implementation

- Focus on minimised menus focused on quality over quantity

- Ensure simple and tight processes and controls that are clear

to all staff from restaurant team members to the board room - Hands-on focus to training and development of new staff

Product innovation and stabilisation

- Premiumisation and theatre vs extensive choice or replicable

offerings - Partnerships and dual-brand offerings promoting choice and

extending day-part trading

Cash is reality

Focus on simple and transparent cashflow forecasts on a weekly

basis

- Talk with suppliers on payment terms to manage working

capital - Protect capital reserves

- Utilise government support

Rightsizing

Account for all environment changes to ensure the balance

between site staff, management and head office is correct, as the

shift to an execution-led approach is adopted

Digital and technology

- Optimise all the omni-channels available to drive revenue with

a grip on margin - Technology integration between systems vs incompatible

isolation software - Map customer experience to fully utilise technology at all

interactions

Restructuring

- Consider consensual options to realign the fixed cost base,

address onerous leases or refinance unsustainable debt

structures

The progression through these challenges is likely to be slow

during 2023 with the optimistic grass shoots appearing in the

second half of the year. But with continued uncertainties, the

winners will be those who have a clear focus on implementation and

consistent execution, developing stable foundations to best utilise

the growth phase of the future.

A&M: Leadership. Action. Results.SM

Our global, market leading Travel, Hospitality and Leisure

(“THL”) team understand the sector, influencing trends

and business situations that require deep expertise. Travel,

hospitality and leisure is facing new and legacy challenges across

the world associated with changes in the nature of demand, rising

operational costs, disruptive market entrants, and increasingly

complex financing environments.

We at A&M can provide practical guidance and help you

navigate the challenges your business is facing locally and

globally. As part of the A&M network, we draw on the travel,

hospitality and leisure expertise of colleagues across the globe.

We have a presence and local expertise in every market your

business may operate in.

Footnotes

2. EU-27: inflation rate of restaurants 2022 |

Statista

3. Over 42,500 Restaurants Have Permanently Closed

Due to COVID (chd-expert.com)

4. Restaurants rebound while food delivery becomes a

post-pandemic norm (kantar.com)

6. Spending slows in September due to cost-of-living

concerns | Barclaycard (home.barclaycard)

7. Monetary Policy Report – November 2022 | Bank of

England

8. Goldman Sachs no longer expects recession in euro

zone in 2023 | Reuters

The content of this article is intended to provide a general

guide to the subject matter. Specialist advice should be sought

about your specific circumstances.