The grand scale of the Chinese economy has once again become a cause of significant concern for the western economic superpowers.

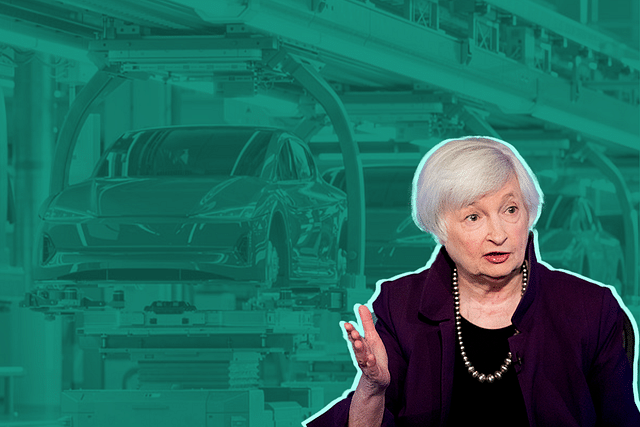

This was evident at the recently concluded G7 Finance Summit in Italy, where Janet Yellen, the United States of America’s (USA) Secretary of Treasury, raised concerns on production in Chinese factories exceeding global demand and its adverse effect on other economies.

In a speech delivered before a media gathering, Yellen said that the Chinese government’s persistent push to ramp up production within its manufacturing sector was not only affecting producers in other countries but was also worsening the macroeconomic imbalance within China.

“Production levels that exceed both China’s domestic demand and the global market’s capacity could result in large volumes of exports at depressed prices. This threatens the viability of firms around the world, including in emerging markets. I believe it also poses a challenge to China’s growth,” Yellen said.

Taking care not to give an impression of this being an issue exclusively between the US and China considering the history of ‘Tariff Wars’ between the two superpowers from the days of the Trump regime, the Treasurer said: “This issue of China’s industrial overcapacity and unfair trade practices adopted to market the excess inventory of finished goods, extends beyond a bilateral concern between the U.S. and China. The G7 countries have collectively recognized the need to protect our workers and businesses from unfair practices”.

In case of the actions taken by the US in its individual capacity, Yellen stated that the country was considering an increase in tariffs on Chinese imports to offset the trade balance between the two countries. The Federal Treasurer also referred to the European Union’s (EU) ongoing probe into China’s export and dump strategy, particularly in the electric vehicle sector.

Yellen’s recent remarks come in the light of a draft notification issued by the President Joe Biden-led US administration a few days back which can potentially increase the present tariffs on Chinese imports.

Considering this and the ongoing EU probe, experts say that China’s relentless pursuit to dominate all product categories in overseas markets will be under increased scrutiny at the G7 Presidential Summit set to be held in Southern Italy next month.

The secret of China’s rise as a force to reckon with lies in its economy. The latter’s strength in turn lies in its manufacturing prowess with it’s roots in the Deng Xiaoping’s premiership.

In a 1979 visit to the southern coastal province of Guangdong, Deng was informed of the rising instances of Chinese youth risking their lives by escaping through the shark infested sea waters to the neighbouring shores of Hong Kong. The reason being severe unemployment and poverty back home.

It was a moment of reality check for the leader of a country which had seen a decline on all fronts in the late Mao years, from education to industrial production.

A few months later, as noted by the late American sociologist Ezra Vogel in his magnum opus study of the Chinese premier’s life- Deng Xiaoping And The Transformation Of China, the leader oversaw the inauguration of China’s first special economic zone (SEZ) near Shenzhen in the same southern province.

The lure of incentives, relaxed regulations and cheap labour attracted several Hong Kong and Japan-based firms to open up manufacturing units in the new SEZ.

Back then in 1979 when China took its baby steps towards becoming a factory to the world, it’s nominal Gross Domestic Product (GDP) stood at USD 263,711 million. In the same year, it’s neighbouring island nation- Japan, world’s second largest economy back then, reported a nominal GDP of USD 1,080,000 million.

With in three decades, China jumped from rank seven to the second, toppling Japan to become the world’s second largest economy.

Experts who closely follow China opine that it is the export-oriented strategy of marketing cheaply produced goods, known as merchandise in trade terminology, on mass scale across the globe that enabled China to accomplish this feat.

At the start of the 21st century, the difference between the merchandise values of China’s imports and that of its exports was narrow. In terms of figures sourced from the World Trade Organisation’s (WTO) Global Trade Data Portal, China’s imports in 2000 stood at USD 243,553 million against exports at USD 266,098.

This changed as the merchandise value of exports started surging way above that of the imports in the run up to the 2008 Beijing Olympics. In the years ahead, although the merchandise value of exports as well as imports both continued to rise, exports in particular consistently outpaced imports with the former at USD 3,380,024 million against the value of goods imported at USD 2,556,802 million in 2023.

Notably, when compared with US in the same year, not only were the latter’s imports higher than its exports, but the total merchandise value of goods exported by China also exceeded than that of the US by USD 1,360,482 million.

While this might present a picture-perfect story of growth, it is pertinent to note two things here.

-

In terms of the sector-wise distribution of China’s aggregate nominal GDP, it is the ‘services sector’ (at 54.6 percent) and not the manufacturing or the ‘industries sector’ (at 38.3 percent) which contributes the largest share. The former takes the bigger pie as it includes the real estate businesses which itself single handedly accounts for nearly 27 percent of China’s GDP. In fact, to ensure that the real estate businesses grow unhindered, China favoured former over the industries sector in terms of the amount devolved to it through low-interest loans.

Secondly, as per a study by the China Power study group of the US-based think tank- Center For Strategic And International Studies, although ‘industries’ or the manufacturing sector ranks second to the ‘services sector,’ it is the former which drives China’s GDP growth. However, the problem for China here being that the production capacity of the manufacturing sector exceeds that of its domestic demand.

“China’s massive manufacturing output has helped fuel the country’s economic growth, but it has also left China heavily reliant on exports. This is because, domestic consumption as a percent of GDP in China has fallen considerably over the last two decades,” the China study group observed in a note titled ‘Unpacking China’s GDP.’

This over reliance on exports also makes China vulnerable to situations where in the demand in foreign market drops as it was seen in the 2009 global financial crisis.

Nonetheless, the country carries on with its manufacturing push. This has become evident even more so post the onset of the real estate crisis in 2021 when Chinese credit policy decided to shift attention to the industries over the former.

“The fate of the Chinese Communist Party depends on its carrot and stick policy. Carrot here is the economy and latter being its military.

“When it comes to economy, the Chinese policy makers are acquiescent of this matter (production exceeding domestic demand). However, they cannot afford to let the state as well as privately run industries to cut down on production as this would send a negative message among its citizens. Thus, to keep the carrot looking good, it has to heavily rely on exports,” said Suyash Desai, an expert on China’s Defence and Foreign policy, currently a scholar at the Taipei based National Taiwan Normal University.

If China dumping its goods in the overseas markets wasn’t enough of a trouble to deal with, it’s silent rise as the leader in the global green goods market, notably in the electronic vehicles (EV) segment, has sent the developed economies of the west in a tizzy.

“China was previously mocked as producer of cheap goods. However, as soon as it realised the potential in the luxury goods and renewables segment, it started moving up the value chain. This has ruffled a lot many feathers among the EU member countries as well as the former’s major competitor- the US,” said Dr Anand V, a China expert and Assistant Professor of Geopolitics and International Relations at the Manipal Academy of Higher Education.

EV’s As China’s Blue Ocean

“Competing in overcrowded industries is no way to sustain high performance. The real opportunity is to create blue oceans of uncontested market space,” noted W. Chan Kim and Renée Mauborgne in their seminal essay titled ‘Blue Ocean Strategy’ published in the Harvard Business Review’s October 2004 edition.

For nearly two decades now, countless number of management school students across the world have read this essay but very few have understood its essence the way China did. This is especially true in case of the EVs which are all the rage now.

Back in 2001 when China was racing against time to outpace Japan as the second major economy, the Chinese Communist Party’s ruling bosses noted the domination of Japanese branded cars over China’s domestic market like anywhere else in the world. Secondly, at the same time, the Chinese policy makers were in search of alternatives to the rising oil imports.

This was also the period when Japanese car makers were testing waters by introducing hybrid vehicles- powered partly with diesel powered internal combustion engines and partly electrical batteries.

China decided to take a completely different route by resolving to produce automobiles entirely powered by lithium phosphate electrical batteries. According to an article published by Zeyi Yang in the MIT Technological Review, the Jiang Zemin led Chinese administration decided to include EVs in its five year plan in 2001.

Later in 2009, his successor Hu Jintao decided to take the EV game to the next level by initiating financial subsidies to domestic car makers like BYD, SAIC and NIO as well as to the foreign EV maker Tesla.

Fast forward to 2023, nearly half of Tesla’s entire EVs produced annually come from its factory near Shanghai in China. Its state owned auto maker-SAIC, which had acquired British car maker Morrison Garages back in 2007, launched its hatchback EV- MG 4 at the Singapore Auto Show.

In the same year, as per the figures provided by China Association of Automobile Manufacturers (CAAM), the annual sales figure for the EVs produced in China stood at 9.4 million (comprising 31 percent of the 30.09 million vehicles sold that year) against the sales of 1.4 million EVs made in US.

EU And USA’s Counter Moves- Signals Of An Impending Trade War

Notably, China’s EV production surge is not limited to its geographical domain. Its homegrown private EV maker BYD is now on the way to set up a production facility next door to US in Mexico, causing the former US President Trump asking his fellow countrymen to be prepared for a bloodbath between US and Chinese auto-makers once he comes back to power.

Sensing impending trouble in an election year, incumbent President Biden on May 14 decided to hit two targets in one go by quadrupling import tariffs on Chinese EVs from 25 percent to 100 percent. Even prior to the hike, Chinese EV makers did not sell their vehicles directly in US.

And the US did not just stop with the tariff hike on EVs.

Nearly a fortnight later on May 22, the United States Trade Representative Katherin Tai, ironically a daughter of a Chinese immigrant family, issued a circular disclosing details of proposed tariff hikes on other Chinese imports.

The imports supposed to be covered under this include mainly electrical components, other hard goods required for producing electrical equipment and medical accessories.

Notably, among the three product categories of Chinese imports in US which will see tariffs being raised to 50 percent are ‘solar cells’ and ‘semi-conductors.’

Experts say both US and the EU are wary of China’s dominance in both product categories with the latter already having become the largest producer of semi-conductors as well as solar cells. According to the experts, both are of the view that Chinese stranglehold over both product categories can come in their way of shifting towards more cleaner alternatives of energy consumption as well as transportation.

While the US has decided to directly latch horns with China, the EU’s approach towards the east Asian superpower has been a mix of caution and liberal attitude.

Nonetheless, since last year, the EU has launched six ‘anti-dumping probes’ in product categories ranging from ‘tin-plate steel’ to ‘EVs’ against Chinese companies.

According to the investigators, several Chinese companies marketing goods in the EU member countries have not been transparent about the financial subsidies they receive from the Chinese government to avoid paying commensurate tariffs.

In case of the EU probe against Chinese EV makers, the body of European countries is keeping even more close tab considering that Tesla’s China-made EVs dominate European market.

Calls for taking up a protectionist stance are increasing more so considering that Contemporary Amperex Technology, a Chinese company, is on the way to open two battery production facilities in Germany, largest of its kind in Europe.

Experts say that the European organisation also wants to avoid a repeat of the embarassing decade of 2000s which saw China topple the EU as the largest producer of solar cells along with the acquisition of famed Scandinavian automobile brand Volvo by the China-owned Zhejiang Geely Holding Group.

However, considering that it is the US which is in direct competition with China, the former will have to go an extra mile to garner EU’s support with the latter reluctant to pick up a direct trade fight with China.