In our EMEA supply chain survey, we discussed how

companies have reordered sourcing priorities, with efforts now

aimed at diversifying supply bases and employing near- or onshoring

strategies.

Here, we take a deep dive into the implications for the DACH

region (Germany, Austria, and Switzerland), revealing the reality

check required regarding decreasing dependence on China, plus

examples of government incentives in place across a number of

sectors.

Our key findings

- Decreasing dependence on China: A strategic

imperative, with 84% of respondents across EMEA viewing it as

crucial – and even stronger in the DACH region at 88%. - Plans and progress: Nearly all surveyed

companies are actively developing or implementing plans to decrease

China sourcing. - Challenges and solutions: Identifying

alternative suppliers and mastering global procurement cost

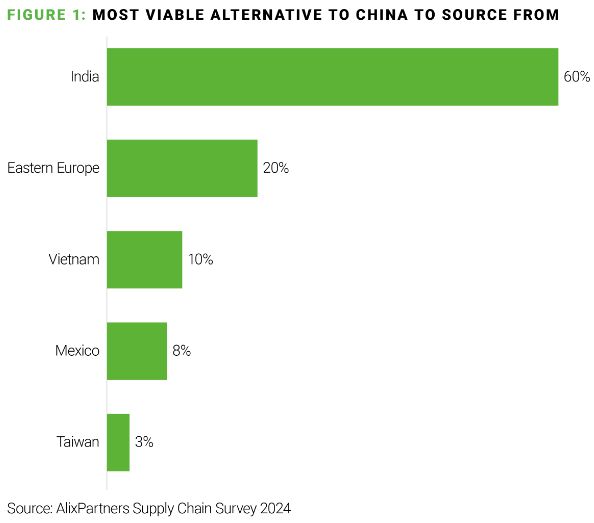

modelling are paramount for DACH companies. India is seen to be the

most viable alternative to China, followed by Eastern Europe,

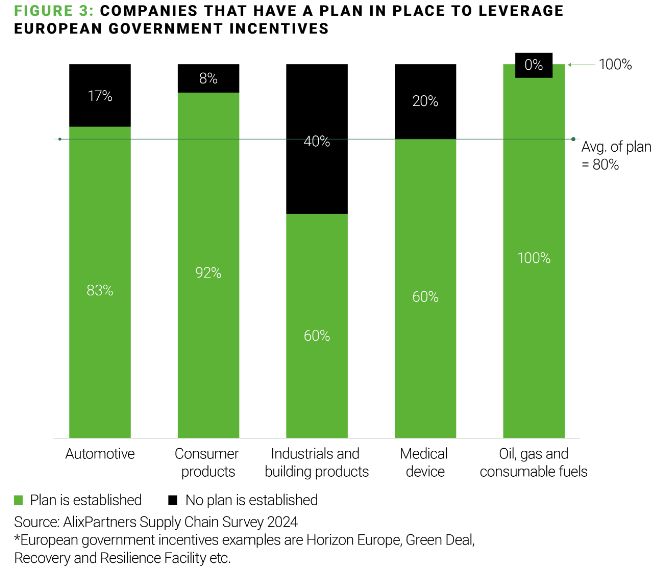

Vietnam, Mexico, and Taiwan. - Government incentives: A pivotal factor in

facilitating the transition towards a “China+”

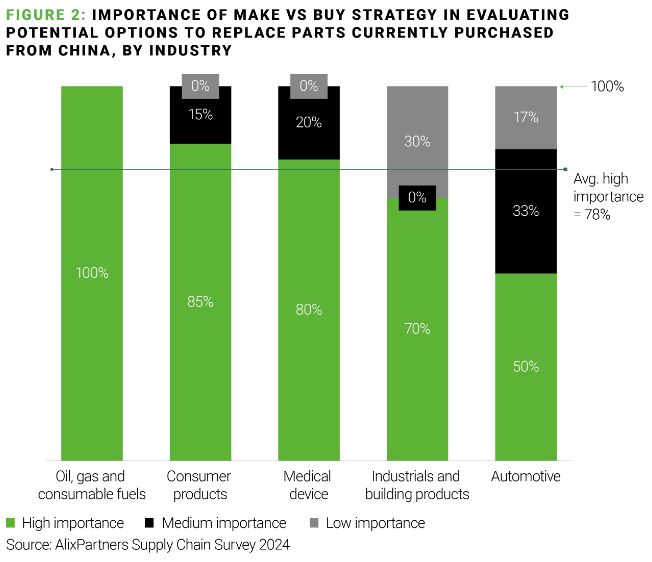

strategy. - Make vs Buy decisions: Critical for future

sourcing strategies, yet 20% of DACH respondents lack a concrete

plan.

Strategic implications for executives

- The importance of agility in supply chain strategy.

- Investing in global procurement capabilities.

- Leveraging government and local incentives.

Sourcing alternatives is key for DACH companies:

Comparable to other EMEA companies, Make vs Buy strategies and

government incentive programs remain important to DACH

businesses:

Decreasing dependence on China: A reality check

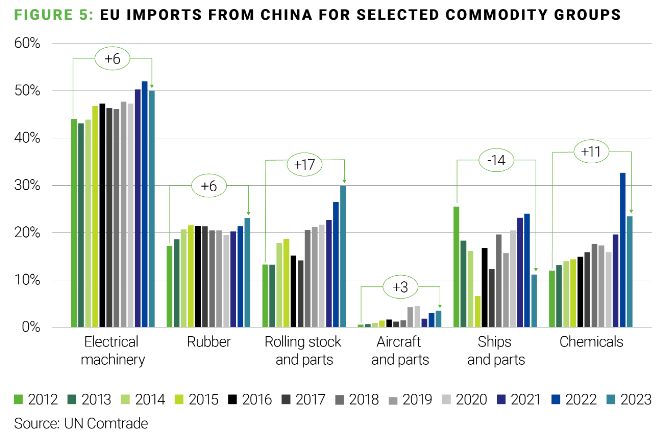

In the global movement towards de-risking supply chains, the

focus on minimizing dependence on China has been particularly

pronounced in the United States. However, the European Union, with

Germany at its core, reached a critical juncture in this endeavor

only recently, in 2022. This shift underlines a broader recognition

of the strategic necessity to diversify sourcing away from a

single-country dependency that has characterized much of the past

decades.

As illustrated above, India is seen as the primary alternative

for businesses looking to adjust their sourcing strategies in the

future, while countries like Vietnam, Mexico, and the Eastern

European region continue to gain traction as viable sources for

imports. Nonetheless, these alternatives start from a relatively

small base, indicating that the journey towards significant

diversification is still in its early stages.

Germany’s reliance on Chinese imports spans a vast array of

products. This includes not only consumer goods such as smartphones

and clothing but also, more critically, intermediate goods and raw

materials essential for various sectors of the German economy. The

dependency is starkly evident in the importation of certain

electronic and electrical components like batteries and

accumulators, along with specific raw materials such as rare earth

elements. China’s dominant production capacity and available

natural resources in these areas poses a considerable challenge for

German industries seeking alternatives.

Moreover, many of the critical raw materials imported from China

are indispensable for the production of future technologies,

including components vital for electric motors, wind turbines,

photovoltaic systems, and other green technologies crucial for

Germany’s transition towards a more sustainable economic

framework.

Despite the clear understanding within the business community of

the need to diversify supply chains and mitigate the dependency on

critical imports from China, the path forward is fraught with

complexity. The process of finding alternative sources is intricate

and anticipated to be prolonged, especially for goods where China

holds a leading global production role or where alternatives are

scarce. This situation underscores the necessity for a strategic

and methodical approach to reduce dependency on Chinese imports,

balancing immediate economic needs with long-term sustainability

and resilience objectives.

As reflected in the earlier table above, the importance

of government incentives cannot be understated, with two sectors in

particular drawing significant attention in this

respect:

Government incentives: Semiconductor sector

The German Government is actively deploying financial incentives

to entice semiconductor companies to establish production

facilities within the country. This strategic move, particularly in

the semiconductor industry, is bolstered by Germany’s desire to

become a pivotal node in the global semiconductor supply chain.

Given the sector’s minimal labor intensity, the disadvantage of

higher labor costs in Germany is offset by the availability of

highly skilled labor and the attractive incentives on offer.

Notable investments in this sector include:

- Intel in Magdeburg: A substantial investment

of €30 billion is earmarked for a new facility, with a

€10 billion subsidy proposed. The planned start of production

is in 2024, with the facility expected to be operational by

2029. - TSMC in Dresden: Traditionally focused on its

Taiwanese production, the Taiwan Semiconductor Manufacturing

Company (TSMC) is branching out to Dresden with a €5 billion

subsidy to mitigate risks associated with political tensions with

China. This diversification effort will see TSMC operating in

conjunction with Infineon, Bosch, and NXP, with production slated

to begin this year. - Infineon in Dresden: Infineon is set to expand

its existing plant with a €5 billion investment, seeking a

€1 billion subsidy. The expansion started production in 2023

and open by 2026. - Wolfspeed in Saarland: Planning a €3

billion investment for a new facility, Wolfspeed aims for a subsidy

of approximately €600 million, with production starting in

2025 and the opening scheduled for 2026.

All the aforementioned subsidies are pending approval from the

European Union. The projects are likely to be supported by the

Klimatransformationsfonds (“Climate Transformation

Fund”), the “EU Chips Act”, and/or IPCEI (Important

Projects of Common European Interest).

Government incentives: Steel sector

The steel industry in Germany is another beneficiary of

government subsidies, particularly aimed at addressing the

challenges of emissions reduction. The transition to emission-free

steel production is supported through significant financial

incentives:

- Thyssenkrupp in Duisburg: A €2 billion

subsidy has been granted for upgrading the plant to produce green

steel. This funding is part of a larger investment requirement,

with additional funding at risk due to legal challenges against the

Klimatransformationsfonds. The project, approved by the EU in July

2023, started production in 2023 and open in 2026. - ArcelorMittal in Bremen and

Eisenhüttenstadt: Targeting decarbonization projects,

ArcelorMittal is poised to receive €1.3 billion, with

operations expected to commence in 2026. The subsidy was approved

by the EU in February 2024. - Salzgitter Flachstahl: Secured a €1

billion subsidy for its decarbonization efforts, with the subsidy

approved by the EU in April 2023. The project began production in

2023 and become operational by 2026. - Funding for these initiatives may also come through “IPCEI

Wasserstoff” (Important Projects of Common European Interest

– Hydrogen), underscoring the strategic emphasis to transform

the steel industry into a greener and more sustainable sector.

These concerted efforts in both the semiconductor and steel

sectors highlight Germany’s strategic positioning and

commitment to not only diversify its supply chains but also to

embrace and lead in the transition towards a more sustainable and

technologically advanced industrial landscape.

Government incentives – Battery technology

Europe’s ambition to bolster its technological sovereignty

is vividly illustrated by its recent initiatives to localize

battery technology and manufacturing. With an eye on

electrification and sustainable energy solutions, significant

investments, strategic acquisitions, and targeted policy incentives

are paving the way for a resilient battery manufacturing ecosystem

across the continent.

The landscape for lithium-ion battery (LIB) manufacturing in

Europe is evolving, driven by the need for local value creation and

European sovereignty over LIBs. Initiatives like the

European Battery Alliance, and research programs

“Horizon 2020” and “Battery

2030+”, exemplify the concerted efforts to anchor

manufacturing within Europe:

- CATL

- Group14 Technologies’ acquisition

of Schmid Silicon Technology Holding GmbH, which marked a

significant leap towards bolstering the global battery supply chain

with advanced silicon battery technology. This strategic move,

enhancing Schmid Silicon’s silane factory in Spreetal, Germany,

aligns with the EU’s decarbonization goals and emphasizes

Europe’s dedication to advancing high-energy density battery

materials. - Tesla in Berlin

- Northvolt in northern Germany

These are supported by significant investments aimed at

fostering LIB ventures and constructing mega-factories, despite the

challenges and competition from dominant Asian manufacturers. In

addition, the competitive landscape faces threats from attractive

investment conditions in the US. This situation points to the need

for EU-wide support and streamlined approvals to bolster

continental battery production. Through strategic acquisitions and

policy incentives, Europe is actively shaping its energy transition

narrative, emphasizing local manufacturing, sustainability, and

innovation.

Recommendations

The path forward: Building resilient, cost-efficient, and

diversified supply chains.

- Strategic imperative of diversification: With

an overwhelming majority recognizing the need to reduce dependency

on China, diversification is no longer optional but a strategic

necessity for resilience and competitive advantage. - Challenges Ahead: The transition entails

significant challenges, notably finding capable alternative

suppliers and understanding the cost implications of

diversification. However, these are surmountable with the right

strategies and investments, particularly in global procurement cost

modelling. - Leveraging incentives: Executives must

navigate and leverage government and local incentives effectively

to facilitate the transition, with a notable disparity in readiness

between EU and US incentives. - Strategic decision-making: The Make vs Buy

decision is crucial in this transition, requiring a strategic

approach to evaluate and implement sourcing options that align with

corporate goals and market dynamics. - Future-proofing through agility: Building a

supply chain that is not only resilient but also agile and

cost-efficient is paramount. This includes exploring nearshoring

opportunities and investing in capabilities that enhance supply

chain visibility and flexibility.

This approach offers a comprehensive view for executives,

emphasizing the need for strategic planning, agility, and

leveraging incentives to navigate the shift away from

China-dependent supply chains, towards a more diversified and

resilient model.

The content of this article is intended to provide a general

guide to the subject matter. Specialist advice should be sought

about your specific circumstances.