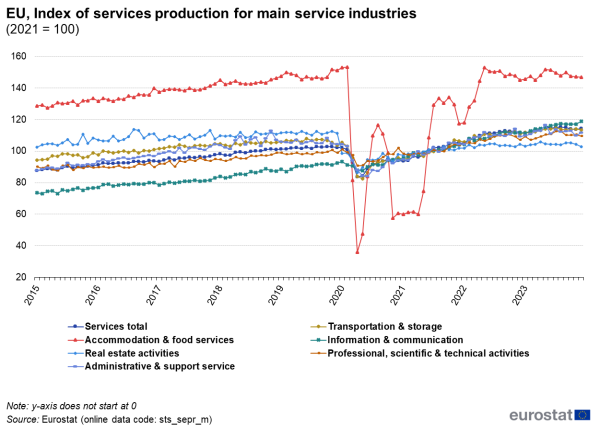

Overview: Services production since 2015

In the years following the financial and economic crisis, services production increased in a relatively steady manner (Figure 1). In the first months of 2020, the Covid-19 crisis and the resulting containment measures by governments had a dramatic effect on the production of services. Within just two months, between February 2020 and April 2020, the production of services in Europe fell by 17 %.

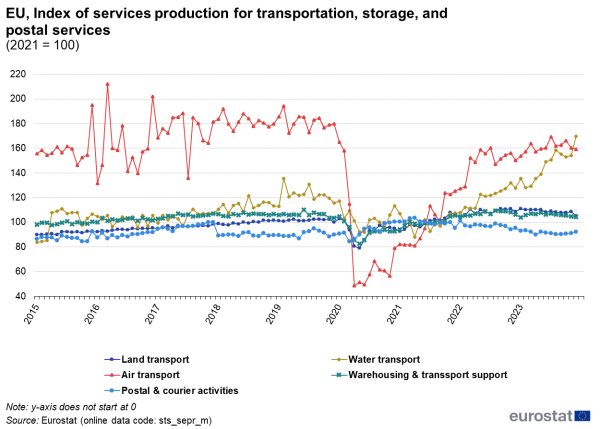

The development was quite heterogeneous depending on the service industry (Figure 2). Transport services declined by almost 19 %, in particular air transport was severely hit. Water transport, on the other hand, was much less affected.

The production of information services dropped by almost 4 %, in particular the production of motion pictures, television shows etc. felt the effects of the pandemic (-26 %). Professional and technical services decreased by more than 8 %, administrative and support services by 15 %, even real estate activities declined by more than 12 %.

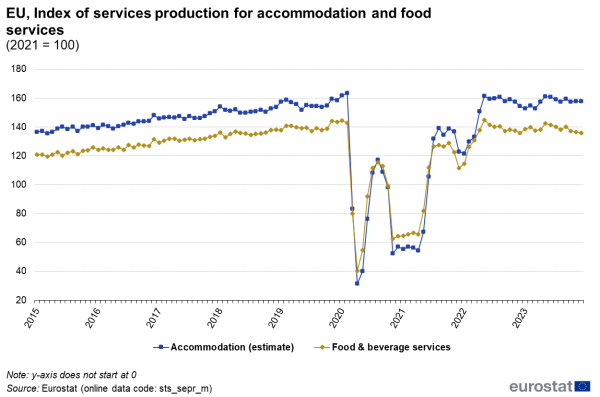

Most affected were accommodation and food services (mainly hotels and restaurants). As a result of the lock down, social distancing measures, and probably a reduced demand, their production fell by more than 75 % (for more on the effects of the Covid-19 pandemic see below).

In May and June 2020, the situation began to improve for almost all service industries and they started to grow in a way largely comparable with the period between 2015 and 2020. By summer/autumn 2021, most industries had regained the pre-crisis level.

In December 2023, total services were 13 % higher than in February 2020. The strength of the recovery was, however, very different depending on the service industry. While information and communication services stood more than 30 % above the pre-crisis level, the volume of accommodation and food services was still 4 % lower than in February 2020.

Source: Eurostat (sts_sepr_m)

Transport and postal services

The evolution of the volume of transport and postal services is depicted in Figure 3. For water transport, a relatively large volatility can be observed. To some extent this appears to be the result of strong movements in prices for these services. Moreover, the figures are largely dominated by data from one country. The index for air transport services also shows some volatility. Moreover, this index dropped dramatically as a result of the Covid-19 crisis (nearly -70 % between February and April 2020).

The index for land transport services has developed in a rather steady fashion since 2015, the same can be said for warehouse and transportation support services. While these industries saw a decline in the first wave of the pandemic, they have since fully recovered. Postal and courier activities are generally much more stable.

Source: Eurostat (sts_sepr_m)

Accommodation services

The volume developments of accommodation services (mainly hotels) and food and beverage services (mainly restaurants) since 2015 are shown in Figure 4 (please note that the index for accommodation services was estimated for this publication). In general, the development of both industries has been very similar. During the Covid-19 pandemic, many hotels and restaurants were closed, resulting in an unprecedented drop in production in these service areas in March and April 2020. During the summer of 2020, the situation improved somewhat but with the next wave of the pandemic, production levels in both these services dropped again and afterwards remained at a low level for several months. In the spring and summer of 2021, activities increased again but decreased again in winter. By the end of 2023, the production in these industries were still somewhat below the levels they had before the Covid-19 pandemic.

Source: Eurostat (sts_sepr_m)

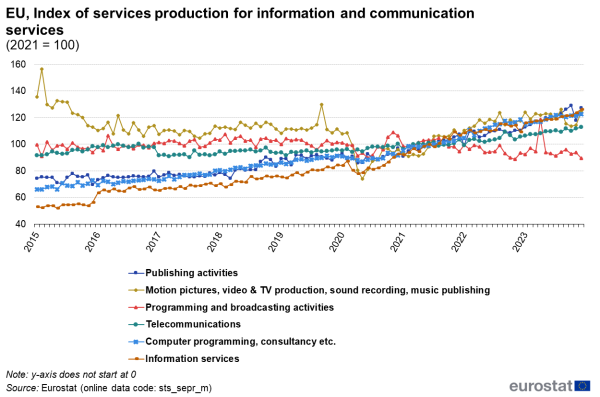

Information and communication services

Since 2016 several information services such as data processing, data hosting, web portals and similar activities have shown relatively dynamic development. These services were also hardly affected by the Covid-19 crisis and containment measures (Figure 5). Computer programming and related consultancy services also showed very steady growth and only minor effects of the pandemic.

Telecommunication services (wired and wireless, satellite telecommunication services, etc.) displayed very steady yet moderate growth during the period of observation.

In general, information and communication services were comparatively less hit by the Covid-19 crisis, with the exception of the production of motion pictures, TV production, sound recording and similar activities.

Source: Eurostat (sts_sepr_m)

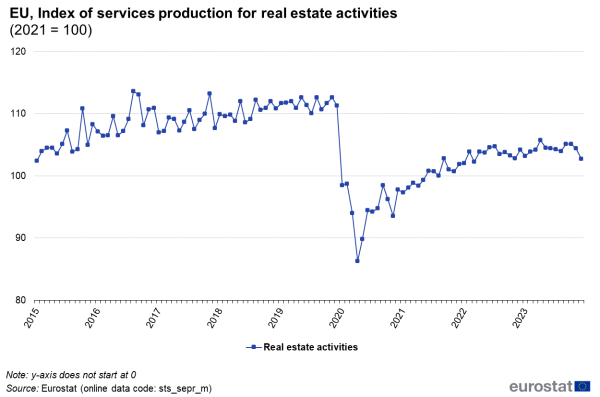

Real estate activities

In general, the production index for real estate activities has developed in a rather steady but not very dynamic way since 2015 (Figure 6). In January 2020, i.e. some weeks before the main outbreak of the Covid-19 pandemic in Europe, the index had already dropped by more than 10 points. A similar fall occurred two months later in March and then again in April but later than the other service industries. In December 2023, the index was more than 7 % below its pre-crisis high in December 2019.

Source: Eurostat (sts_sepr_m)

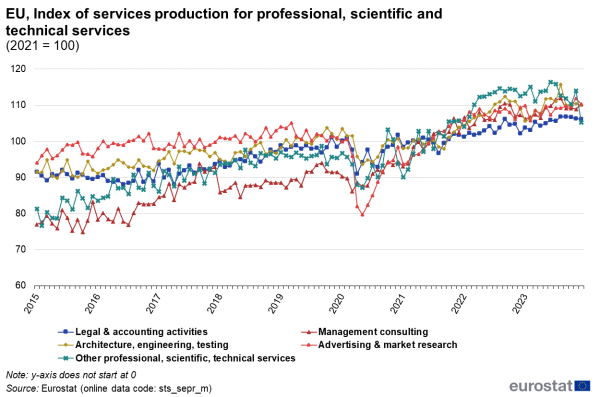

Professional, scientific and technical services

Figure 7 summarises the development of various industries which provide professional, scientific and technical services (largely to other businesses). Most of these services show a relatively stable development pattern. The only exception to this is “other professional, scientific and technical services”, such as specialised design, photography, and translation” which, however, has a relatively low influence on the overall results for this industry.

The Covid-19 crisis hit, in particular, the advertising and market research industry. Legal services and accounting as well as architectural and technical services were mainly reduced in March and April 2020 but have seen a relatively steady, although moderate, growth and have surpassed the pre-crisis level.

Source: Eurostat (sts_sepr_m)

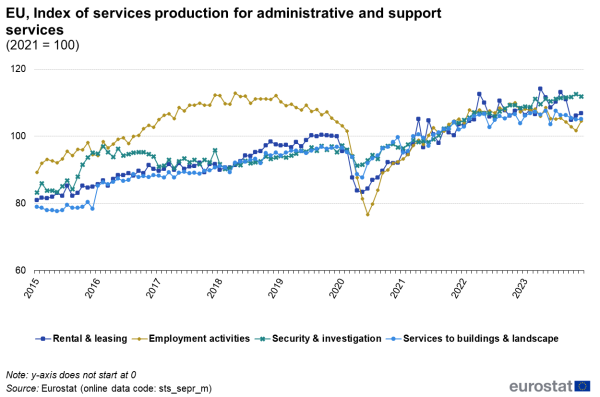

Administrative and support services

Figure 8 displays the production development in typical business services. Security services as well as services to buildings (such as cleaning) and landscapes have developed in a very stable way – evidently the demand for these services is not much influenced by the general economic climate. During the Covid-19 crisis, employment activities also saw a significant reduction but already surpassed the pre-crisis level in early 2022.

Source: Eurostat (sts_sepr_m)

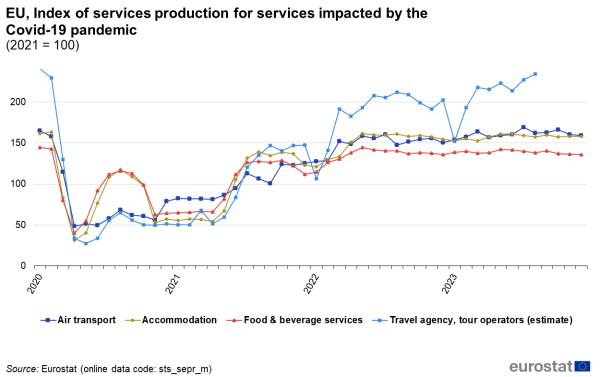

Main effects of the Covid-19 pandemic on services production

Figure 9 summarises those industries which were most strongly hit by the Covid-19 pandemic and the ensuing containment measures.

While the index of services production dropped by 19 index points between February and April 2020, food and beverage services fell by more than 100 index points. During the summer of 2020, the production of these services increased again but then dropped again in the second half of the year and remained at an extremely low level. In the summer of 2021, the situation improved somewhat but soon another decline set in. The most recent data show that the index for accommodation services has just barely recovered from the effects of the pandemic. Accommodation services display, by and large, the same development pattern as food and beverage services.

Air transport services also saw a massive reduction in the first wave of the pandemic (-109 index points between February and April 2020) but their recovery was steadier than the recovery of hotels and restaurants.

The most detrimental effects of the Covid-19 pandemic were experienced by travel agencies, tour operators and similar service providers (note that the data for these services had to be estimated to a lower data coverage for data with the new base year 2021). The index for their production dropped by almost 200 points in the first wave of the pandemic and since then has increased very slowly, even during the last months there was a stagnation and a slight drop. The most recent data show the production of this industry is now more or less at the level it was before the pandemic.

Source: Eurostat (sts_sepr_m)

Source data for tables and graphs

Data sources

Available service data

In 2017, Eurostat launched the publication of the index of services production (ISP) on a regular basis for the European Union (EU) and the euro area. The former STS regulation did not include the obligation to calculate an ISP but foresaw the obligation of Member States to produce and transmit quarterly data for the service turnover for the majority of service industries which are, in most cases, defined at NACE division level. A number of Member States also produced and transmited these data on a monthly basis (see article on service turnover). Together with data on service producer prices Eurostat estimated service production indices for EU Member States on the basis of available turnover and price data.

The new Regulation (EU) No 2019/2152 (European Business Statistics Regulation) and the Commission implementing regulation (Regulation (EU) No 2019/2152 of 27 November 2019) which supplied the detailed statistical requirements for European business statistics entered into force in 2021. Member States are now obliged to transmit monthly services production data to Eurostat for almost all services industries – with the exception of public services and financial services and some minor industries (see below).

Apart from the introduction of a new index of services production the European Business Statistics Regulation improves service statistics in several other ways:

- The coverage of service industries in short-term statistics is enlarged. With few exceptions all private services are included in the statistics at two-digit NACE level. In particular the coverage of transport support services is improved but also the coverage of business support services. The remaining exceptions are public and financial services which are already well covered by other statistics and the service industries M72 (scientific research and development) and M75 (veterinary activities), and group M70.1 (activities of head offices).

- The turnover indicator for services are calculated with a monthly reference period instead of quarterly (with the same coverage as the ISP).

- The scope of service producer prices or similar indices that can serve as deflators for turnover data is considerably enlarged and brought in line with the coverage of the production and turnover indicators.

Statistical authorities have now almost finished the process of implementing the new indicator on services production and data delivered to Eurostat are almost complete. Because of some remaining gaps and in order to calculate indices at the aggregate European level (for the EU and the euro area) Eurostat has adapted its production process somewhat and calculates aggregates for services production with a lower coverage of countries as usual (e.g. 50% in terms of weights instead of 60%). Moreover, several series are still estimated. As a consequence of the new production process the older estimates for the index of services production which dated back to 2006 (the first year when service producer prices were available) are no longer published.

Context

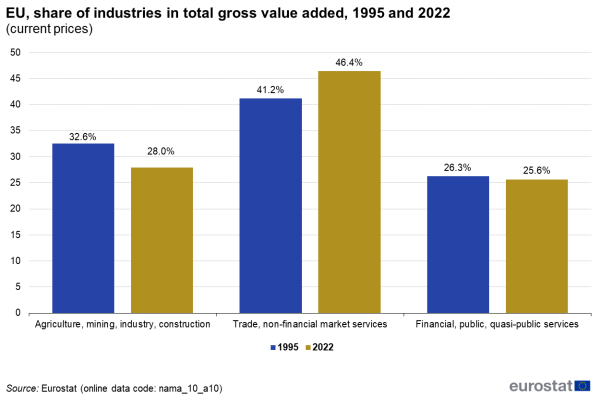

Over the last decades service industries have become increasingly important in European economies (in absolute and in relative respect). Figure 10 shows that the share of the gross value added of agriculture, industry and construction in the total gross value added of the EU decreased from 33 % to 28 % between 1995 and 2022. During the same period the respective share of trade and non-financial service industries increased from 41 % to 46 %. The share of financial, public and quasi-public services remained relatively stable.

Source: Eurostat (nama_10_a10)