Since 2 February 2022, management companies of AIFs and UCITs

must comply with the new ESMA Guidelines on Marketing

Communications which further outline the harmonised marketing

communication requirement across the EEA introduced by the

Cross-border Distribution of Funds Regulation.

By adopting Regulation (EU) 2019/1156 on facilitating

cross-border distribution of collective investment undertakings

(‘CBDF Regulation‘) and Directive (EU) 2019/1160 on facilitating

cross-border distribution of collective investment undertakings,

the EU aims to create a level playing field for the cross border

marketing and distribution of funds in the EEA, while at the same

time ensuring more uniform and better protection for investors.

Following the CBDF Regulation, applicable as of 2 August 2021,

AIFMs, EuVECA managers, EuSEF managers and UCITS management

companies must ensure that all marketing communications addressed

to investors are:

- identifiable as being marketing communications, and

- describe the risks and rewards of purchasing units or shares of

an AIF/UCITS in an equally prominent manner, and - contain information which is fair, clear and not

misleading.

The ESMA guidelines on marketing communications

under the Regulation on cross-border distribution of funds

(‘ESMA Guidelines‘) aim to further clarify

the requirements that funds’ marketing communications must meet

when directed at professional or retail investors.

Do not hesitate to contact the authors for more information

about the marketing of funds in one of our home jurisdictions or

regarding additional national requirements regarding marketing

communications.

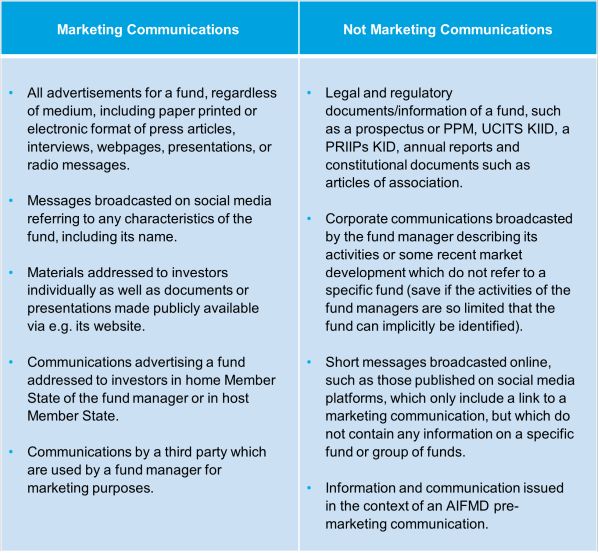

What is marketing communication?

No definition of ‘marketing communication’ can be found

in the CBDF Regulation or in the ESMA Guidelines. However, the ESMA Guidelines

classify a non-exhaustive list of type of communications as

marketing communications (or not):

Requirements that funds’ marketing communications must

meet

If a communication qualifies as a ‘marketing

communications’ in the meaning of the CBDF Regulation or the

ESMA Guidelines, such communications must comply with strict legal

requirements.

1: check if the marketing communication requires NCA

approval

If applicable, any reference to a UCITS or an AIF in a press

article, advertisement or press release on the internet or on any

other medium may only be published after the home national

competent authority (‘NCA’) of the promoted fund has

granted approval.

For a first overview of the national rules applicable to the

marketing of funds, check out the ESMA overview.

2: include an identification as marketing

communications

Marketing communications must be clearly labelled as marketing

documents and inform (potential) investors that the communication

is not a contractually binding document, or an information document

required by law. This requirement will be deemed complied with when

the marketing communication i) mentions clearly the terms

“marketing communication” (preceded by the

“#-symbol for social media use) and ii) includes a disclaimer

such as the following:

“This is a marketing communication. Please refer to the

[prospectus of the [UCITS/ AIF/EuSEF/EuVECA]/Information document

of the [AIF/EuSEF/EuVECA] and to the [KIID/KID] (delete as

applicable)] before making any final investment

decisions.” For on-line marketing communication, a

shorter identification of the marketing purpose of the

communication is acceptable (e.g. the mere use of the terms

“Marketing Communication” in the case of a banner or

short videos or the “#MarketingCommunication” hashtag for

social media platforms).

3: Equally describe risks and rewards

When a marketing communication includes information on potential

benefit of purchasing units or shares of a fund (rewards), risk

disclosure should be included also using the same font size in the

body of the text and not in a footnote or in small characters. Both

risks and rewards should be mentioned either at the same level or

one immediately after the other.

The ESMA Guidelines also mention that the disclosure of the risk

profile of the promoted fund in a marketing communication should

refer to the same risk classification as that included in the KID

or KIID.

In relation with the AIFs open to retail investors, if

applicable, the marketing communication should clearly mention the

illiquid nature of the investment.

4: The marketing communication must be suitable for the

targeted (potential) investors

All marketing communications should contain fair, clear and not

misleading information. The level of information presented, and the

wording used should be adapted to whether investment in the

promoted fund is open to retail investors or professional

investors. Moreover, the marketing communication should be written

in the official languages, or in one of the official languages,

used in the part of the Member State where the fund is distributed,

or in another language accepted by the NCA of that Member

State.

5: The information must be consistent with other

documents

The information presented in the marketing communication must be

consistent with the legal and regulatory documents of the promoted

fund such as the prospectus, the offering memorandum (or PPM), the

KID or KIID, annual reports,.

6: Pay special attention to the descriptions of the

features of the investment

When a marketing communication describes some features of the

promoted investment, such description should be up to date,

accurate and proportionate to the size and format of the

communication. The marketing communication should include at least

a short description of the investment policy of the fund and an

explanation on the types of assets into which the fund may

invest.

The information contained in marketing communication should be

presented in a way that is likely to be understood by the average

member of the group of investors to whom it is directed or by whom

it is likely to be received.

All statements embedded in the marketing communication should be

adequately justified based on objective and verifiable sources,

which should be quoted.

7: Include sufficient context regarding the associated

costs

When referring to the costs associated with purchasing, holding,

converting or selling units or shares of an AIF/UCITS, marketing

communications should include an explanation to allow investors to

understand the overall impact of costs on the amount of their

investment and on the expected returns.

Where the currency applicable to the costs is different from

that of the targeted investors’ residency, the marketing

communications should clearly include the currency in question, as

well as a warning that the costs may increase or decrease as a

result of currency and exchange rate fluctuations.

8: Information on past performance and expected future

performance

In addition to the required up-to-date information on features

of the investment (item 6 above), in a marketing communication

information on past performance of the promoted

fund should be consistent with the past performance included in the

prospectus, the offering memorandum (or PPM), the KID or KIID or

other regulatory provision.

The past performance is to be disclosed for the preceding 10

year for funds establishing a KIID, or for the preceding five years

for other funds, or for the whole period for which the relevant

funds have been offered, if less than five years. Past performance

information should always be based on complete 12-months periods,

but this information may be supplemented with performance for the

current year updates at the end of the most recent quarter.

When the information on past performance is included, this

information should be preceded by the following statement:

“Past performance does not predict future

returns“.

Information on expected future performance

should be based on reasonable assumptions supported by objective

data. It should be disclosed only prefund and on a time horizon

consistent with the recommended investment horizon of the fund.

If the information on expected future performance is based on

past performance and/or current conditions, this information should

be preceded by the following disclaimer: “The scenarios

presented are an estimate of future performance based on evidence

from the past on how the value of this investment varies, and/or

current market conditions and are not an exact indicator. What you

will get will vary depending on how the market performs and how

long you keep the investment/product.“

Marketing communications should also include at least a

disclaimer according to which future performance is subject to

taxation which depends on the personal situation of each investor

and which may change in the future.

9: Include sufficient sustainability

information

When a marketing communication refers to the

sustainability-related aspects of the investment in the promoted

fund, it should be consistent with the information included in the

legal and regulatory documents of the promoted fund such as the

website, periodic reports and relevant pre-contractual

documentations as required following the Sustainable Finance Disclosure Directive and Taxonomy Regulation.

In particular, the information should not outweigh the extent to

which the investment strategy of the product integrates

sustainability-related characteristics or objectives.

For more general information on sustainability related

information to include in a fund’s documentation, please read

our other articles on the mandatory ESG-disclosure resulting from

the Sustainable Finance Disclosure Regulation or

the Taxonomy Regulation.

The content of this article is intended to provide a general

guide to the subject matter. Specialist advice should be sought

about your specific circumstances.