Extended Producer Responsibility (“EPR”) is readily becoming a concern for players in the apparel and textiles markets. More traditionally an issue for manufacturers of electronics, mattresses, paint, and tires, for example, regulations that put the responsibility for the post-consumer waste management and/or recycling of products – and sometimes, their packaging – on the manufacturer are starting to become a critical focus for those in the business of making and selling garments and accessories, as lawmakers aim to crack down on the rising production and rapid discarding of fast fashion wares and to get a handle on the growing output of the fashion industry as a whole.

In light of the growing focus on EPR in the fashion/apparel segment, the introduction of – and corresponding developments associated with – a few pieces of pending legislation in the United States, European Union, and United Kingdom are worthy of close attention …

(1) European Union – Revision of the Waste Framework

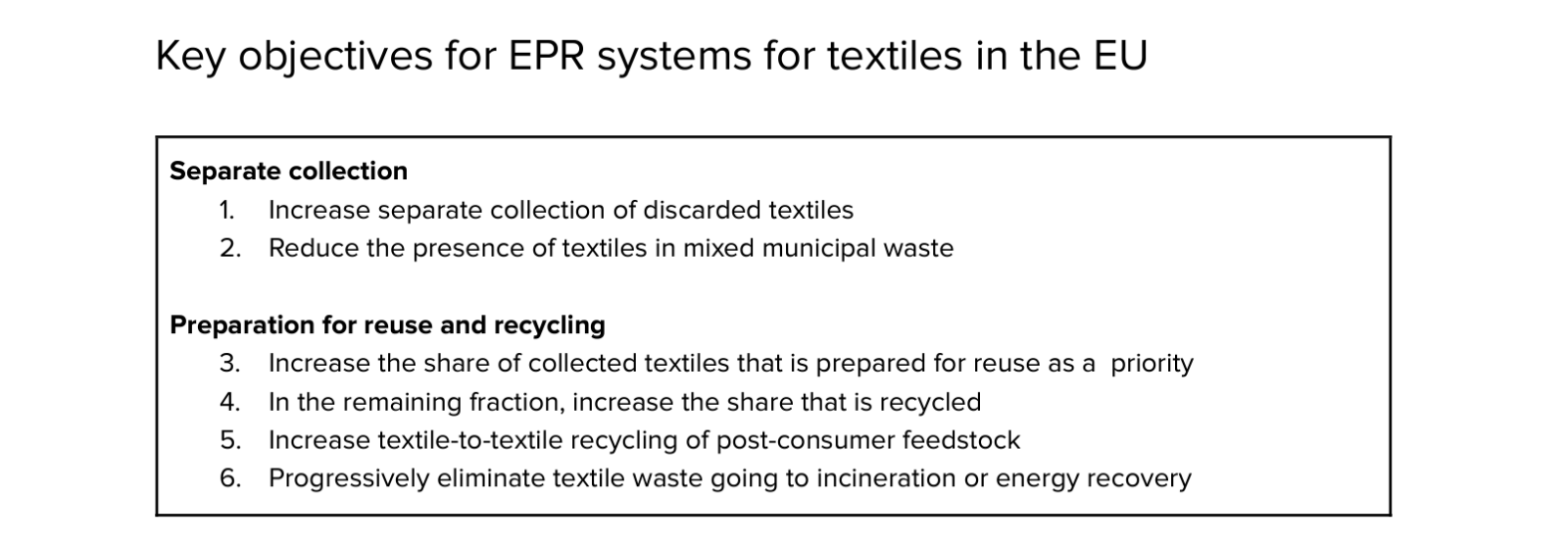

On July 5, 2023, the European Commission published a proposal to amend the existing Waste Framework and impose mandatory and harmonized EPR schemes across the European Union, so that producers will be required to cover the costs of textile waste management, including the costs of separate collection, sorting, and recycling of textiles, thereby, making them responsible for the full lifecycle of textile products. In terms of textile waste, the proposed rules apply to various types of textile products, including clothing, accessories, blankets, bed linen, curtains, hats, footwear, mattresses, and carpets, as well as products that contain textile-related materials, such as leather, composition leather, rubber, or plastic.

image via Ellen MacArthur Foundation

In accordance with the proposed textile amendment to the Waste Framework, EU member states would have 18 months from the date of adoption by the Council of the European Union to enact the directive (and thus, mandate the establishment of textile-specific EPR schemes) by way of national law. Then, within a matter of 30 months of the entry into force of the directive, member states would need to ensure that EPR schemes are in place to mandate the separate collection of textiles for re-use, preparing for re-use, and recycling.

Among other things, impacted companies will be required under the textile-specific EPR proposal to submit an application for registration in each member state where they make textiles available on the market for the first time (in order to allowed to bring those textile products to market) and to designate a legal entity – called a “producer responsibility organization” – to manage the fulfillment of its financial and operation obligations under the EPR scheme.

> Aside from monitoring developments in the textile aspect of the EU’s EPR Proposal (most recently, Parliament’s recent vote in favor of the proposed revision of the waste framework to extend to textiles), producers of textiles can start preparing for the potential implementation of the revised directive by “considering how they will design their extended producer responsibility [programs],” according to a Norton Rose Fulbright note, including the selection and/or development of the producer responsibility organization. The Norton Rose attorneys state that they expect the EPR textile proposal to be adopted “in light of the EPR schemes already introduced by the EU for, among others, batteries, packaging waste, and electronics.”

Note: Some EU member states already boast legally mandated EPR programs. France is most notable thanks to two pieces of textile-specific legislation in place: the Anti-Waste for a Circular Economy Act (Law No. 2020-105), which was adopted in February 2020, and the French Climate and Resilience Law (Law No. 2021-1104), which came into force in August 2021.

(2) France – Anti-Fast Fashion Legislation

It is worth noting that in addition to its existing EPR schemes, a newly-introduced piece of legislation that is looking to crack down on fast fashion in France makes specific mention of EPR. At a high level, the “first-of-its-kind” fast-fashion bill endeavors to add an initial tax of €5 per fast fashion item and “a maximum penalty of €10 per product by 2030.”

But beyond that, Article 2 states that the bill “aims to strengthen the extended producer responsibility sector for clothing textiles, household linens, and shoes. In particular, Article 2 aims to ensure that the financial contributions paid by producers also depend on the environmental and carbon impact of their productions and on whether or not they are part of a fast fashion commercial approach. To ensure this modulation of companies’ contributions, existing law allows the establishment of penalties according to criteria in particular of sustainability and recyclability, but these are not currently mobilized by the sector.”

(3) United Kingdom – The Packaging Waste (Data Reporting) (Amendment) Regulations 2024

As of April 1, 2024, the Packaging Waste Regulations 2024 will come into force in the United Kingdom in an effort to make producers “the full net cost of collection and end-of-life treatment for the household packaging waste” that they place on the market. The key changes introduced by the 2024 regulations, which amend the Packaging Waste (Data Reporting) (Amendment) Regulations of 2023, entail:

(1) Requiring the Environment Agency to publish a public list of large producers;

(2) Shifting the obligation of reporting from the brand owner of empty packaging to the party that packs or fills the packaging;

(3) Making the importer responsible for imported, branded packaging unless the brand owner specifically requests the importation, and providing a clearer definition of importer to ensure proper obligations for importers who discard imported empty packaging; and

(4) Imposing reporting obligations on distributors who supply unfilled packaging to a large producer, who then supplies it to a small or non-obligated producer.

As for the applicability of the 2024 Packaging Waste Regulations, TaylorWessing’s Megan Kowarth and Richard Miles note that the EPR scheme will apply to organizations that: (a) supply packaged goods to the UK market under a brand; (b) place goods into unbranded packaging, including goods packaged for another organization; (c) import products in packaging to supply into the UK market; (d) own an online marketplace that allows non-UK businesses to sell their goods in the UK; (e) hire or loan out reusable packaging; and/or (f) supply empty packaging to a business that is not classed as a large organization.

A producer’s obligations under the regulations will depend on the organization’s size, with “small organizations” (i.e., those with revenue of £1-£2 million and that handle/supply more than 25 tons of empty packaging and packaged items per year) “will be required to record data regarding all empty packaging and packaging items handled or supplied throughout the UK market.” Larger organizations (i.e., those with revenue of more than £2 million and that handle/supply more than 50 tons of empty packaging and packaged items per year) will have” more onerous obligations,” including paying fees to the environmental regulator and purchasing packaging waste recycling notes and packaging waste export recycling notes to evidence that they have paid a packaging re-processor to recycle an amount of packaging waste equivalent to the packaging material it has handled or supplied.

> Osborne Clarke attorneys state in a recent note that “businesses that fall within the scope of the EPR [packaging] scheme should review these new regulations to determine if their obligations are affected.”

(4) United States – Responsible Textile Recovery Act

In March 2023, California Senator Josh Newman introduced a textile-focused EPR bill (SB 707) to the California Senate. The bill aims to establish an EPR scheme for textiles by requiring producers of clothing and other textiles to implement and fund a state-wide collection and recycling program for “covered products,” which include any apparel, textile, or textile article that is unsuitable for reuse by a consumer in its current state or condition. Specifically, the bill would require textile “producers” to fund, design, and implement a program for collecting, sorting, and recycling textile articles under the oversight of CalRecycle, a branch of the California Environmental Protection Agency.

SB 707 was withdrawn from a legislative hearing in July 2023, and is expected to be reconsidered during the 2024 legislative calendar.

> For those looking to get a sense of what a textile EPR scheme might look like in California, the state’s program for plastics is an example of what an existing EPR program looks like. Signed into law in June 2022, the Plastic Pollution Prevention and Packaging Producer Responsibility Act (SB 54) created an EPR program and imposes some related prohibitions for certain single-use packaging in California. The law “imposes significant recycling and EPR requirements for ‘producers’ of single-use packaging and food service items sold or otherwise distributed in California,” per Beveridge & Diamond PC attorneys. This includes prohibitions on the “producer[s]” of “covered material” from selling, offering for sale, importing, or distributing “covered materials” in the state unless the “producer” is part of a producer responsibility organization, or assumes responsibility, on an individual basis, to comply with the law’s requirements.

The Bigger Picture for EPR: If designed appropriately, EPR schemes could achieve “four critical objectives that would bring fashion within ecological limits and address attendant social tensions,” according to Ethical Corporation Magazine’s Lewis Akenji. These scheme could: “(1) improve clothing recycling and waste management; (2) ensure fashion brands pay for the costs of environmental damage and waste management resulting from operations across their supply chains; (3) change the design of clothing and business strategy to ensure that operations and products are less harmful and can be easily assimilated by nature or recycled after use; and (4) ensure fair and just practices across the industry, especially to partners in low-income countries, where citizens endure the double whammy of poor manufacturing conditions and the negative impacts of environmental pollution.”

The problem in many cases, according to Akenji, is that the fashion industry “tends to focus mainly on the first objective of waste management and has practically reduced it to recycling,” thereby, enabling companies to continue to operate as usual instead of attempting to redesign their products in order to extend the lifespan of existing textiles and reduce the consumption of new ones.