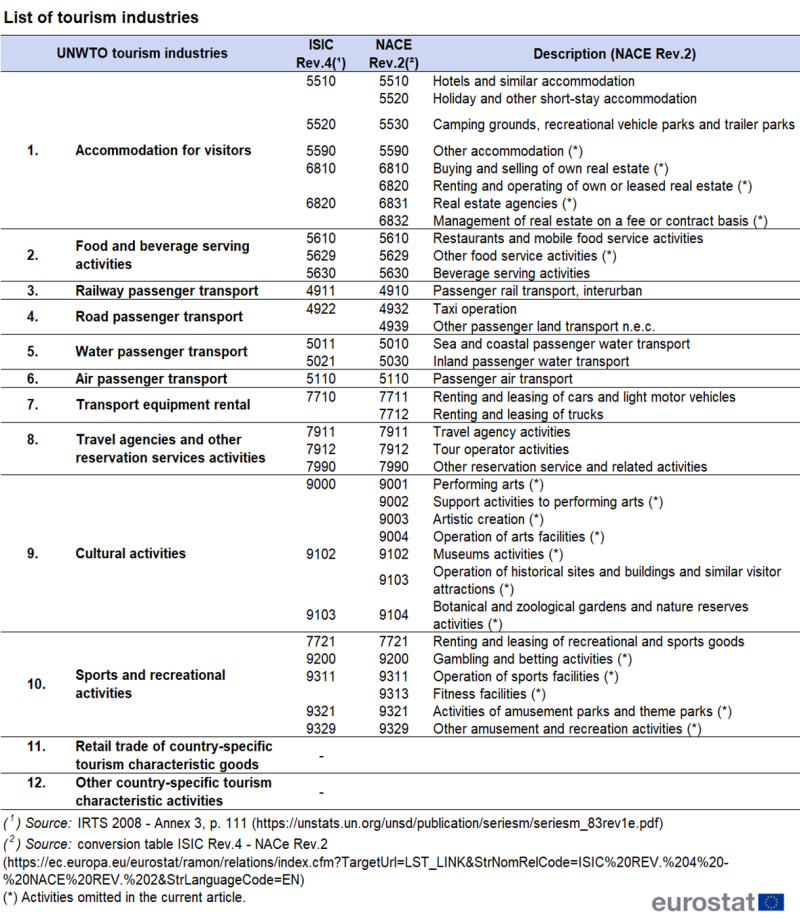

Key economic indicators

The discussion below refers to four selected indicators: number of enterprises, number of persons employed, net turnover and value added – firstly at EU level, secondly at country level.

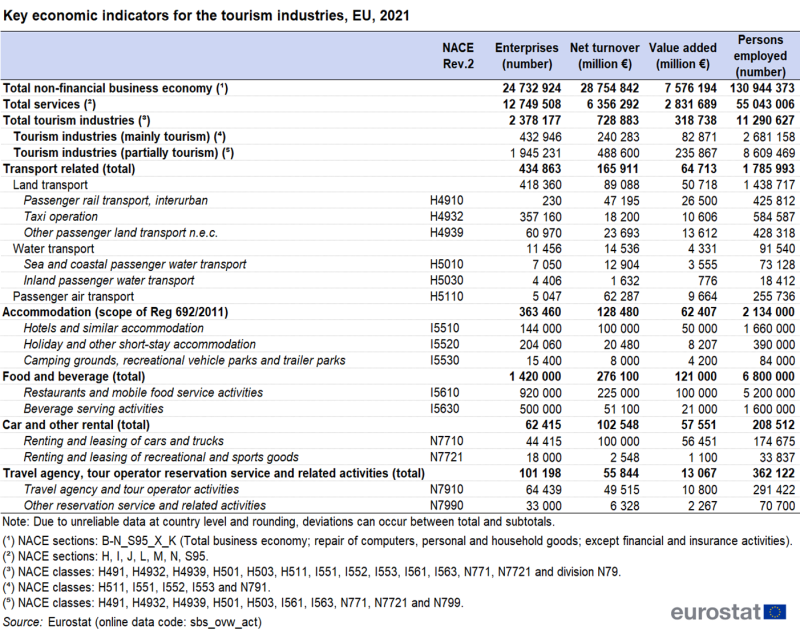

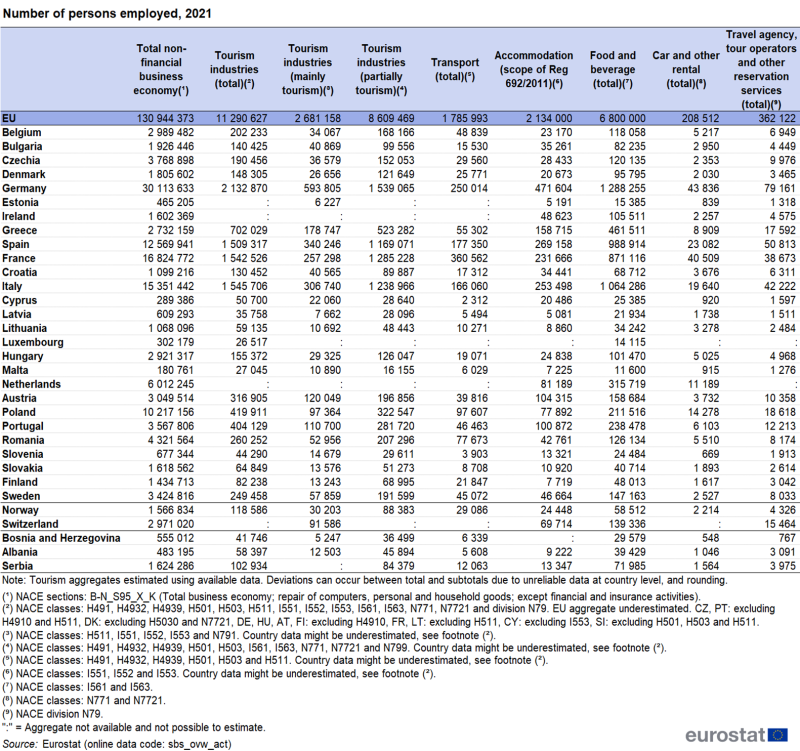

In 2021, almost one in ten enterprises in the EU non-financial business economy belonged to the tourism industries (see Table 1, Table 2). These 2.4 million enterprises employed 11.3 million persons, accounting for 8.6 % of the persons employed in the non-financial business economy and 20.5 % of persons employed in the services sector.

The tourism industries’ shares of net turnover and value added were relatively lower, with the tourism industries accounting for 2.5 % of the net turnover and 4.2 % of the value added of the non-financial business economy. These figures very likely reflect – among other explanations – the higher share of micro, small and medium-sized enterprises and the level of part-time employment in many tourism industries.

Source: Eurostat (sbs_ovw_act)

Source: Eurostat (sbs_ovw_act)

As explained in the “Data sources” section, tourism industries do not provide services only to tourists. Their employment, turnover, etc., is also related to services provided to non-tourists. In Table 1 and Table 2, the subdivision “mainly tourism” and “partially tourism” takes this into account. For instance, 2.7 million persons are employed in “mainly tourism” industries (passenger air transport, accommodation services and travel agencies and tour operators) that are assumed to serve predominantly tourists, while 8.6 million persons are employed in “partially tourism” industries where the customers are likely to be a mix of tourists and non-tourists (e.g. restaurants).

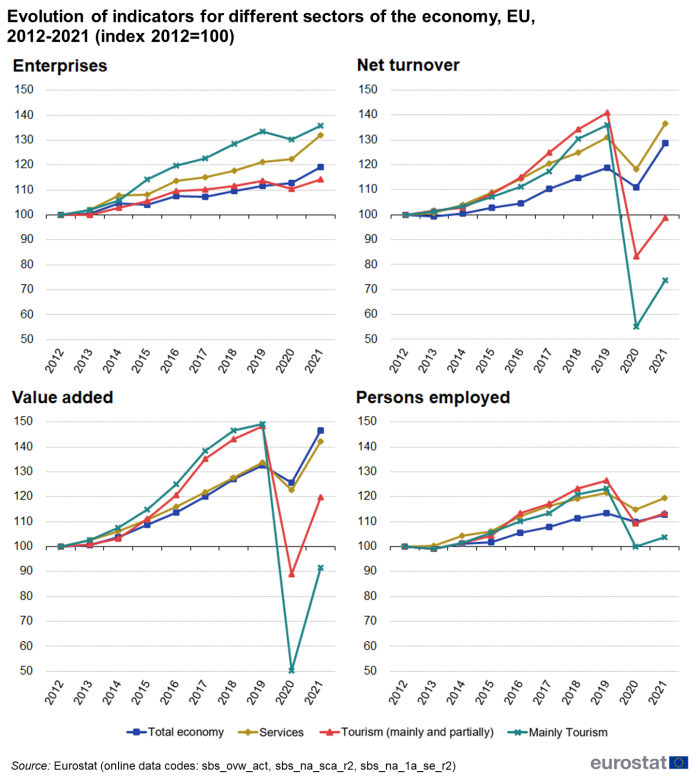

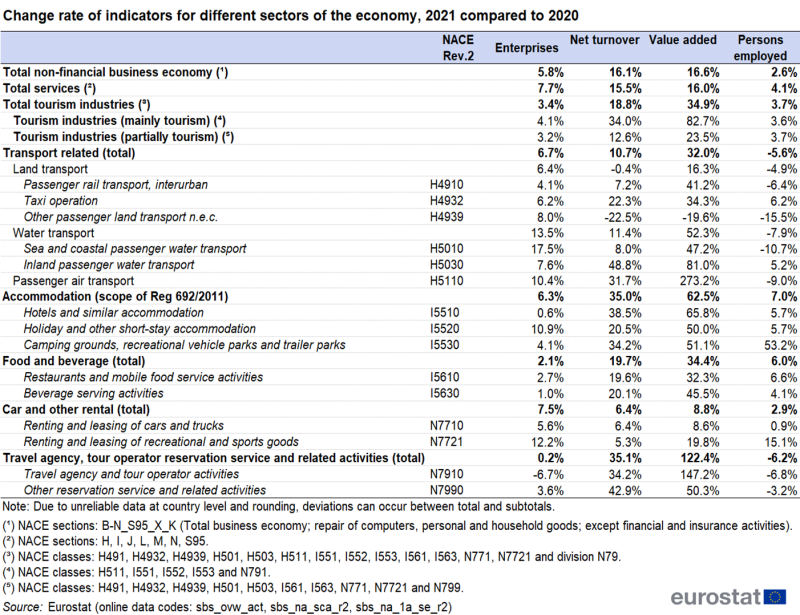

Figure 1 presents the growth of the sectors from 2012 to 2021. In the period up to 2019, tourism industries (mainly and partially) showed a much stronger growth than the total economy for all indicators concerned. But in 2020, the impact of the Covid-19 pandemic caused dramatic drops of the turnover and value added of the tourism industries (-41.0 % and -40.1 % respectively, comparing 2020 with 2019). The number of persons employed in the tourism industries and the number of enterprises dropped less strongly, but still recorded levels that were respectively 2.8 % and 13.5 % lower in 2020 compared with 2019. A slow recovery started in 2021, when all indicators showed an increase compared to 2020, by 2.6 % in number of persons employed, 5.8 % in number of enterprises, 16.1 % in net turnover and 16.6 % in value added (see Table 3).

Analysis by subsectors

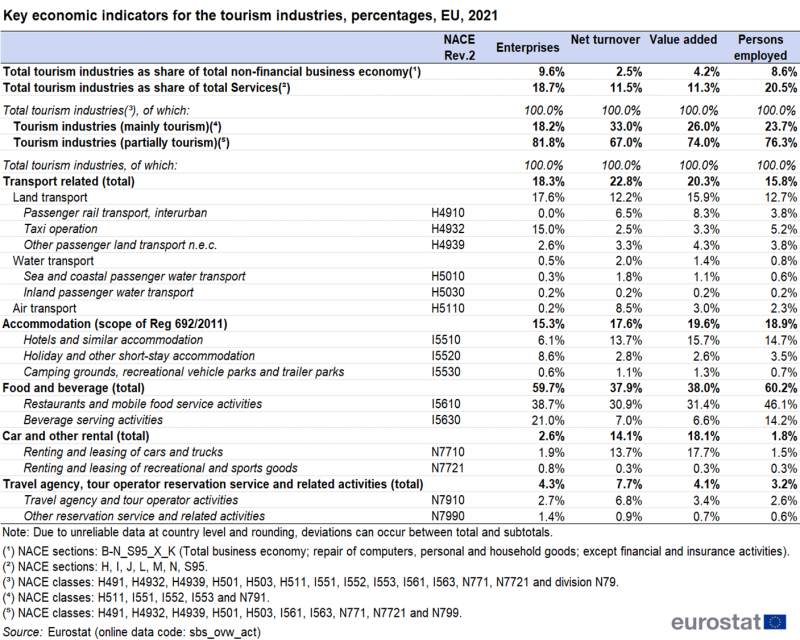

Three out of four enterprises in the tourism industries operated in accommodation (NACE I55) or food and beverage serving activities (NACE I56): 15 % and 60 %, respectively (see Table 1, Table 2, Figure 2). Looking at the number of persons employed, the weight of these activities was 79 % persons employed in the tourism industries. However, in terms of net turnover and value added, their share was much lower (56 % and 58 %, respectively).

(%)

Source: Eurostat (sbs_ovw_act)

The net turnover of passenger transport related industries (parts of NACE H49, H50, H51) represented 23 % of the turnover for all tourism industries: 38 % of this share came from the subsector of passenger air transport (NACE H5110) (see Table 1).

Travel agencies and tour operators (NACE N7910) and other related activities (NACE N7990) recorded a turnover of €56 billion in 2021, an increase by €15 billion (+35 %) compared with 2020. These activities represented 8 % of the net turnover in tourism industries, compared with a 4 % share in number of enterprises and value added, and a 3 % share in persons employed.

Geographical analysis

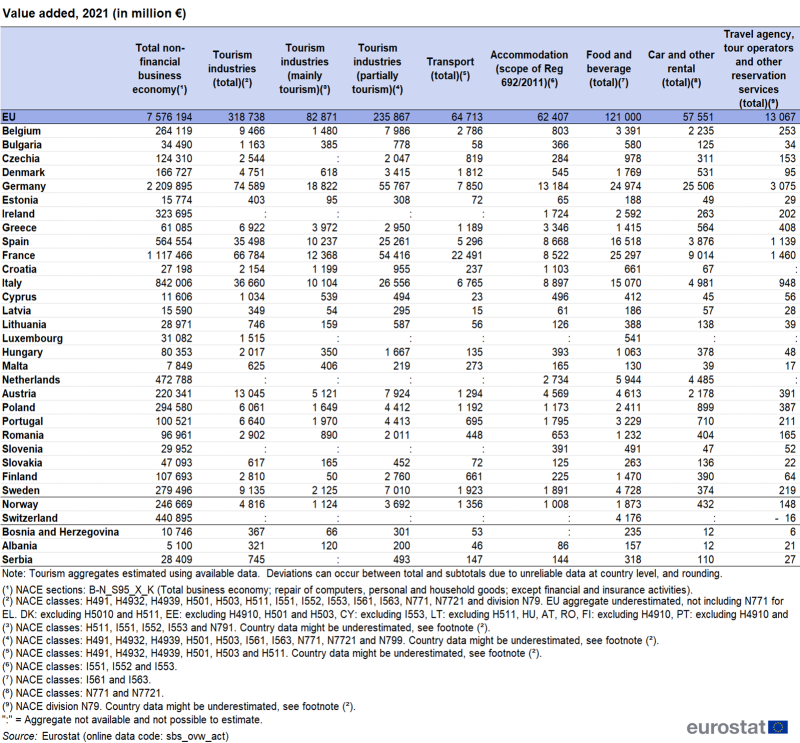

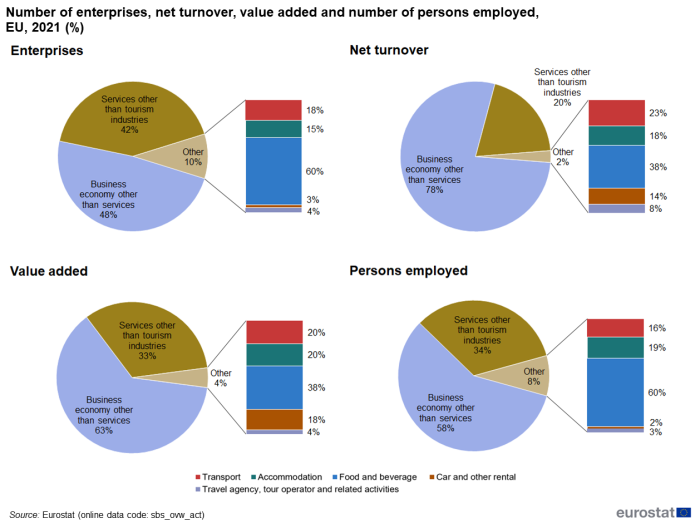

More than half (56 %) of the 2.4 million enterprises in the tourism industries in the EU in 2021, were located in four Member States: 371 000 in Italy, 359 000 in Spain and France, each and 246 000 in Germany (see Table 4).

Source: Eurostat (sbs_ovw_act)

Looking at the available EU Member States’ data, in terms of employment (see Table 5), Germany (not including passenger inter-urban rail transport) was on top with 2.1 million persons employed in the tourism industries, followed by Italy, France (not including passenger air transport) and Spain (1.5 million each).

The highest share of employment in the tourism industries was observed in Greece (26 % of the total non-financial business economy of the country), followed by Cyprus (18 %) and Malta (15 %) (note that data on total employment in the tourism industries is missing for a number of countries).

Source: Eurostat (sbs_ovw_act)

The availability of country data on turnover and value added is also fragmented (see Table 6 and Table 7).

Net turnover amounted to €143 billion for France, followed by Germany (€140 billion), Italy (€95 billion) and Spain (€85 billion).

In terms of value added the first four countries were the same: Germany, with €75 billion, followed by France (€67 billion), Italy (€37 billion) and Spain (€35 billion). The highest shares of value added in the tourism industries in the total non-financial business economy of the country were observed in Greece (11 %), Cyprus (9 %), Malta and Croatia (8 % each), and Portugal (7 %).

Infra-annual analysis

The above analysis was based on structural business statistics (SBS). While SBS is a rich and comprehensive source of information on European businesses, these statistics are only provided annually. Compared with other sectors of the economy, the tourism sector has a relatively strong seasonal component, hence the need to look at infra-annual data to complete the analysis. Short-term business statistics provide monthly and quarterly indices for a subset of tourism industries. For the analysis in this article, an aggregate was created including NACE divisions H51 (Air travel), I55 (Accommodation) and N79 (Travel agency, tour operator and other reservation service and related activities).

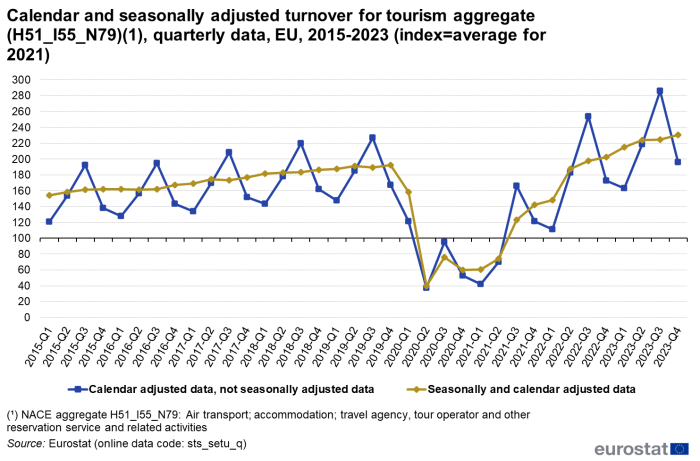

Figure 3 shows for the EU above mentioned tourism industries, the quarterly evolution of the turnover, seasonally adjusted or working days adjusted, for the years 2015 to 2023 (index: average 2021 = 100). The graph shows a positive trend that was interrupted in spring 2020. After the travel restrictions implemented in March and April 2020 in response to the Covid-19 outbreak, the turnover of tourism industries dropped sharply in the second quarter of 2020. In spring and summer 2021 many restrictions were raised and travelling became easier. In 2022 the turnover shows clear signs of recovery, reaching and even surpassing the pre-pandemic levels, while the positive trends continues also in 2023.

(index=average for 2021)

Source: Eurostat (sts_setu_q)

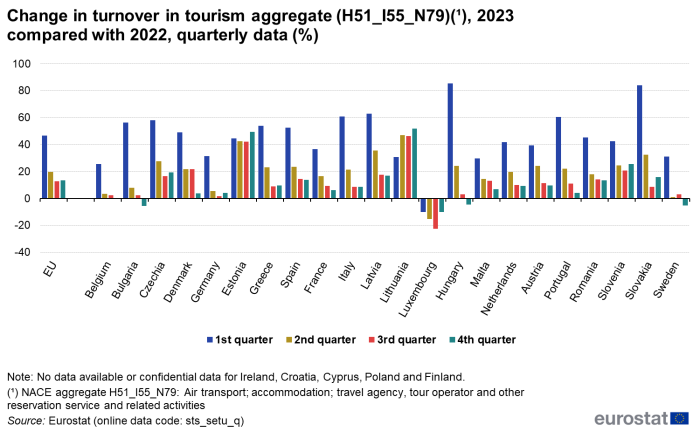

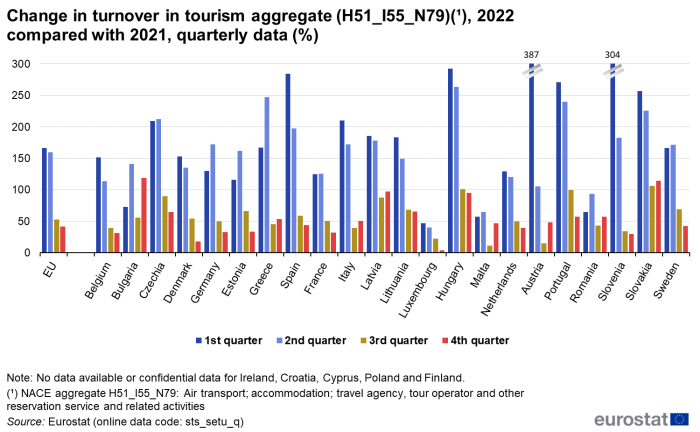

Figure 4a focuses on 2023 and shows a clear positive trend in the turnover in these tourism industries. At EU level, the highest increases compared with the same periods of 2022 were recorded in the first quarter, when the turnover increased by 47 % compared with the first quarter of 2022. The turnover increased also in the next quarters: +20 % in the second quarter and +13 % in the third and fourth quarter. The lower increases between 2022 and 2023 compared with 2021 and 2022 (see Figure 4b) reflect the recovery of tourism industries already in 2022. The positive trend was recorded in most EU member states with available data, except Luxembourg, with a decrease of -10 % in the first and fourth quarter, -15 % in the second quarter and -23 % in the third quarter, Bulgaria, Hungary and Sweden with a decrease in the fourth quarter.

(%)

Source: Eurostat (sts_setu_q)

(%)

Source: Eurostat (sts_setu_q)

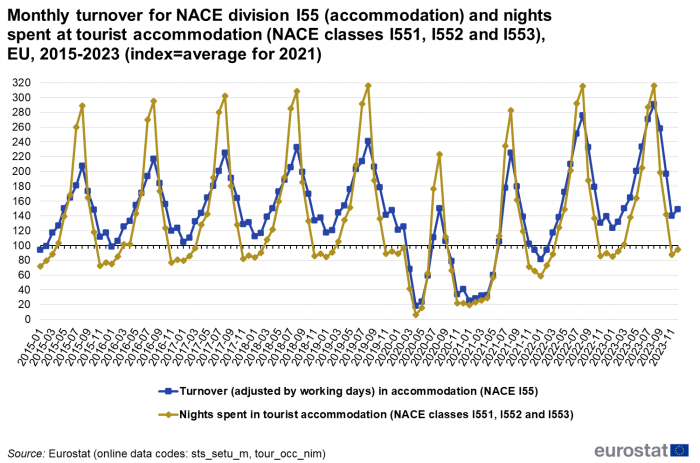

Figure 5 shows for the period January 2015 to December 2023, the monthly evolution of the working days adjusted turnover in EU accommodation, and the nights spent in tourist accommodation establishments (index: average 2021 = 100). As expected, the two series follow a similar pattern in terms of peak and trough periods; however, the variability appears to be more pronounced for the physical flows (nights spent) as compared with the monetary flows (turnover). This graph clearly shows the sharp drop in March and April 2020 when many hotels were closed. Despite the partial recovery during the summer months of 2020, the turnover and the nights spent in tourist accommodation remained at very low levels compared with the previous years. The first signs of recovery appeared in May 2021, while in June 2022 the turnover reached the pre-pandemic levels.

(index=average for 2021)

Source: Eurostat (sts_setu_m), (tour_occ_nim)

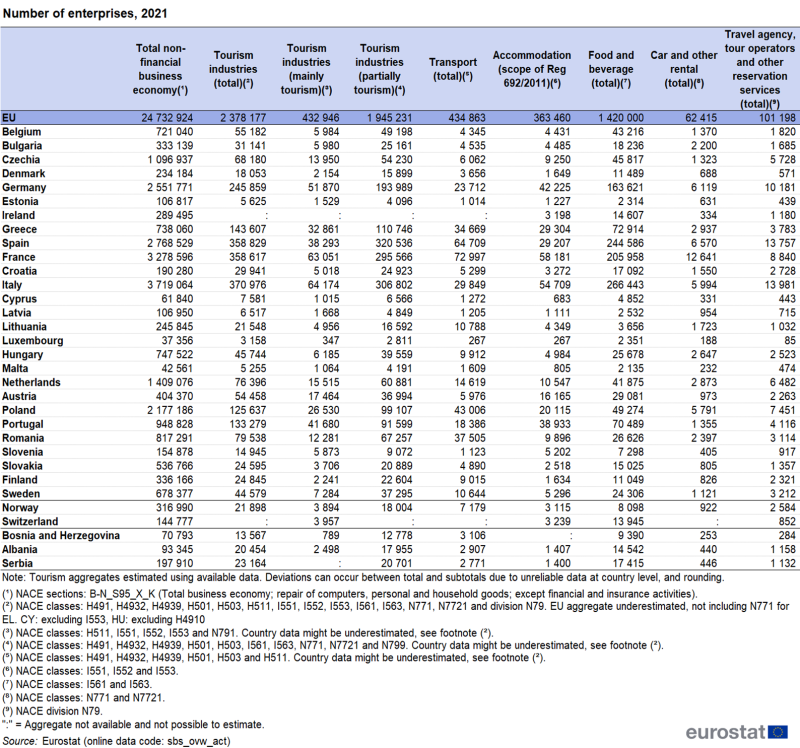

Data sources

Structural business statistics (SBS) are a main component of business statistics in the European Statistical System (ESS) and describe the structure, main characteristics and performance of economic activities across the European Union. Data is available at a detailed level of economic activities, which allow for the identification and selection of industries that are part of the tourism sector. According to the International Recommendations for Tourism Statistics 2008 the tourism sector (also: ‘tourism industries’ or ‘tourism characteristic activities’) includes ten internationally comparable activities and two country-specific activities – this article focuses on the former. An overview of these activities (and the corresponding codes in the international classifications ISIC and NACE) is given in Table 8. All these activities are covered by SBS, except for culture, sports and recreation.

This article uses a fine-tuned list of the tourism industries, better adapted to the European setting and avoiding overestimations of the economic variables. Activities omitted include “other accommodation” (NACE 5590), “other food service activities” (NACE 5629) and “real estate activities” (NACE 68), these activities are not sufficiently related to tourism to justify their inclusion in the current analysis.

Existing business statistics (SBS, STS) cannot distinguish between services provided to tourists and to non-tourists – typical examples include restaurants catering to tourists but also to locals and railway passenger transport used by tourists as well as by commuters. For this reason, this analysis considers these industries in their totality. Considering the total turnover or employment overestimates the true economic importance of tourism for these industries, but on the other hand, tourism also contributes to other industries not listed in Table 8. The approach used in this article should not be confused with the methodological framework to compile tourism satellite accounts (TSA); the most recent Eurostat statistical report on TSA in Europe is available from the Eurostat website.

Notwithstanding these shortcomings, SBS data allow for an economic analysis of the sector which is not possible using only tourism statistics. A second relevant source within existing business statistics is short-term business statistics (STS). STS can fill the gap of information on turnover or prices where monthly accommodation statistics are limited to evolutions in flows of tourists. As a trade-off with its strong timeliness, STS is available with a lower granularity of activities for services; as a consequence the further analysis of monthly economic indicators focuses on air transport (NACE H51), accommodation (NACE I55) and travel agency, tour operator reservation service and related activities (NACE N79).

Source data for tables and graphs

Context

Following its communication “A new industrial strategy for Europe” (March 2020), the Commission will systematically analyse the risks and needs of different industrial ecosystems. The notion of ecosystem captures the complex set of interlinkages among sectors and firms spreading across countries in the Single Market. Ecosystems encompass all players operating in a value chain: from the smallest start-ups to the largest companies, from academia to research, together with the forces that shape the market environment in which they operate.

Tourism is one of the 14 ecosystems identified, each with its own set of sectors that should cover the entire economic industrial landscape. The tourism ecosystem is a network of globalised and interconnected value chains of both online and offline tourism services providers, where small companies operate along with large multinational corporations.

The green transformation of industry supported by the Strategy will reduce the environmental footprint of our industrial activities and empower industry to provide effective solutions for the societal challenges of the future such as sustainable tourism.

Tourism statistics focus on the accommodation sector on the one hand and the demand side (from households) on the other hand. ESS tourism statistics relate mainly to physical flows: arrivals or nights spent at tourist accommodation establishments or trips made by residents of a country.

This article presents economic data extracted from other areas of official business statistics, in particular structural business statistics (SBS) and short-term business statistics (STS), in order to provide users with a better economic analysis of this sector, which is an important motor for many countries’ economies and labour market.