The European Union’s (EU) upcoming carbon border tax is causing waves of anxiety among British green energy producers. As per the new directive, “British wind and solar farms exporting power to continental Europe from 2026 could face CO2 fees, despite producing no emissions, unless the UK and EU agree to amend the carbon border tax.”

Thus, industry leaders fear that this new policy could penalize the UK’s green energy sector. They are apprehensive that their efforts to combat climate change could be undermined, potentially disrupting trade relationships.

What is the Carbon Border Tax?

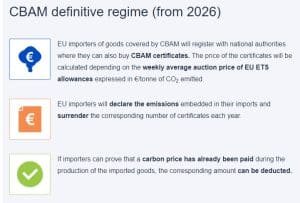

The EU’s carbon border tax, officially known as the Carbon Border Adjustment Mechanism (CBAM), is designed to prevent “carbon leakage”. This happens when companies shift production to countries with weaker climate regulations, thereby undermining global efforts to reduce emissions. The tax aims to level the playing field by imposing fees on imported goods from countries with less stringent climate policies.

Will the EU CBAM Impact British Renewable Exports?

A few days ago, Reuters reported that industry experts revealed how charges outlined in a little-known clause of the CO2 levy law could impact the revenues of renewable energy projects in the UK. This could further add to already-high EU power prices and even lead to higher emissions.

Andy Berman, deputy director of the industry group Energy UK pointed out that it’s a two-way problem. She added,

“(It) disincentivizes clean power in the UK at the moment in which we’re trying to ramp up the provision of clean power, and it’s going to increase (power) prices in northern Europe.”

Catherine Stewart, the UK Treasury’s deputy director for trade policy also expressed her views on EU’s tax policy by stating,

“It is an issue that we are conscious of and one that we have raised, that the UK has raised, with the EU.”

Despite the UK’s commitment to reducing emissions and its robust green energy sector, industry leaders fear that the carbon border tax might negatively impact British companies. The concern is that the tax will be applied to all imports, regardless of the exporting country’s green credentials and carbon footprint.

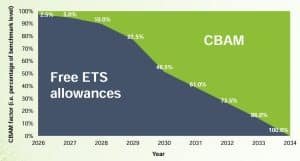

source: Carbon Border Adjustment Mechanism – European Commission (Europa.eu)

source: Carbon Border Adjustment Mechanism – European Commission (Europa.eu)

Let’s elaborate on the potential impact on the renewable industry and trade relations at large.

Economic Feasibility at Risk

Analysts warn that the additional costs could render it “uneconomic” to export surplus clean power from Britain to Europe, especially during periods of low demand, high renewable generation, and low power prices.

Aurora Energy Research’s analysis, shared with Reuters, indicates:

- Up to 3 GWh of renewable power could be curtailed by 2030 if the fee discourages exports. This capacity is enough to supply 2,000 homes annually.

- Adding a tax on exports essentially reduces the profit margin every time exports occur. By 2030, the carbon border fee could reduce the revenue British renewable projects earn for their power by 5%.

The research firm highlighted key facts about the renewable capacity buildout based on government policy and market forces.

1. Increasing power demand

Europe aims to decarbonize and achieve Net Zero emissions by 2050, primarily by electrifying its economy and expanding renewable energy to cut emissions. Growing demand for Power Purchase Agreements (PPAs) boosts investment in renewables. Enhanced energy efficiency lowers power demand.

2. Strong policy support and Government ambition

Government ambition pushes deploying renewables and robust policy support fosters investor confidence. Sudden policy changes or lack of support can harm investor confidence in renewables within a country.

3. Rising fuel and carbon prices

High gas prices have led to a switch back to coal generation. New market players have increased speculation and volatility, a trend expected to continue. Independent Commodity Intelligence Services (ICIS) estimates carbon prices will reach €90 per tonne by 2030.

4. Phase-out of thermal capacity

As Europe phases out coal and older, unabated gas assets to meet decarbonization goals, it creates opportunities for low-carbon alternatives to meet rising power demand. The retirement of thermal capacity strains system requirements like frequency and voltage control, which cannot be fully met by renewables alone.

Impact on Wholesale Prices and Emissions

Market Screener has reported two interesting analyses:

Aurora Research: The company analyzed the consequence of the reduction in cheap British electricity exports. It can potentially spike wholesale power prices by up to 4% in markets like Ireland and Northern Ireland which rely heavily on UK imports.

AFRY Services: The research firm indicated that if European countries increase coal and gas power generation to cover the shortfall, CO2 emissions could rise by 13 million tonnes annually. This increase is equivalent to the emissions of 8 million cars.

The figure shows that: Failure to remove renewables barriers leads to 80% higher CO2 price in 2030 significantly raising wholesale electricity prices for European industry & consumers.

sources: Aurora Energy Research, EIKON, S&P

sources: Aurora Energy Research, EIKON, S&P

Can Renewable Exports Avoid CO2 Fees?

A European Commission spokesperson stated that renewable power exports could avoid CO2 fees if they meet specific criteria and prove their origin. However, industry experts argue this is challenging. They assume that most electricity traded across interconnectors is anonymous, making it difficult to calculate the carbon content.

They have also voiced concerns, stating the tax penalizes sectors leading the fight against climate change. RenewableUK stressed the need for a system that rewards green energy credentials without unnecessary barriers. They called for policies that consider the actual carbon footprint of imports rather than applying a blanket approach.

Linking Carbon Markets: A Viable Solution

One potential solution is linking the EU and UK carbon markets, which would exempt UK power producers from the tax.

Alistair McGirr, SSE’s Group Head of Policy and Advocacy noted,

“Linking the carbon markets could prevent UK exporters from paying a tax to the EU that could otherwise benefit the UK budget.”

Despite this suggestion, neither Brussels nor London has shown enthusiasm for the idea.

Former UK climate change minister Graham Stuart also spoke in favor of linking carbon markets that could be explored under the post-Brexit Trade and Cooperation Agreement. The European Commission spokesperson added that the EU is open to linking its carbon market with others, but it “must stem from a mutual wish from both parties.”

Green Enhancing, Not Green Washing: Bolstering EU’s Carbon Markets

We discovered a significant aspect of tax implication on industry and consumers from the latest press release of the Council of EU.

Notably, the Council adopted its position on the Green Claims Directive to tackle greenwashing and help consumers make informed greener choices. The directive sets minimum requirements for substantiating, communicating, and verifying environmental claims. This move follows a 2020 study revealing that over half of environmental claims are vague, misleading, or unfounded. Thus, reliable, comparable, and verifiable claims are essential for informed consumer decisions.

Alain Maron, Minister of the Government of the Brussels-Capital Region, responsible for climate change, environment, energy, and participatory democracy has commented on this move,

“Today, we reached an important agreement to fight greenwashing by setting rules on clear, sufficient and evidence-based information on the environmental characteristics of products and services. Our aim is to help European citizens to make well-founded green choices.”

Organizations like Anew Climate, Rubicon Carbon, and others, hailed the EU’s progress on the Green Claims Directive (GCD) but called for further action to ensure it supports transparent and credible green claims, vital for achieving net zero. Key recommendations include:

- Reliable Green Claims: Ensure claims are reliable, comparable, and verifiable across the EU to prevent greenwashing.

- Simplified Framework: Avoid unnecessary administrative burdens and support the use of all types of carbon credits, not just EU-originated removal credits.

- Uniformity in Standards: Align with existing frameworks like the CRCF and ICVCM to avoid overlap and enhance international consistency.

They collectively believe adopting these measures will boost voluntary private-sector investment in climate mitigation. It would also advance the Green Deal and strengthen Europe’s competitive market.

source: EU-CBAM

source: EU-CBAM

This analysis emphasizes the need for dialogue between UK and EU policymakers to ensure the tax does not sabotage the global fight against climate change. Furthermore, a balanced approach is crucial for British Green Energy to recognize its efforts while minimizing trade disruption. Overall, the future of UK-EU trade and the global climate agenda hinges on achieving this equilibrium.